Today I’m taking a look at Costco and Target; 2 fellow huge box merchants. Shares of retail giant Costco (EXPENSE) have actually increased concerning 63%% over the previous year, while Target (TGT) shares are up about 39% over the exact same period. Both supplies have done well, however which is the much better possibility for capitalists moving forward? Let’s analyze that inquiry.

I’m neutral on Costco based upon its costly appraisal. Regarding Target, I’m favorable this supply based upon its economical appraisal, appealing reward return, and lengthy background of reward development. Additionally, sell-side experts check out Target as having substantially much more upside in advance over the following twelve month.

The Setup

Costco is much precious by capitalists, and truly so. The supply has actually created good-looking returns for its investors for many years, to the song of virtually 900% over the previous years. Costco is frequently mentioned as being well taken care of and having an eye-catching service design as a result of reoccuring yearly charges paid my its participants.

Target has actually created a complete return of 224% over the previous years. Target is adept, however it has actually considerably delayed Costco’s efficiency over the previous ten years. However, this might produce an extra engaging configuration for a financial investment in shares of Target today, as we’ll review following.

Massive Gap in Valuations

While Costco is a terrific service with a solid record of efficiency, it trades at fairly a high numerous now in time. Costco has an off-cycle that finishes in August, and will certainly quickly report its Q4 2024 profits outcomes. The business trades over 50 times agreement 2025 profits quotes. This overpriced numerous fallen leaves little space for mistake moving forward if the business dissatisfies capitalists in Q4 or throughout the following .

Meanwhile, Target professions at a a lot more sensible appraisal of 14.8 x onward profits quotes, well listed below Costco’s numerous and likewise considerably listed below the S&P 500’s ( SPX) onward appraisal of 24x. One can definitely make a situation that Costco is a higher-quality service than Target based upon its reoccuring subscription charges, however an appraisal 3 times as pricey feels like way too much of a space.

Furthermore, regardless of Costco’s credibility for high quality, Target is a higher-margin service, with gross margins of 26.1% roughly two times as high as Costco’s gross margins of 12.5%. Target’s earnings margin of 4.2% is likewise visibly greater than Costco’s 2.8%. From my viewpoint, Target’s considerably reduced appraisal uses the supply much more drawback defense and even more space to shock to the advantage.

Two Strong Dividend Growth Stocks

Costco is a reward supply, however its return of 0.5% is rather insignificant. That claimed, Costco is worthy of credit rating for its solid reward development, having actually elevated its reward price 19 years straight.

Meanwhile, Target’s reward return is 2.9%. This is virtually 6 times greater than Costco’s existing return, and greater than double the return for the S&P 500. Target has a a lot more outstanding record of regularly paying and expanding its reward thanCostco Target is a Dividend King that has actually enhanced its payment for an extraordinary 55 years straight.

Both firms likewise preserve fairly traditional payment proportions, indicating that both rewards look risk-free for the near future. While Costco has actually done a great task of expanding its reward, Target’s return is considerably greater, and its regular background of reward development is also much better, which sustains my favorable sight of the supply.

Is EXPENSE Stock a Buy, According to Analysts?

Turning to Wall Street, price gains a Strong Buy agreement score based upon 17 Buy, 5 Hold, and no Sell scores appointed in the previous 3 months. The typical price supply rate target of $936.25 suggests concerning 4.0% prospective upside from existing degrees.

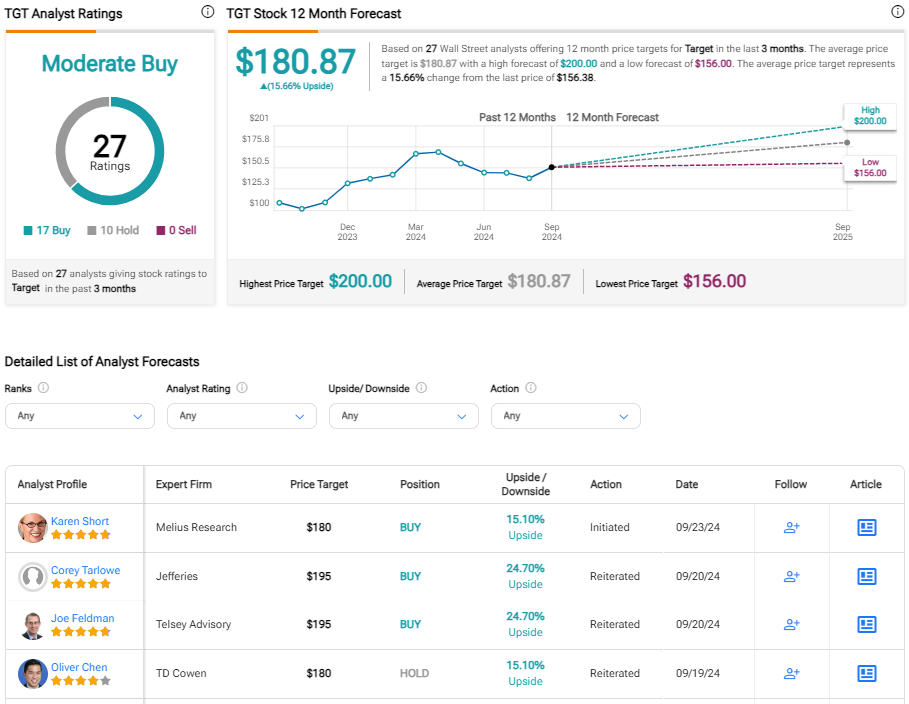

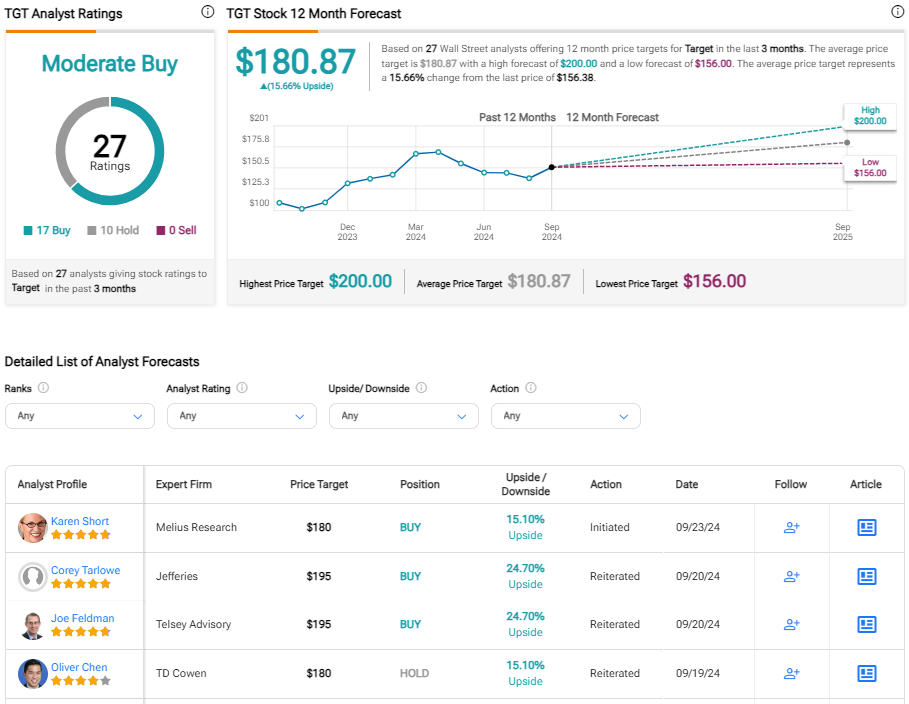

Is TGT Stock a Buy, According to Analysts?

At the exact same time, TGT gains a Moderate Buy agreement score based upon 17 Buys, 10 Holds, and absolutely no Sell score appointed in the previous 3 months. The typical TGT supply rate target of $180.87 suggests around 16% prospective upside from existing degrees.

Smart Choices

As you can see making use of TipRanks’ Stock Comparison Tool listed below, both Costco and Target obtain Outperform scores from TipRanks’ Smart Score system.

Smart Score is a measurable supply racking up system produced by TipRanks. It offers supplies a rating from one to 10, based upon 8 vital market aspects. Scores of 8, 9, or 10 are taken into consideration comparable to an Outperform score.

Cocsto’s Outperform- comparable Smart Score of 9 goes over, however Target prevails with a perfect-10 Smart Score.

Target Stock Looks Like the Preferred Investment Choice

Costco is a terrific business and has actually been a terrific entertainer for its investors over years. However, I’m neutral on shares now as this solid run of efficiency has actually sent its appraisal over 50x onward profits, offering the supply little margin for mistake moving forward.

Target professions at a a lot more appealing appraisal of under 15x onward profits, uses a greater reward return, and much longer background of reward development. I’m favorable on Target offered its economical appraisal, appealing reward return, and 55 straight years of reward development. Costco is a great supply with a trustworthy background of efficiency, however today I check out Target as the much better financial investment alternative based upon my evaluation of both options.

Disclosure