Semiconductor professional Cirrus Logic ( NASDAQ: CRUS) might not be a home name like several of its market peers, yet the firm has actually done remarkably well on the marketplace up until now this year with gains of 69% since this writing.

Cirrus, which is understood for providing chips for Apple‘s ( NASDAQ: AAPL) items, has actually outmatched the wider Nasdaq -100 Technology Sector index’s gains of 10% by a large margin. The excellent information is that Cirrus’ impressive development is right here to remain, and the firm can end up the year highly many thanks to its biggest client. What’s much more, the arrival of artificial intelligence (AI)– allowed smart devices is most likely to open a large lasting development possibility for Cirrus Logic.

Let’s take a closer take a look at the reasons capitalists need to take into consideration purchasing Cirrus Logic supply hand over clenched fist prior to it’s far too late.

Cirrus Logic’s current outcomes direct towards a brilliant future

Cirrus Logic launched financial 2025 first-quarter outcomes (for the 3 months finished June 29) onAug 6. The firm’s profits boosted 18% year over year to $374 million and was well in advance of the agreement quote of $318 million. What’s much more, Cirrus’ changed profits leapt a strong 67% year over year to $1.12 per share, squashing Wall Street’s $0.61 per share quote.

The favorable information really did not finish right here, as Cirrus anticipates its financial Q2 profits to land in between $490 million and $550 million. The middle of the advice variety stands at $520 million, which’s well over the Wall Street quote of $485 million. Cirrus clocked profits of $481 million in the very same quarter in 2015, suggesting that its leading line gets on track to raise by 8% on a year-over-year basis.

Cirrus’ leading line can land closer to the greater end of its advice variety many thanks to its biggest client, Apple, which made up a tremendous 88% of its leading line last quarter. Cirrus administration explained on the current profits teleconference that its profits surpassed the leading end of its initial advice variety many thanks to “stronger than expected shipments into smartphones.”

Because Apple is Cirrus’ biggest client, the stronger-than-expected efficiency implies that Cirrus obtained even more orders for its chips last quarter. That’s not shocking, as Apple appears to be planning for a hostile rollout of its next-generation apples iphone that are all set to support generative AI features.

Apple’s reported apple iphone 16 is anticipated to strike the marketplace following month and the technology titan is anticipated to deliver 90 million devices of its upgraded smart device schedule this year. That would certainly be a 10% rise over in 2015. But at the very same time, supply chain records suggest that Apple is stockpiling on 120 million display screen panels, recommending that it might wind up producing much more devices than what the marketplace is presently expecting.

If that’s without a doubt the situation, Cirrus Logic’s development in the present quarter is most likely to surpass assumptions once more. But much more notably, the assimilation of the Apple Intelligence collection of generative AI functions right into the technology titan’s upcoming smart devices is anticipated to set off a strong upgrade cycle. Apple’s smart device deliveries are anticipated to raise by 10% in 2025 and 2026, according to JPMorgan‘s price quotes.

Cirrus is anticipated to land even more buck web content in the future generation of apples iphone, which implies that it ought to have the ability to obtain even more profits from each device of the apple iphone that Apple creates. So, the phase appears established for Cirrus Logic to finish the year highly, and it ought to have the ability to maintain its recently discovered energy in the future too many thanks to Apple’s entrance right into the AI smart device market, an area that’s presently in its very early stages of development.

A pair much more factors to acquire the supply

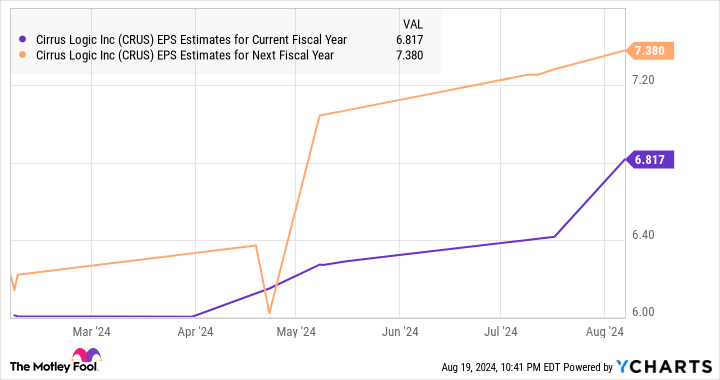

Analysts have actually fasted to elevate their profits development assumptions for Cirrus Logic, as appears from the graph below.

Cirrus Logic ended up financial 2024 (upright March 30) with non-GAAP profits of $6.59 per share. The over graph informs us that experts weren’t anticipating a boost in Cirrus’ profits in the present , yet that has actually transformed of late. Additionally, the firm’s fundamental development projection for the following factors towards an enhancement in its development price.

However, if Apple without a doubt determines to increase the manufacturing of its upcoming apples iphone and Cirrus winds up providing much more material to the technology titan, there is a likelihood of Cirrus’ profits conveniently surpassing experts’ assumptions moving forward.

That’s why currently would certainly be a great time for capitalists to acquire this semiconductor supply. It’s trading at simply 26 times routing profits, a price cut to the Nasdaq -100 index’s profits multiple of 31. And the AI-driven development in the smart device market and Cirrus’ limited connection with among the biggest gamers in this room can cause better-than-expected development moving forward.

Should you spend $1,000 in Cirrus Logic today?

Before you acquire supply in Cirrus Logic, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for capitalists to acquire currently … and Cirrus Logic had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $792,725! *

Stock Advisor offers capitalists with an easy-to-follow plan for success, consisting of advice on constructing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since August 22, 2024

JPMorgan Chase is a marketing companion of The Ascent, a Motley Fool firm. Harsh Chauhan has no placement in any one of the supplies stated. The Motley Fool has placements in and suggests Apple and JPMorganChase The Motley Fool suggestsCirrus Logic The Motley Fool has a disclosure policy.

Up 69% in 2024, This Red-Hot Artificial Intelligence (AI) Growth Stock Could Keep Soaring was initially released by The Motley Fool