Since its going public in late 2020, Palantir Technologies ( NYSE: PLTR) has actually been just one of one of the most polarizing supplies onWall Street Jim Cramer just recently described it as a “meme stock,” and in 2014, an online author of brief records classified it an “AI imposter.“

Although its deal with the united state armed forces and knowledge firms can create Palantir ahead across as evasive or deceptive, I would certainly suggest that the adverse belief bordering the firm is rooted in a misconception of its organization and worth recommendation. Simply placed, Palantir is not your ordinary business software application firm.

With its shares up by 145% throughout the previous one year and the firm’s induction onSept 23 right into the S&P 500, it’s obtaining more difficult to purchase the bearish story onPalantir It has actually become a beloved of the expert system (AI) change, its collaborations with technology titans recommend that it’s a genuine gamer, and it shows up that its following stage of development is simply starting.

I see fintech system SoFi Technologies ( NASDAQ: SOFI) in similar method as Palantir, and I assume its supply might comply with a comparable trajectory to the one Palantir took, making it a possibly profitable purchasing possibility now.

Palantir’s journey down memory lane

When it went public, Palantir’s private-sector organization was a reasonably tiny component of its procedure, and doubters classified the firm a pietistic federal government specialist. On top of that, 2022 was a harsh year in the stock exchange, and modern technology supplies specifically took a success. Two essential functions of the macroeconomic setting that year were extraordinarily high rising cost of living and a hostile change in financial plan including climbing rates of interest.

It really did not take wish for organizations to check their costs and tighten up their monetary controls. As budget plans reduced, so did sales of costly software such as cloud computer and AI analytics devices.

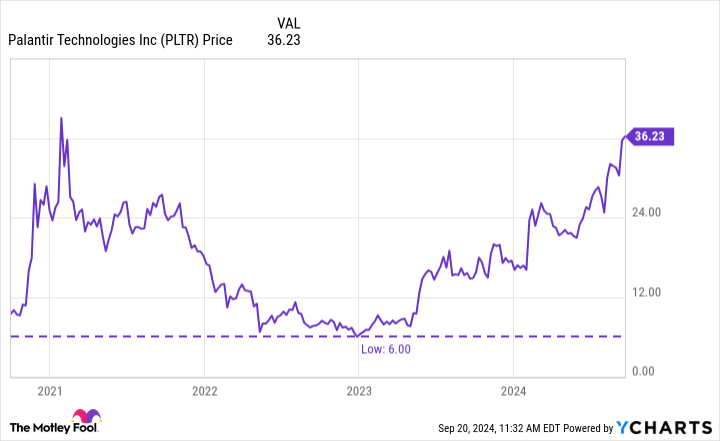

This took a toll on Palantir– and much of its accomplices– and its development reduced substantially. At completion of December 2022, Palantir supply struck a lowest level of simply $6.

Not also 2 years later on, its share rate is currently up greater than sixfold from that low point. What taken place?

From a macro point ofview, passion in AI actually began to remove in 2023, which reignited software application costs.

From a company-specific point ofview, it launched its 4th significant item in April 2023: the Palantir Artificial Intelligence Platform (AIP). During the previous year, AIP has actually acted as a significant stimulant and has actually aided the firm actually permeate the economic sector.

At the exact same time as it has actually been branching out and boosting its earnings base, Palantir has actually been taking a regimented method to expenses. As an outcome, it has actually broadened its operating margins. Today, Palantir is continually both free-cash-flow and net-income favorable.

Unsurprisingly, some capitalists have actually altered their song on Palantir and currently see it as a real disrupter in modern technology’s latest arising chances.

SoFi’s trajectory looks comparable to Palantir’s

Due to the high degrees of competitors in the financial-services sector, some individuals question that on the internet financial institution SoFi will certainly ever before actually capture on. To me, that seems like a comparable placement to the one taken by those that really felt that Palantir would not have the ability to do well in the private-sector software application market.

Yet SoFi’s organization design does have a number of uncommon benefits that separate it from the competitors. For beginners, it does not have brick-and-mortar branch areas. Its digital-only method can be a huge marketing factor for more youthful clients that might not intend to hang out mosting likely to a financial institution, and that could be most likely to have their car loan applications denied by standard organizations.

SoFi likewise has a wide community of monetary solutions past borrowing. It provides examining accounts and charge card, for instance, and its customers can utilize its application to purchase the stock exchange. That varied collection of items is supplied with a high degree of comfort by a firm that really feels much less antiquated than tradition financial institutions and brokerage firm companies.

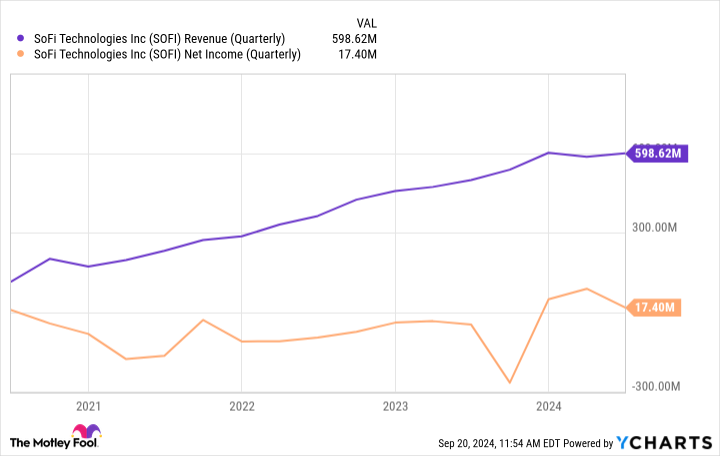

SoFi has actually done a wonderful work cross-selling different items to its clients, which has actually brought about more powerful device business economics and a change from a cash-burning procedure to a continually lucrative organization.

These monetary fads comply with courses fairly comparable to those taken byPalantir This goes over taking into consideration SoFi’s biggest resource of development, borrowing, has actually been little bit altered throughout 2024 as a result of high rates of interest.

But equally as the arrival of AI played a significant function in Palantir’s rebound, I see this month’s rate of interest reduced– and those that are anticipated to comply with– as fresh stimulants for SoFi. Assuming the Fed provides a collection of price cuts throughout the following year or even more, I assume SoFi’s borrowing organization will certainly speed up, which need to boost the firm’s total earnings.

In amount, I see SoFi as one more misconstrued and underappreciated possibility. It’s greater than simply one more financial institution, and I assume throughout the following year, it might start experiencing some remarkable velocities in earnings and earnings if borrowing task rebounds.

SoFi supply is down around 64% considering that it started trading on the Nasdaq in June 2021, however taking into consideration the capacity for rate of interest decreases to stimulate brand-new development in the borrowing section, I would certainly not be stunned to see the shares recoup and comply with a comparable course to the one Palantir has actually charted considering that the beginning of 2023.

Should you spend $1,000 in SoFi Technologies now?

Before you purchase supply in SoFi Technologies, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to purchase currently … and SoFi Technologies had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $710,860! *

Stock Advisor supplies capitalists with an easy-to-follow plan for success, consisting of support on constructing a profile, routine updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since September 16, 2024

Adam Spatacco has placements in Palantir Technologies and SoFiTechnologies The Motley Fool has placements in and suggestsPalantir Technologies The Motley Fool has a disclosure policy.

Prediction: This Will Be the Next Stock to Follow Palantir’s Path was initially released by The Motley Fool