Since the begin of 2023, a technology rally has actually increased many technology supplies. Advances in high-growth fields like expert system (AI) have actually highlighted the substantial capacity of firms energetic in relevant areas like chip style and cloud computer. Nvidia ( NASDAQ: NVDA) has actually been among the greatest receivers of the bull run, with its shares up 785% given that January 2023.

The business benefited from raised need for AI chips and its capability to provide its equipment to the majority of the marketplace. At the begin of in 2015, Nvidia’s market cap was $360 billion. Yet, current development has actually seen it end up being the initial chipmaker valued at greater than $3 trillion, signing up with the rankings of firms like Apple and Microsoft.

Nvidia’s speedy increase increases the inquiry: what business could be alongside strike such a turning point?

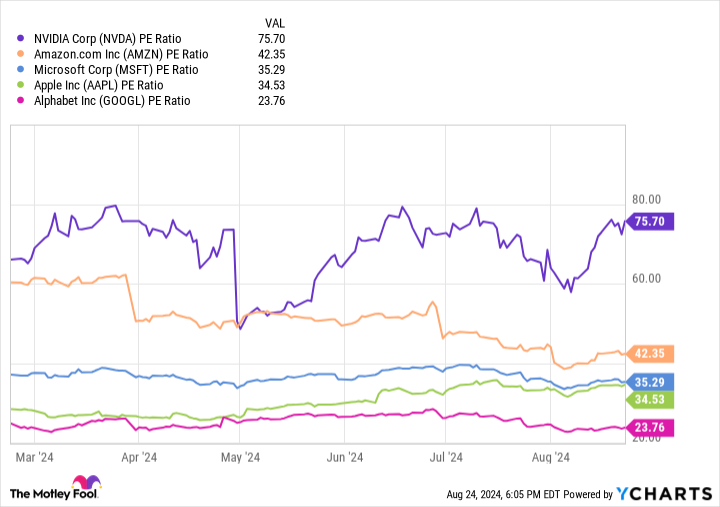

As the globe’s fourth-most-valuable business, Alphabet‘s ( NASDAQ: GOOGL) ( NASDAQ: GOOG) market cap of $2 trillion places it in a prime setting to be the following business to go across the $3 trillion limit. The technology titan has actually constructed itself right into a golden goose with development stimulants in several markets. Meanwhile, the graph listed below reveals its supply is among the most effective deals in technology.

Alphabet’s supply is up 19% year to day, providing even more supply development than any one of these firms with the exception ofNvidia Yet, Alphabet flaunts the most affordable price-to-earnings (P/E) proportion amongst its peers, suggesting its supply supplies one of the most worth.

So, right here is an underestimated supply that might sign up with Nvidia in the $3 trillion club.

Growth stimulants throughout technology

Alphabet has a powerful setting in technology, having actually broadened to several fields of the sector. Hard- striking brand names like Android, YouTube, Chrome, and the lots of items under Google have actually made Alphabet the go-to for loads of vital solutions. The appeal of these systems has actually seen the business collect a substantial individual base, organizing 9 systems that have actually attained 1 billion or even more individuals since 2023.

Alphabet’s leading duty in technology is mostly many thanks to constant reinvestment in its company and desire to attempt brand-new endeavors. This technique has actually resulted in a lengthy listing of now-defunct items, with Google Hangouts, Stadia, and Google Glass simply a couple of. However, Alphabet’s preparedness to purchase encouraging markets has actually additionally enabled it to accomplish rewarding duties in electronic marketing, cloud computing, and AI.

The business has actually utilized its substantial individual base to market advertisements on its numerous systems, a company that currently represents 78% of its profits. The electronic marketing sector deserves concerning $740 billion and is increasing at a compound yearly development price (CAGR) of 7%, with Alphabet in charge of 26% of all international advertisement sales.

However, Alphabet’s greatest development chauffeur over the in 2015 has actually been Google Cloud, with its 11% market share in cloud computer. The system is increasing promptly, providing profits gains of 29% year over year in the 2nd quarter of 2024. Cloud computer has actually turned into one of the fastest-growing areas of AI, a sector establishing at a CAGR of 37% via 2030.

Google Cloud outshined market leaders Microsoft’s Azure and Amazon Web Services in sales development in Q2 2024 and has actually revealed no indicators of slowing down. The system is most likely to improve incomes for many years.

Alphabet provides years of constant gains

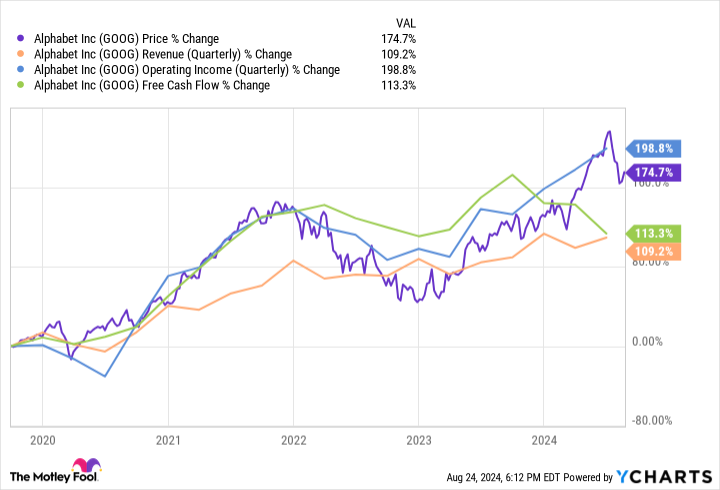

Alphabet has a credibility for constant development. In reality, a financial investment of $10,000 in its supply in 2014 would certainly currently deserve near $58,000.

The technology titan has actually verified itself to be a king of integrity, recommending that it’s even more of an issue of when, not if, its market cap will certainly strike $3 trillion.

The last 5 years have not been very easy for lots of technology firms, with a globally pandemic in 2020 and several years of financial unpredictability. However, the graph over programs that Alphabet’s incomes and supply rate have actually still provided triple-digit development because period.

The Google moms and dad’s cost-free capital struck $61 billion this year, showing it has the funds to proceed purchasing its company and stay on top of its competitors. Its P/E of 24 is amazingly reduced contrasted to its peers, suggesting currently is the moment to purchase this underestimated supply that will likely sign up with Nvidia in the $3 trillion club prior to it’s far too late.

Should you spend $1,000 in Alphabet today?

Before you purchase supply in Alphabet, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for financiers to purchase currently … and Alphabet had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $786,169! *

Stock Advisor offers financiers with an easy-to-follow plan for success, consisting of advice on constructing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since August 26, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Dani Cook has no setting in any one of the supplies discussed. The Motley Fool has settings in and suggests Alphabet, Amazon, Apple, Microsoft, andNvidia The Motley Fool suggests the adhering to choices: lengthy January 2026 $395 get in touch with Microsoft and brief January 2026 $405 get in touch withMicrosoft The Motley Fool has a disclosure policy.

This Undervalued Stock Could Join Nvidia in the $3 Trillion Club was initially released by The Motley Fool