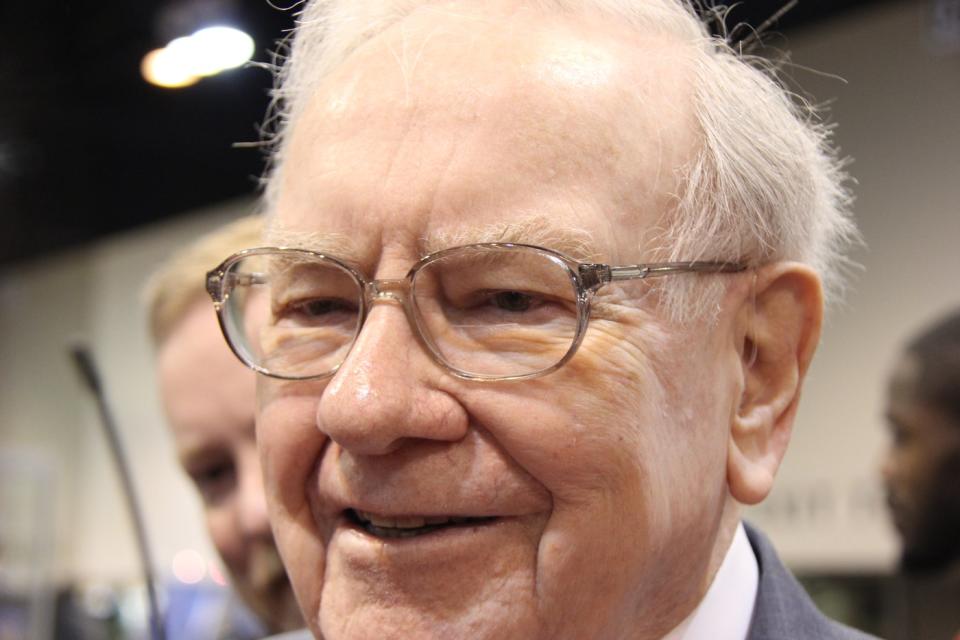

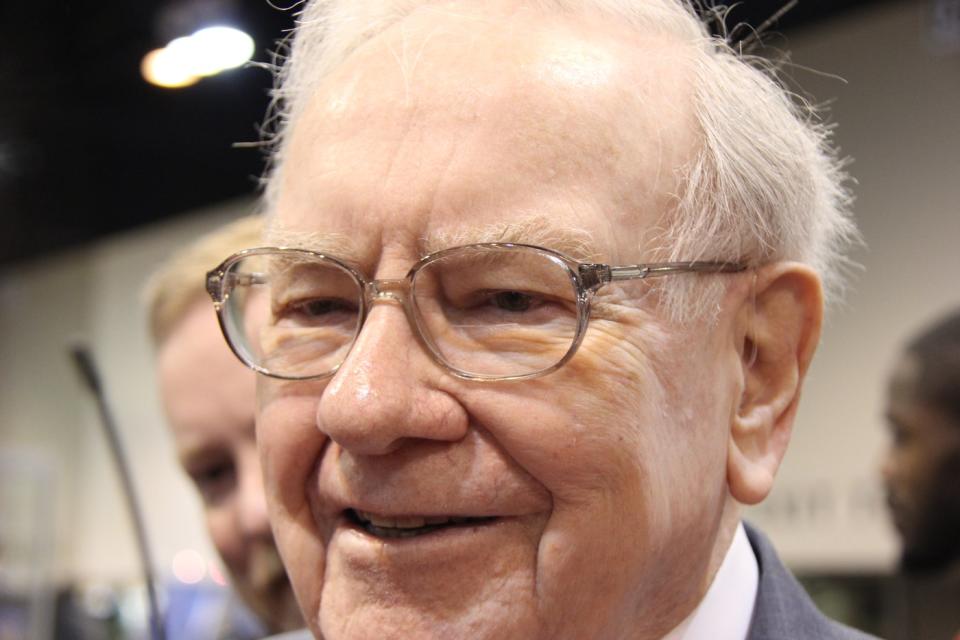

Coca-Cola ( NYSE: KO) is not the largest placement in Warren Buffett’s profile, yet it is just one of the billionaire’s faves– and one that likely will continue to be there at present degrees.

Buffett began purchasing shares of the globe’s largest nonalcoholic drink manufacturer in 1987 and proceeded contributing to the placement for a duration of 7 years. Those 400 million shares have not moved given that. In truth, he has actually also explained his holding on Coca-Cola as “a Rip Van Winkle slumber.”

Buffett, recognized to consume alcohol a number of containers of Coke a day, plainly likes the item, and he additionally likes the truth that really feel similarly, as well. This brand name toughness uses the firm a moat, or affordable benefit, a crucial element Buffett seeks in a firm. On top of this, the drink titan has actually expanded incomes gradually and benefits capitalists with returns.

For these factors, Coca-Cola is most likely below to remain in its placement in the Berkshire Hathaway ( NYSE: BRK.A)( NYSE: BRK.B) profile. But it could not be the only supply to win Buffett’s irreversible commitment. In truth, a supply that he simply minimized his placement in can really sign up with Coke as one of Berkshire Hathaway’s “forever” holdings. My forecast is this supply will certainly end up being Buffett’s following Coca-Cola …

Buffett lately marketed some shares of this supply

So, which supply am I discussing? Well, it’s one more firm that’s a house name, though it runs in the modern technology market instead of the drink market: Apple ( NASDAQ: AAPL)

But wait a min, you may be claiming, Buffett marketed some of his shares in the apple iphone manufacturer throughout the 2nd quarter. Isn’t that a poor indication?

Not always. At the Berkshire Hathaway yearly conference in May, Buffett indicated that his Apple sales are connected to securing the present 21% funding gains tax obligation price, and not as a result of a loss of belief in the firm. He anticipates the tax obligation price to rise, taking into consideration the present dimension of the government shortage. Even counting the sale of 49% of his Apple placement, Buffett stated it is “extremely likely” that at the end of the year, it will certainly be Berkshire’s biggest common-stock holding.

The current sale in Apple brings the holding back to 400 million shares. Sound acquainted? That’s the exact same variety of shares Berkshire keeps in Coca-Cola This, naturally, is an intriguing information to explain, yet I’m not basing my forecast on it. I have a more powerful disagreement for why Buffett can check out Apple as his following Coca-Cola

A “brilliant CEO”

And this involves his self-confidence in the method the firm is run and its strong incomes document. In Buffett’s 2021 investor letter, he described Tim Cook as Apple’s “brilliant CEO” and commended his choice to repurchase Apple shares. Share buybacks enhance the possession of present owners without them paying a cent.

These repurchases assisted Berkshire enhance its holding from 5.2% of Apple in 2018, when it finished its acquisitions of the supply, to 5.4% by 2020. Berkshire began purchasing Apple shares back in 2016.

Cook’s experience additionally has actually assisted Apple along the course of double-digit incomes development over the previous 5 years. And, like Coca-Cola, Apple has a significant moat, with customers of the apple iphone crowding to the firm each time a brand-new variation is launched. Last year, for the very first time ever before, Apple won the leading 7 areas on the listing of the top-selling smart devices that’s put together by Counterpoint, a modern technology marketing research company.

An “enduring moat”

“A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital,” Buffett composed in his 2007 letter to investors, highlighting the significance of this when picking financial investments.

Lastly, another aspect of Apple can aid it end up being the “second Coca-Cola” in the Berkshire Hathaway profile: the firm’s dedication to returns. Berkshire Hathaway has actually balanced regarding $775 million yearly in Apple returns given that 2018.

Technology firms aren’t recognized to pay remarkable returns given that they spend a whole lot back right into development, so Apple’s reward isn’t the largest on the block. But the firm has actually continuously paid one given that 2012. And at $1 per share yearly, for a returns return of 0.4%, it’s an appealing component of the full bundle.

All of this motivates me to anticipate that, like Coca-Cola, Apple will certainly be a long-term component in the Berkshire Hathaway profile. And many thanks to its solid incomes record, solid moat, and reward plan, this technology supply makes a terrific enhancement to any type of profile requiring the great mix of development and safety and security.

Should you spend $1,000 in Apple today?

Before you purchase supply in Apple, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for capitalists to purchase currently … and Apple had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $729,857! *

Stock Advisor offers capitalists with an easy-to-follow plan for success, consisting of support on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since September 9, 2024

Adria Cimino has no placement in any one of the supplies stated. The Motley Fool has placements in and advises Apple andBerkshire Hathaway The Motley Fool has a disclosure policy.

Prediction: This Stock Will Become Warren Buffett’s Next Coca-Cola was initially released by The Motley Fool