There isn’t a supply on the marketplace that has actually been spoken about much more in the previous 2 years than Nvidia ( NASDAQ: NVDA) The increase of expert system (AI) has actually made Nvidia’s graphics refining systems (GPUs) among one of the most in-demand items due to their function in training AI.

It has actually likewise made Nvidia among the best supplies on the marketplace. From September 2022 to the begin of September 2024, its supply increased over 750%– 18 times greater than the S&P 500‘s gains over that period. That’s not a very easy task for a business whose market cap was around $300 million at the time.

Nvidia has actually likewise uploaded monetary outcomes to back this buzz, enhancing profits and operating earnings by 122% and 174%, specifically. The appreciation is well should have. That claimed, there are 2 business that I’d be most likely to buy now since there appears to be much more lasting assurance around their services.

1. Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Company ( NYSE: TSM) (TSMC) is among the globe’s most-important technology business in spite of not being a family name like a few other large technology business. It runs the globe’s biggest semiconductor (chip) factory, producing chips for business’ details requirements.

Companies pertained to TSMC with a chip layout, and it generates the chip according to the firm’s demand. It might appear easy sufficient, yet producing chips with that said degree of accuracy and at that range calls for intricate procedures (placing it gently) and progressed modern technology that nothing else firm has actually had the ability to match.

One firm that depends greatly on TSMC isNvidia TSMC produces Nvidia’s chips for its GPUs, data-center cpus, and various other AI-related chips. Without TSMC’s production capacities, there’s a solid situation that Nvidia’s items would certainly take a top quality hit. That’s mainly why Nvidia hasn’t accepted various other chip makers and fits depending on TSMC.

Nvidia’s reliance on TSMC is why I like it at this phase. Much of Nvidia’s high evaluation is improved assumptions of what it ought to come to be, and its capacity to supply on that particular will certainly rely on TSMC’s manufacturing ability. The ceiling might not be virtually as high for TSMC, yet its trajectory is relatively much more dependable.

TSMC likewise has an eye-catching reward that decreases a few of the spending danger. Its reward return is presently over the S&P 500’s typical, making it less complicated for financiers to stay individual throughout rough times and depend on its lasting capacity.

2. Apple

Apple ( NASDAQ: AAPL) really did not get to the factor of being the globe’s most beneficial public firm by chance; it has actually taken years of non-complacency and self-displined implementation. With Apple’s record of self-control, it was perplexing why a lot of Wall Street financiers were relatively surprised as Apple continued to be reasonably silent throughout current AI mania.

Apple has a background of allowing various other business develop something and afterwards venturing right into that location with a better layout and making it much more easy to use. We’ve seen it with smart devices (apple iphone), tablet computers (iPad), smartwatches (Apple Watch), online fact (Apple Vision Pro), and handfuls of various other technology equipment.

Of program, Apple isn’t simply walking around replicating others; instead, the technology titan does a terrific work of allowing others be the test subject and afterwards discovering maybe from their errors prior to launching its very own services and products to the marketplace. That appears to be the very same strategy it’s taking with AI, also.

Apple hasn’t hurried right into AI like the majority of various other large technology business. In reality, it does not also describe its coming AI capacities as “artificial intelligence”; it’s “Apple Intelligence.” (It’s simply creative sufficient to function.) Nvidia remains in an unstable setting; equally as quick as it increased, it can drop if it falls short to fulfill assumptions. Apple does not rather have that very same danger, though it’s not excluded from volatility.

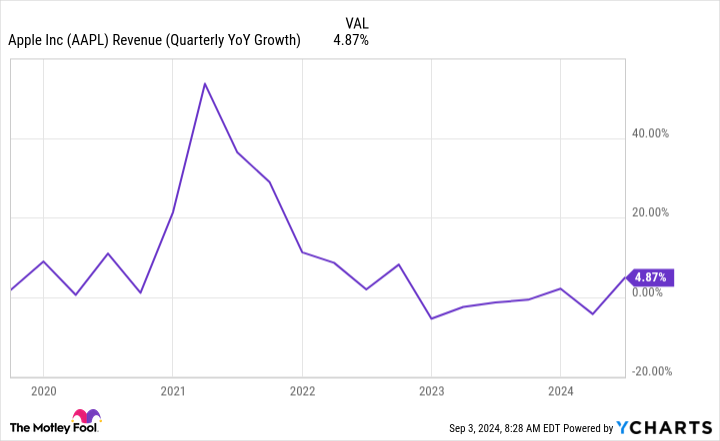

Ideally, Apple Intelligence will certainly provide Apple a prompt monetary increase, with customers hurrying to acquire its next-gen items because it’ll just come on more recent equipment designs. After a depression in Apple’s smart device market over the previous couple of years, I’m certain the firm would not mind an added lift from someplace.

Short- term increase apart, there aren’t way too many business I rely on much more long-term thanApple The upside constantly appears to exceed the prospective disadvantage.

Should you spend $1,000 in Taiwan Semiconductor Manufacturing now?

Before you acquire supply in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for financiers to acquire currently … and Taiwan Semiconductor Manufacturing had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $656,938! *

Stock Advisor supplies financiers with an easy-to-follow plan for success, consisting of advice on developing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 because 2002 *.

*Stock Advisor returns since September 3, 2024

Stefon Walters has settings inApple The Motley Fool has settings in and suggests Apple, Nvidia, andTaiwan Semiconductor Manufacturing The Motley Fool has a disclosure policy.

There’s No Denying It; Nvidia Is on a Historic Run, but Here Are 2 Tech Stocks I’d Buy Instead was initially released by The Motley Fool