The Dow Jones Industrial Average is chock-full of trustworthy leading returns supplies. It is a best listing for financiers searching for industry-leading firms that can sustain their profiles with easy earnings.

Walmart ( NYSE: WMT), Coca-Cola ( NYSE: KO), Procter & &Gamble (NYSE: PG &) , and Johnson & Johnson are the only 4 firms that are both Dow parts and Dividend Kings— which are firms that have actually paid and increased their rewards for at the very least 50 successive years.

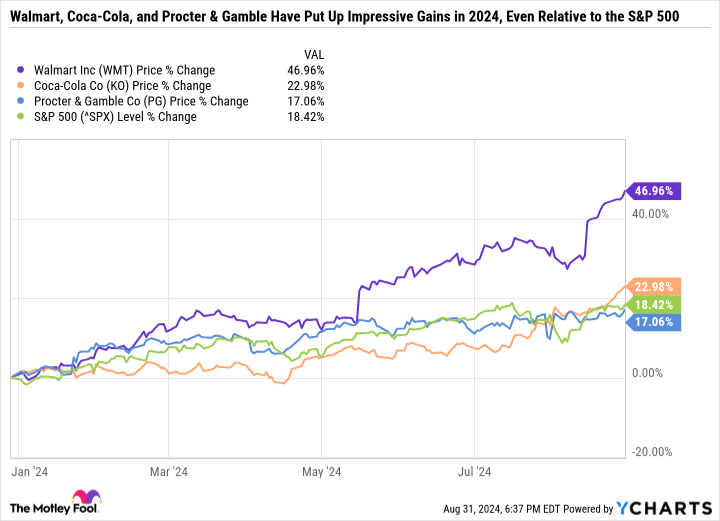

Here’s why Walmart, Coca-Cola, and Procter & &(* )simply struck all-time highs yet might still deserve purchasing currently.Gamble resource:

Walmart’s of

Outside and a couple of various other development supplies, I would certainly say that Nvidia has actually had one of the most remarkable efficiency in 2024. Walmart is the It and is up 47% year to day whilebest-performing Dow dividend stock in 2024 is up around 8% because duration. Target WMT

On Aug struck an all-time high while Walmart struck a five-year reduced. Dollar General sellers and firms that depend upon optional costs are battling, and yet Discount is prospering.Walmart a business is succeeding, therefore a number of its peers are doing inadequately, it’s generally an indication that monitoring has actually made some smart critical steps.

When indeed, And leading brass should have a great deal of credit history for making the essential financial investments over the last couple of years to boost existing shops, develop much better shops, make supply chain and business renovations, and much more.Walmart’s currently has the benefit of dimension, which has actually permitted it to be cost-competitive with practically any kind of various other seller or grocer.

Walmart currently, it is likewise an incredibly well-run firm with a clear vision for opening future development.But has a tested service version, is assigning brand-new resources successfully, and gets on track to provide document readjusted incomes in spite of a difficult service environment.

Walmart these factors, For should have to be floating around an all-time high.Walmart-

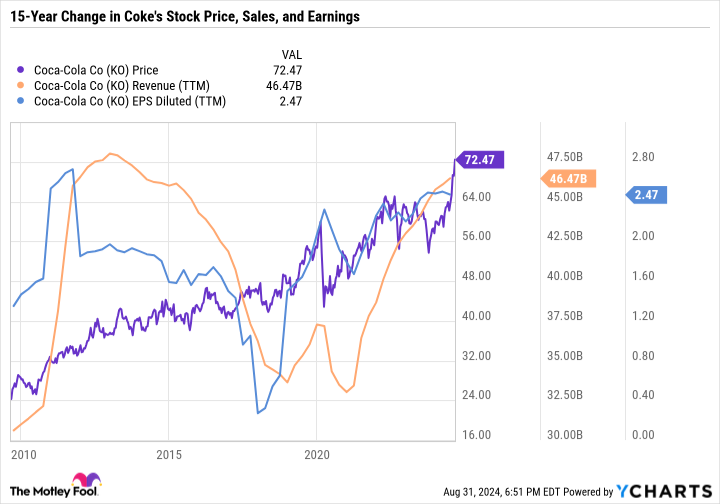

Coca is ultimately a championCola is up 23% year to day yet simply 32% over the last 5 years.

Coke drink king had actually invested years enhancing its success also at the expenditure of slowing down sales development. The, it acquired a 15% risk in Then in 2018, Bodyarmor in 2019 for $4.9 billion, and the continuing to be 85% risk in Costa Coffee in 2021 for $5.6 billion. Bodyarmor the included profits from these brand names, Despite sales remained to waste away in the very early 2020s.Coke’s the pandemic is partly at fault due to the fact that

But counts greatly on away-from-home sales (believe dining establishments, showing off occasions, shows, and so on). Coke lately has actually the firm started going back to development. Only zoom out, and its profits and incomes are about the exact same today as in the very early 2010s yet the supply cost is up 170%.But proceeds

At has actually not expanded over the last 15 years from a revenues and sales viewpoint, yet its supply cost is a lot greater. Coke, However appraisal is still not horribly high, with an onward price-to-earnings (P/E) proportion of 25.4. Coke’s agreement approximates projection solid incomes development in the short-term. Analyst also much better, the firm’s drink profile looks well-positioned to expand many thanks to functional renovations and much better assimilation of its current purchases.But in

Throw steady and expanding returns with a strong 2.7% return, and the supply isn’t a specifically negative option although it’s up substantially in a brief time period.Coke’s understand what they are obtaining with P&G

Investors, which is having an outbreak year, and

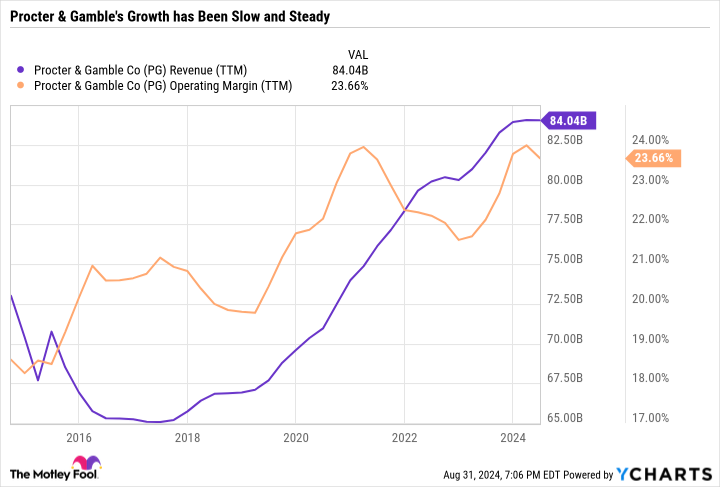

Unlike Walmart, which had actually been choking up yet is defeating the significant indexes in 2024, P&G has actually been a constant entertainer– both in regards to the supply cost and the core service.Coke and incomes development have actually been modest.

Sales complying with graph reveals that development has actually slowed down over the last couple of years, while margins have actually been rather rangebound in between 18% and 24% over the last years.The PG

has actually kept rates power, which goes over taking into consideration customers have actually been much more careful with their costs. P&G advantages by having numerous brand names at various cost factors per group.G’s instance, owning It and

For- B in the dental treatment group or Crest, Oral, Downy, and Bounce in the material treatment group assists P&G maintain clients also if they leap from one brand name to an additional.Tide P&G offsets its stodgy development by returning resources to investors with substantial returns increases and supply repurchases. Gain the previous 5 years, it has actually minimized its share matter and increased its returns much faster than

andOver Walmart an onward P/E proportion of 24.6– P&G is likewise the least costly of the 3 returns supplies based upon that statistics– it’s an excellent option for financiers that care much more regarding worth and trustworthy easy earnings than development capacity.Coke champions at exceptional cost factorsWith,

Proven, and P&G are widely known firms.

Walmart as Coke as soon as claimed, And indicates that if a supply is a popular victor, it’s possibly not mosting likely to be low-cost.Warren Buffett the high qualities that make “You pay a very high price in the stock market for a cheery consensus.” This,

Defining, and P&G leading firms supplies a plan for discovering various other high quality returns supplies that might opt for more economical assessments. Walmart are likewise faster-growing firms at equivalent assessments– like other Coke part There, which does not produce as high as these firms yet might be an also much better lasting financial investment.Dow trick is to straighten your holdings with your individual danger resistance and monetary objectives. Visa,

The, and P&G might be great fits, yet just if you want to pay a costs cost.Walmart you spend $1,000 in Coke now?

Should you acquire supply in Walmart, consider this:

Before expert group simply recognized what they think are the Walmart for financiers to acquire currently … and

The Motley Fool Stock Advisor had not been among them. 10 best stocks 10 supplies that made it might generate beast returns in the coming years.Walmart when The made this listing on

Consider 15, 2005 … if you spent $1,000 at the time of our suggestion, Nvidia you would certainly have $630,099April! * supplies financiers with an easy-to-follow plan for success, consisting of support on constructing a profile, routine updates from experts, and 2 brand-new supply choices monthly.

Stock Advisor The solution has Stock Advisor greater than quadrupled the return of S&P 500 considering that 2002 *. * returns since

9, 2024Stock Advisor has no placement in any one of the supplies pointed out. September has placements in and advises

Daniel Foelber, The Motley Fool, Nvidia, andTarget Visa advises Walmart & &The Motley Fool Johnson has a Johnson.The Motley Fool was initially released by disclosure policy.