Everyone intends to locate the following Tesla ( NASDAQ: TSLA) But purchasing the electrical automobile (EV) room can be tough. Many EV firms have actually declared bankruptcy for many years, and dividing the great from the bad can be tough.

Thankfully, Tesla developed a clear theme for success. And today, there’s one EV stock that looks exceptionally eye-catching. But there’s just one financial investment approach most likely to prosper.

This is just how Tesla ended up being a substantial success

In 2006, Tesla CHIEF EXECUTIVE OFFICER Elon Musk exposed “The Secret Tesla Motors Master Plan” to the general public. “As you know, the initial product of Tesla Motors is a high-performance electric sports car called the Tesla Roadster,” his essay started. “However, some readers may not be aware of the fact that our long term plan is to build a wide range of models, including affordably priced family cars.”

Musk summed up the plan of attack for Tesla:

Today, Tesla is a big sign of success when it pertains to implementing on long-lasting visions. The Tesla Roadster was a success, however offered its $100,000-plus rate factor, its market was constantly tiny.

Tesla required to verify its production chops, and reveal the general public that EVs might be great and interesting. It utilized this success to style, develop, and provide 2 brand-new designs: The Model S and Model X. These designs were still costly, however presented Tesla to thousands of countless brand-new proprietors.

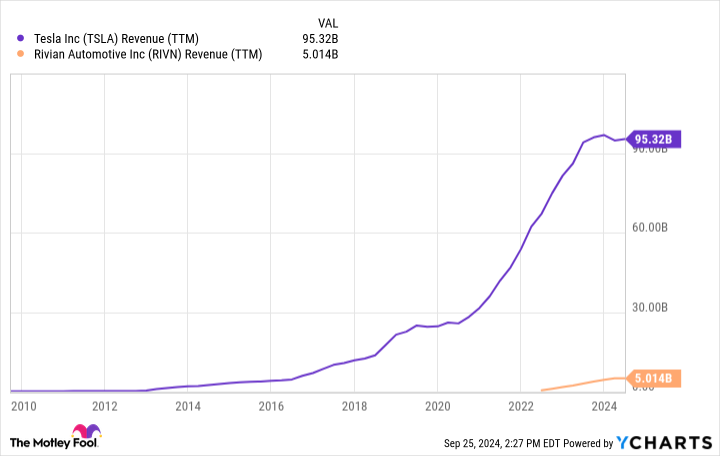

Tesla after that utilized its track record and accessibility to funding to debut 2 brand-new mass market designs, the Model 3 and Model Y. These 2 designs, with far more economical rate factors, enabled Tesla to expand its revenue by greater than 1,000% over the last years.

Tesla’s plan of attack functioned marvels for its evaluation. The firm is presently worth around $800 billion. Another firm, on the other hand, is valued at simply $11 billion– yet it’s implementing Tesla’s tested plan of attack perfectly.

Rivian might be the following large EV supply

When it pertains to complying with Tesla’s theme for success, couple of EV firms look as eye-catching as Rivian ( NASDAQ: RIVN)

In 2018, Rivian revealed the launching of its R1T and R1S designs. Like Tesla’s earlier designs, the R1T and R1S were ultra-luxury, top quality, no-compromise cars with rate factors that might quickly exceed $100,000 with specific alternatives. Consumer comments was wonderful. Consumer Reports discovered that Rivian has the greatest client satisifcation and commitment degrees of any kind of automobile producer– electrical or otherwise. Around 86% of Rivian proprietors claimed they would certainly acquire an additionalRivian No various other brand name was over the 80% mark.

What will Rivian finish with its newly found track record and sales base? Exactly what Tesla did: Build a lot more economical autos. Earlier this year, the firm exposed 3 brand-new designs: The R2, R3, and R3X. All are anticipated to debut with beginning rates under $50,000. It was fulfilling this rate factor that aided place Tesla on the map for numerous individuals. If Rivian can perform, it ought to verify really effective.

If Rivian can reproduce Tesla’s success, why is its market cap floating simply over $10 billion? First, its brand-new designs aren’t anticipated to hit the trail till 2026 at the earliest. Second, the called for production centers aren’t also full yet. Third, the firm is still shedding cash at a quick clip considering that automobile production is funding extensive. However, monitoring anticipates to get to favorable gross earnings by the end of 2024. Finally, Rivian is attempting to contend in a market section– electrical cars– that has actually seen several personal bankruptcies for many years.

It’s clear that the marketplace is unconvinced of Rivian’s strategies, although it is implementing on a tested design for development, and has actually shown its capability to make cars that clients enjoy. The following couple of years, nevertheless, will certainly be crucial. Rivian will certainly come to be a family name like Tesla if it can perform, an outcome that will likely see a quick development in its evaluation.

There’s no warranty that the firm will certainly preserve its capability to touch funding markets economically or obtain its production capacities up and running swiftly. It will certainly need to market its cars in a hypercompetitive market. Yet it is this unpredictability that offers client financiers with a profitable entrance factor for Rivian supply today. If you can continue to be client, Rivian’s surge might ultimately mirror Tesla’s.

Should you spend $1,000 in Rivian Automotive today?

Before you acquire supply in Rivian Automotive, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for financiers to acquire currently … and Rivian Automotive had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $743,952! *

Stock Advisor offers financiers with an easy-to-follow plan for success, consisting of support on constructing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since September 23, 2024

Ryan Vanzo has no setting in any one of the supplies stated. The Motley Fool has placements in and suggestsTesla The Motley Fool has a disclosure policy.

The Ultimate Electric Vehicle (EV) Stock to Buy With $1,000 Right Now was initially released by The Motley Fool