Buying Alphabet ( NASDAQ: GOOG) ( NASDAQ: GOOGL) supply is seldom a negative concept.

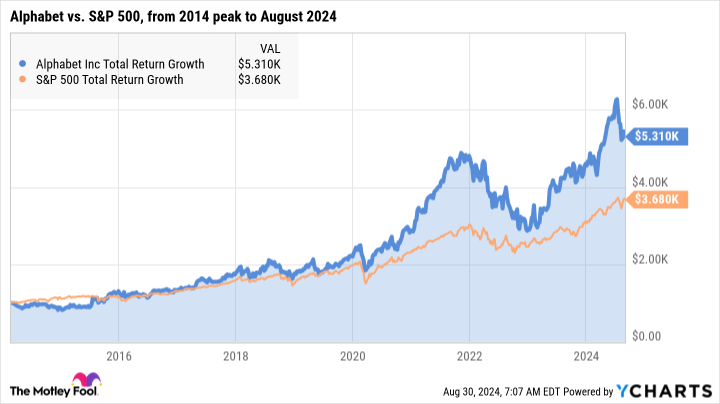

Imagine getting $1,000 of Alphabet supply onFeb 25, 2014. That ended up being the most awful day of that year to enter into the innovation titan’s shares. The day’s optimal, with a document rate of $30.50 per split-adjusted share, was complied with by an 18% dive over the following 10 months. The bear lure accumulated as European regulatory authorities thought about separating the firm, Android phone sales had a hard time, magnates left, and brand-new item concepts like Google Glass and Waymo self-driving autos weren’t capturing on.

That’s okay, though. If you had actually hung on to that $1,000 financial investment via thick and slim, you would certainly have a market-beating $5,310 in your pocket about one decade later on.

Alphabet’s supply has actually stumbled in the past– and return turning

You would certainly naturally have actually done also much better if you purchased Alphabet on any kind of various other day of that year, yet the firm conquered its problems and stomped the more comprehensive market also from the most awful feasible beginning factor of 2014. I anticipate future generations to claim comparable aspects of purchasing Alphabet supply in 2024– that financial investment must defeat the marketplace for several years or perhaps years to find, regardless of exactly how inadequately you might have timed the acquisition.

Time in the market beats timing the market, you recognize. And this company was built to last for a very long time.

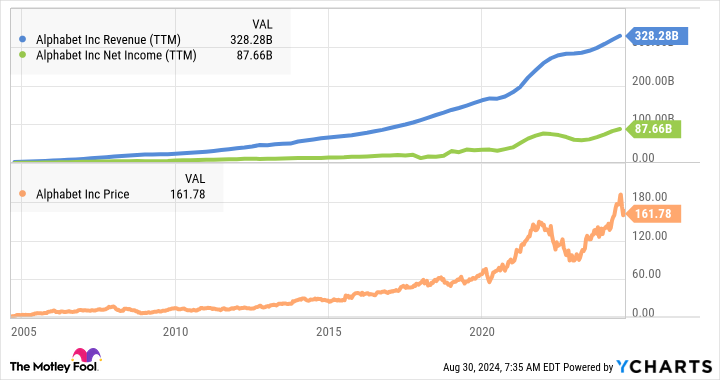

I can not consider any kind of solitary firm more probable than Alphabet to supply durable returns in 2040, 2050, and past. That dreadful rate decrease in 2014 is a hardly noticeable graph squiggle now. And Alphabet’s company results simply remained to expand:

Alphabet’s supply is a deal today

Wait– it still improves. On top of Alphabet’s tank-like remaining power, the supply occurs to be uncommonly inexpensive today.

After getting to one more all-time document of $191.40 per share in July, Alphabet shares have actually pulled back 15% to about $162 per share. As I create this, they trade at 23.4 times tracking profits with a price-to-earnings-to-growth (PEG) proportion of 1.1. These are one of the most inexpensive earnings-based assessment proportions amongst the “Magnificent Seven” of technology titans.

Moreover, Alphabet has actually taken a leading function in the expert system (AI) boom. Google Cloud is a preferred cloud computer system where various other business can educate and run their very own AI systems. The Google Gemini chatbot contends straight with OpenAI’s ChatGPT in language understanding and generation. The firm is positioned to maximize generative AI as a lasting development stimulant.

I might take place, yet you obtain my factor. Alphabet’s supply was a great financial investment prior to the current sell-off, and it’s an also much better acquire today. Market sell-offs can be your buddy when you’re seeking to purchase a terrific firm like Alphabet.

Should you spend $1,000 in Alphabet today?

Before you acquire supply in Alphabet, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to acquire currently … and Alphabet had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $731,449! *

Stock Advisor supplies capitalists with an easy-to-follow plan for success, consisting of support on constructing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since August 26, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. Anders Bylund has placements in Alphabet and Vanguard S&P 500 ETF. The Motley Fool has placements in and suggests Alphabet and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The Recent Tech Sell-Off Made This Artificial Intelligence (AI) Stock an Even Better Buy was initially released by The Motley Fool