The supply of SoFi Technologies ( NASDAQ: SOFI) has actually been squashed this year after increasing in 2014. It’s down 20% year to day regardless of what looks like quite strong efficiency.

However, the trend could transform, and quickly. Let’s see why SoFi supply can skyrocket over the following 5 years.

Expanded organization, reduced rates of interest

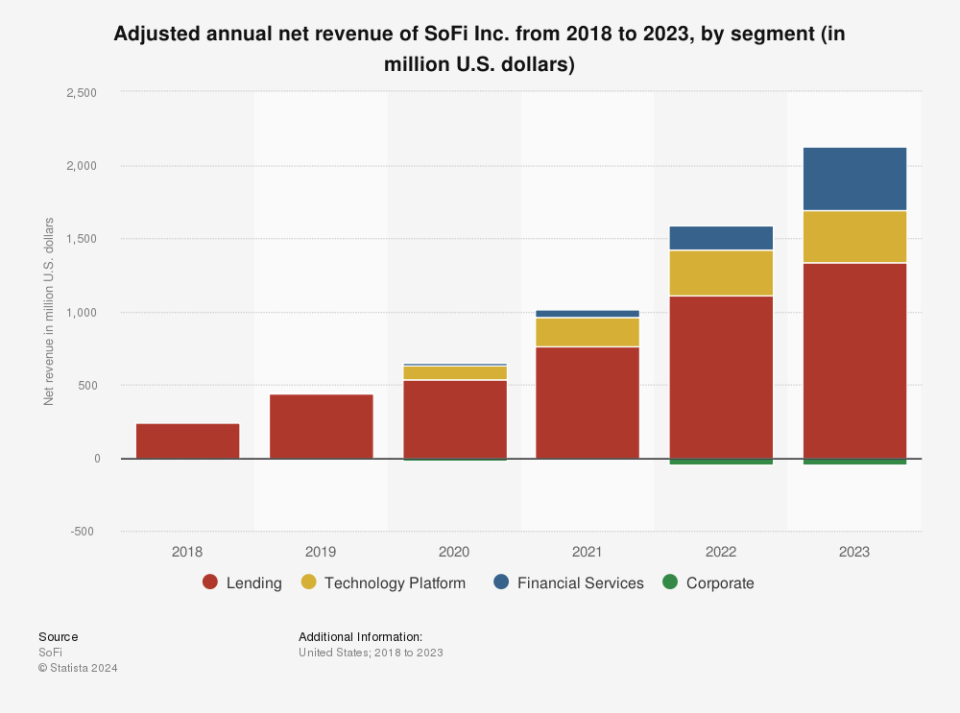

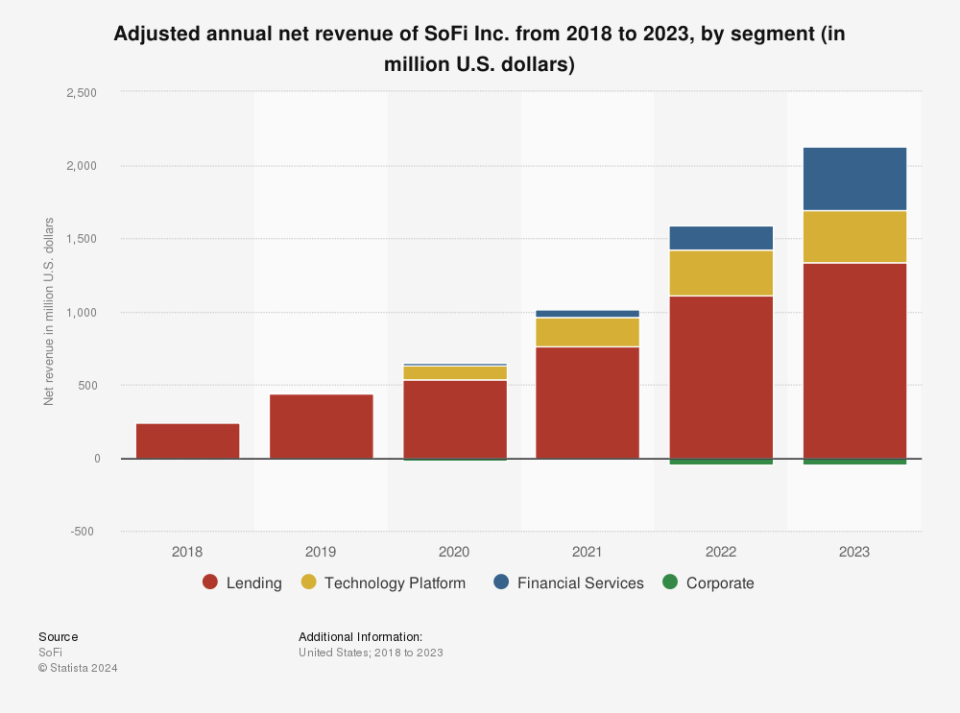

SoFi’s primary organization is offering, yet it has actually broadened right into a huge range of monetary solutions like savings account and financial investments. Offering various other solutions supplies a number of advantages for SoFi.

It offers it brand-new income resources, it develops higher cross-platform involvement amongst present participants, it can draw in brand-new participants, and– what stands apart currently– is that it guards business from the changing effects of interest rates.

Lending can be a financially rewarding organization, yet it’s extremely conscious rates of interest, and SoFi’s borrowing section has actually been under stress as prices stay high.

Now that rates of interest resemble they’re mosting likely to begin boiling down, the stress ought to start to reduce. Meanwhile, the various other sections are still in development setting, and they remain to make up a greater percent of the firm’s general organization.

The borrowing section remains to expand, yet the non-lending sections are expanding much quicker. They represented 45% of business in the 2024 2nd quarter, up from 38% a year earlier. As the various other sections surpass offering development, SoFi will certainly come to be an extra secure organization, with reduced direct exposure to rate of interest motion.

If the borrowing section grabs with reduced prices, which is just how the section functions, capitalists’ present problems concerning business will certainly drop away. When you incorporate that with the stamina in the firm’s development version, SoFi supply can blow up over the following 5 years, and currently can be a good time to purchase in.

Should you spend $1,000 in SoFi Technologies now?

Before you purchase supply in SoFi Technologies, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for capitalists to purchase currently … and SoFi Technologies had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $743,952! *

Stock Advisor supplies capitalists with an easy-to-follow plan for success, consisting of support on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since September 23, 2024

Jennifer Saibil has placements in SoFiTechnologies The Motley Fool has no placement in any one of the supplies stated. The Motley Fool has a disclosure policy.

Prediction: SoFi Stock Will Soar Over the Next 5 Years. Here’s 1 Reason Why. was initially released by The Motley Fool