Super Micro Computer ( NASDAQ: SMCI) has actually been among the most significant victors of the expert system (AI) boom.

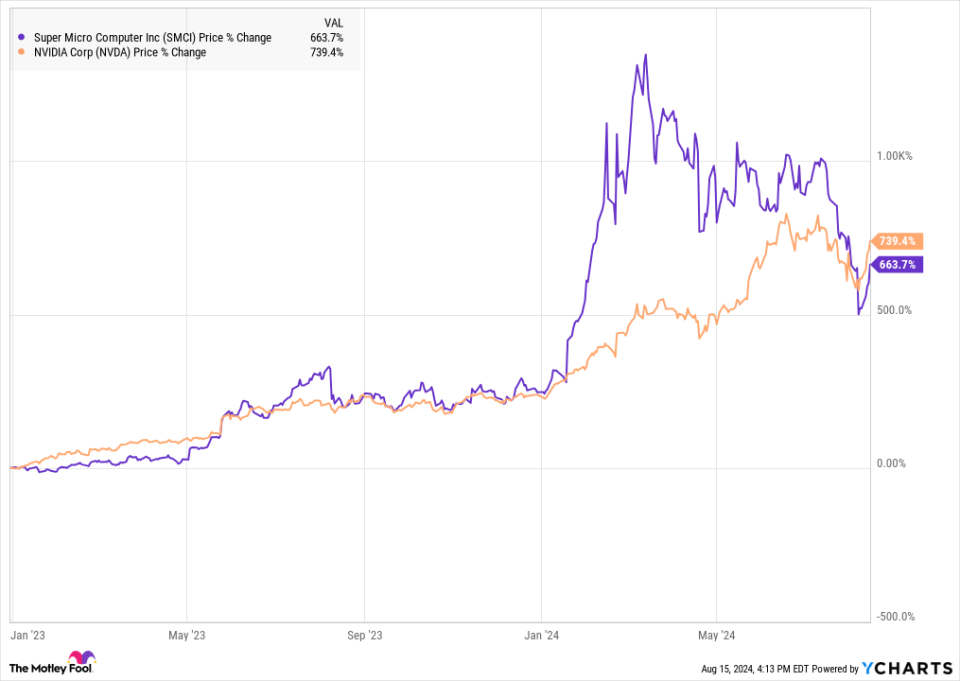

Even after the pullback in current months, Supermicro, as the firm is additionally understood, is still up virtually 700% from the beginning of 2023, virtually matching Nvidia as the graph listed below programs.

The firm, that makes high-density web servers that are especially well fit to running AI applications, has actually completed that by installing Nvidia- like development numbers with profits leaping 144% in its lately reported fiscal-fourth quarter.

In action to the supply rise, Supermicro lately chose to award financiers with a 10-for-1 supply split, which enters into impact onOct 1. The firm stated it was dividing the supply to make it much more obtainable.

Should you get Super Micro Computer prior to the stock split? Let’s have a look at the proof.

Recent efficiency is blended

There’s no doubt that Supermicro is experiencing rising development, yet there’s been an imperfection on the firm’s document, and it’s one factor the supply toppled after the current revenues record. Gross margin has actually been dropping also as profits has actually risen. In the 4th quarter, the firm reported a gross margin of simply 11.2%, below 17% in the quarter a year back. That equated right into reduced operating margins for Supermicro also, being up to 6.5% from 10.3%.

The excellent information is that the firm anticipates gross margin to recoup, stating that supply chain traffic jams have actually increased rates for brand-new elements, yet that ought to decline over the following year. Management additionally stated that lasting gross margins will certainly gain from reduced production expenses in manufacturing in Malaysia andTaiwan It additionally prepares to broaden in the Americas and in Europe.

If margins recoup following year, the supply ought to relocate higher.

Will the supply split aid?

Investors ought to recognize that a supply split does not do anything to transform the basic worth of a supply; it simply splits the typical pie right into even more items, making specific shares less expensive.

There’s additionally some proof that supplies have actually outshined the S&P 500 in the year following their supply divides, according to study from Bank of America, which located that supplies that divided gain 25% generally contrasted to simply a 9% gain for the S&P 500 That might be since supply divides often tend to adhere to solid energy in the share rate and lead to component from administration’s self-confidence in business.

However, a minimum of some proof appears to oppose those searchings for. Nvidia, for instance, the supply leading the AI boom and a close companion of Supermicro, released a 10-for-1 supply split on June 7. Since after that, the supply is up simply 1.5%, somewhat behind the S&P 500’s 3.5%.

Chipotle supply came to a head prior to its 50-for-1 supply split on June 26 and has actually given that dropped 21%.

Celsius Holdings, the power beverage manufacturer, is down 20% given that its 3-for-1 split last November, and Broadcom, the networking chip expert, is down 3% given that its July 15 10-for-1 split, contrasted to a 0.5% dip for the S&P 500 throughout that very same duration.

Clearly, a supply split isn’t a warranty of outperformance also if supply divides have actually outshined traditionally generally.

Should you get Supermicro prior toOct 1?

Whether you’re an AI supply capitalist or a stock-split capitalist, the bright side is that Supermicro’s pullback develops an eye-catching chance to get the supply as it’s down virtually 50% from its height in March when it was confessed to the S&P 500.

Super Micro Computer currently trades at a price-to-earnings proportion (P/E) of 31, which appears like an anticipate a supply that still has a lots of development possibility and anticipates to see margins broaden over the coming years.

Supermicro has a variety of affordable benefits that ought to assist it remain to prosper in the AI web server market, consisting of a close connection with Nvidia and know-how with high-density web servers. Plus, the firm is a leader in straight fluid air conditioning (DLC), a vital modern technology for maximizing equipment efficiency. CHIEF EXECUTIVE OFFICER Charles Liang lately stated, “We are targeting 25% to 30% of the new global datacenter deployments to use DLC solutions in the next 12 months, with most deployments coming from Super Micro.”

The supply split alone isn’t a great factor to get the supply, yet with Supermicro’s solid development potential customers, appealing assessment, and bigger, lasting chance in AI, getting prior to the supply split appears like a fantastic relocation.

Should you spend $1,000 in Super Micro Computer now?

Before you get supply in Super Micro Computer, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for financiers to get currently … and Super Micro Computer had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $758,227! *

Stock Advisor gives financiers with an easy-to-follow plan for success, consisting of support on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since August 22, 2024

Bank of America is a marketing companion of The Ascent, a Motley Fool firm. Jeremy Bowman has placements in Bank of America, Broadcom, andChipotle Mexican Grill The Motley Fool has placements in and advises Bank of America, Celsius, Chipotle Mexican Grill, andNvidia The Motley Fool advises Broadcom and advises the complying with alternatives: brief September 2024 $52 places onChipotle Mexican Grill The Motley Fool has a disclosure policy.

Should You Buy Super Micro Computer Before the Stock Split? was initially released by The Motley Fool

&w=100&resize=100,70&ssl=1)