It’s been yet one more amazing revenues period for capitalists as megacap technology business confirmed that the artificial intelligence (AI) train is relocating full speed in advance.

One AI gamer particularly is yet to release monetary outcomes for the 2nd quarter.On Aug 28, semiconductor expert Nvidia ( NASDAQ: NVDA) will certainly report revenues, and you can wager that bulls and births all throughout Wall Street will certainly be concentrating on every last number the business generates.

Let’s study what capitalists ought to search for and evaluate if currently is a great time to purchase shares of Nvidia.

What is Wall Street projecting for Nvidia revenues?

Nvidia records earnings in 5 groups: information facilities, pc gaming, specialist visualization, automobile, and initial tools production (OEM).

Each section is linked to AI in some kind or style, however the frustrating bulk of Nvidia’s organization originates from information facilities. During the business’s very first quarter of financial 2025 (finished April 28), complete earnings was $26 billion. Nearly 87% of that, or $22.7 billion, originated from the information facility organization.

According to agreement expert price quotes, Wall Street is anticipating that second-quarter sales will certainly be about $28.5 billion. Should Nvidia accomplish this target, it would certainly stand for 111% development year over year.

In the area listed below, I’ll damage down why I assume Nvidia could surprise these price quotes and describe several of that tailwinds that can be raising its crucial information facility procedure.

An excellent proxy for Nvidia

It’s apparent that an usual string sewing the general material of megacap technology today is AI. But at an extra granular degree, AI’s assimilation with cloud computer is a large motion within the modern technology sector at big.

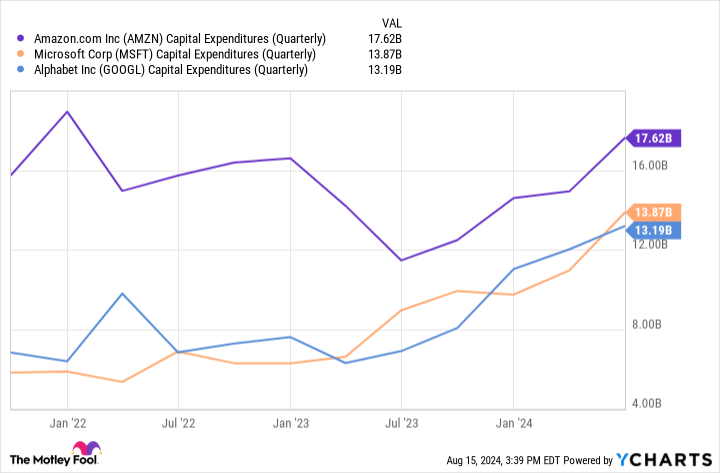

The cloud computer landscape is controlled by Amazon, Microsoft, and Alphabet.

During the 2nd quarter, each of these “Magnificent Seven” participants exposed some intriguing functions. Namely, each is strongly enhancing financial investments in capital investment (capex).

In the instance of Amazon, the business’s huge campaign is an $11 billion financial investment right into information facilities in Indiana as component of a wider rollout to create its very own AI-powered chips. As for Microsoft, the business hasn’t been timid regarding brand-new investments in nuclear-powered data centers as the business looks for to increase down on AI facilities in a power reliable means.

During Alphabet’s second-quarter revenues phone call, primary monetary policeman Ruth Porat stated that capex investing was “driven overwhelmingly by investment in our technical infrastructure with the largest component for servers followed by data centers.”

Do you see the motif? All of Nvidia’s friends are spending 10s of billions of bucks right into information facility facilities, and the fads in the graph over recommend it will not be reducing anytime quickly.

Considering the mass of Nvidia’s earnings and revenues originates from information facility solutions and the business’s advanced graphics refining systems (GPU), I see the climbing capex patterns from others in huge technology as an excellent proxy of what’s to find for Nvidia.

Should you purchase Nvidia supply prior toAug 28?

AI became the most popular ticket in the technology world towards completion of 2022 when OpenAI launched ChatGPT.

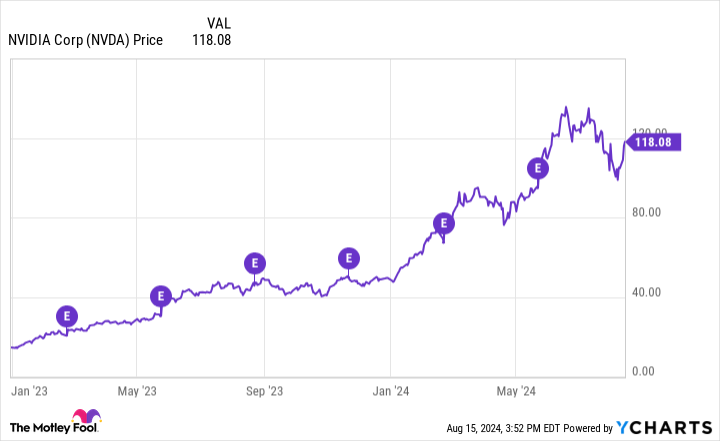

In the graph below, you can see just how Nvidia supply responded complying with a collection of revenues records given that the start of in 2015. The revenues record days are annotated by the purple circles with “E” in the center.

It’s clear that Nvidia supply has actually increased significantly over the last 20 months or two. More particularly, the supply hardly ever went down right away complying with an incomes record, and when it did, the sell-off was short.

To me, this aids verify that purchasing Nvidia supply either prior to or after its last a number of revenues records finished in the very same outcome: gains.

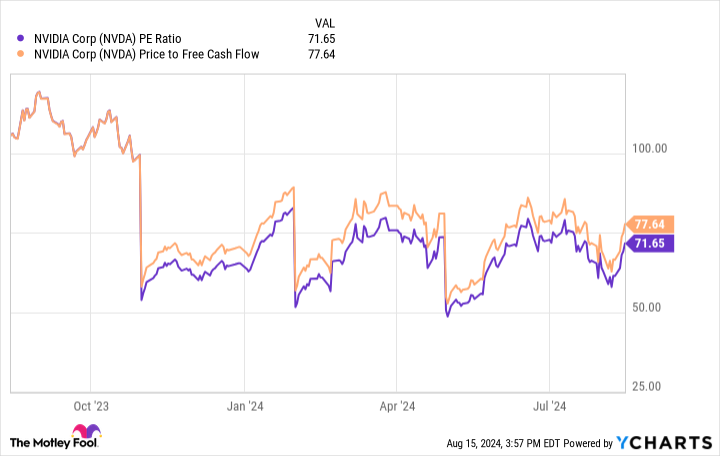

When it pertains to appraisal, Nvidia supply is cheaper today than it was a year back on both a price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) basis. This compression in multiples has actually happened since the business’s revenues and capital are in fact climbing much faster than its sales, an indication of an exceptionally healthy and balanced and effective procedure.

Given the fads from its Magnificent Seven peers kept in mind above, I’m meticulously confident that Nvidia can experience yet one more outstanding quarter. For these factors, it may be an excellent concept to purchase some shares currently since background recommends Nvidia supply can be gone to more gains.

But I would not obtain as well captured up in the specific timing. If you choose to evaluate the revenues record initially and afterwards make a decision to purchase the supply, maybe you’ll be spending at a somewhat greater appraisal. Given the fads in the revenues graph, I’m positive that gains will certainly still be on the perspective for lasting capitalists whether they purchase Nvidia supply prior toAug 28.

Should you spend $1,000 in Nvidia today?

Before you purchase supply in Nvidia, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to purchase currently … and Nvidia had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $779,735! *

Stock Advisor offers capitalists with an easy-to-follow plan for success, consisting of support on constructing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since August 12, 2024

John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. Adam Spatacco has placements in Alphabet, Amazon, Microsoft, andNvidia The Motley Fool has placements in and suggests Alphabet, Amazon, Microsoft, andNvidia The Motley Fool suggests the complying with choices: lengthy January 2026 $395 contact Microsoft and brief January 2026 $405 contactMicrosoft The Motley Fool has a disclosure policy.

Should You Buy Nvidia Stock Before Aug. 28? was initially released by The Motley Fool