Artificial intelligence (AI) is the most popular investing theme of the minute. Much ink has actually been splashed on the innovation’s incredible power and possible financial effect. Could it be as transformative as its evangelists would certainly have you think? PwC– among the “big four” bookkeeping companies– thinks AI can include $15.7 trillion to the international economic climate by 2030. If that shows to be real, it definitely fulfills the mark in my publication.

While Nvidia took spotlight, one more AI business, Palantir ( NYSE: PLTR), simply passed a significant landmark that might aid increase its account and supply rate. Founded in 2003, the business definitely isn’t brand-new, yet current innovations in AI are turbo charging the business’s capacity to make a profit. The business’s share rate did the same, up 150% this year alone.

This made it qualified for incorporation in the S&P 500, and Palantir formally signed up with the index late last month. What does this mean for the business?

Joining the S&P 500 is a large offer and might influence Palantir’s supply rate

The S&P 500 is an index included the 500 biggest business in the united state by market capitalization. It’s likewise among one of the most popular and prominent indexes about– so prominent that it’s frequently made use of as a proxy for the stock exchange overall. This presence typically equates to an uptick in financial investment from the retail market. Some of these capitalists are reading about the business for the very first time, while others see its incorporation as a mark of authenticity.

Beyond retail, nonetheless, the index is tracked by all kind of funds, like the uber-popular SPDR S&P 500 ETF Trust or Vanguard 500Index Fund When a firm signs up with the S&P, there is a flooding of funding right into the supply as these funds adjust to match the index.

All this brings about what’s in some cases called the “S&P 500 effect”– a bump in supply rate after being consisted of in the index. Take Nvidia, as an example. The chipmaker was revealed as the substitute for the collapsing Enron back in November of 2001. In the month that adhered to, its supply rate rose greater than 30%. Will this occur to Palantir?

Correlation is not causation

Unfortunately, the impact might be even more of a coincidence. A research study appointed by the Federal Reserve Bank of New York considered the impact and located that there truly isn’t a great deal of proof for it, or a minimum of that any type of straight impact is brief.

Stocks that obtain contributed to the index have a tendency to currently get on a growth. They have previous energy. The research revealed that this energy was the key source of efficiency over the long-term post-inclusion. Essentially, the favorable rate activity would certainly have occurred with or without being included. Still, whether it is the reason or otherwise, the truth stays that when a firm is contributed to the S&P 500, it has a tendency to do well.

Palantir is appealing, yet beware of its evaluation

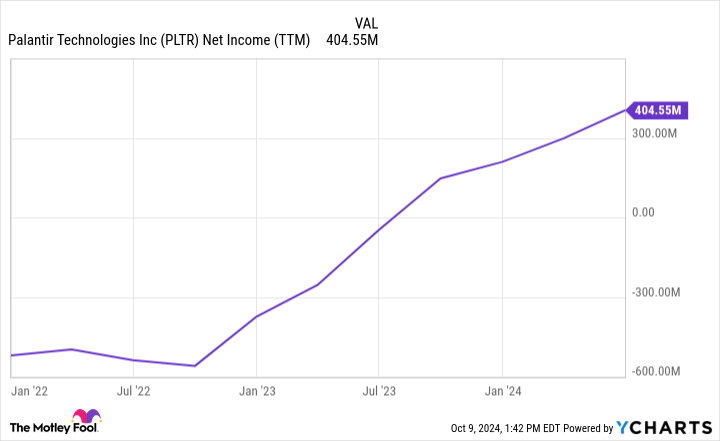

The business is revealing solid development in its top-line profits and incredible decreases in operating costs. This implies big growths in its earnings. Take a take a look at the graph revealing the departure in 2022.

These are patterns you intend to see. The business is remaining to discover success in the financially rewarding globe of federal government agreements and revealed last month that it had actually landed one more, this time around with the united state Army, to aid upgrade its AI abilities. The brand-new agreement implies the business is currently dealing with all 5 of the united state armed solutions.

Palantir’s as a firm looks wonderful. Its revenue development looks readied to proceed its quick increase. However, its capacity to earn money isn’t the problem. Sometimes a wonderful business can end up being a not-so-great financial investment if it’s valued too expensive. I believe that holds true below. While evaluation metrics can be rickety for a while as a firm ultimately starts to make a profit, I can not disregard simply exactly how out of order its supply rate appears to be.

It presently has an ahead price-to-earnings proportion (P/E) of 103 and a price-to-sales proportion (P/S) of 41. Compare that to Nvidia, which is valued at fairly a costs right now, which has an ahead P/E of 46 and a P/S of 26. Alphabet‘s metrics are 21 and 6, specifically.

With the supply rate where it is, I can not advise the supply to a lot of capitalists. I believe there are far better areas to place your cash. However, if you are more youthful with a high threat resistance and a long time perspective, maybe an intriguing play.

Should you spend $1,000 in Palantir Technologies now?

Before you acquire supply in Palantir Technologies, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for capitalists to acquire currently … and Palantir Technologies had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $812,893! *

Stock Advisor offers capitalists with an easy-to-follow plan for success, consisting of assistance on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since October 7, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. Johnny Rice has placements in SPDR S&P 500 ETFTrust The Motley Fool has placements in and advises Alphabet, Nvidia, Palantir Technologies, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Palantir Just Joined the S&P 500. History Says the Artificial Intelligence (AI) Stock Will Do This Next. was initially released by The Motley Fool

&w=324&resize=324,235&ssl=1)