No business has actually been a larger champion than Nvidia ( NASDAQ: NVDA) as almost every technology business has actually jointly put billions of bucks right into establishing their generative AI (expert system) abilities. The business has actually included $2.5 trillion to its market cap over the last 2 years as sales and earnings took off with the need for its GPUs.

The chipmaker has actually revealed unbelievable rates power amidst the solid need. That’s shown by its gross margin increasing right into the top 70% variety. And with the thriving sales development, it’s seen extremely high operating utilize, which equates right into substantial fundamental development. To make certain, Nvidia’s efficiency as a company, not simply a supply, over the last 2 years has actually been absolutely nothing except remarkable.

But Nvidia isn’t the only AI chip supply out there. And CHIEF EXECUTIVE OFFICER Jensen Huang simply discussed why one more business might deserve owning, probably much more so than his very own business.

“The world’s best by an incredible margin”

At a capitalist seminar previously this month, Huang had full marks for among Nvidia’s greatest organization companions: Taiwan Semiconductor Manufacturing ( NYSE: TSM), referred to as TSMC.

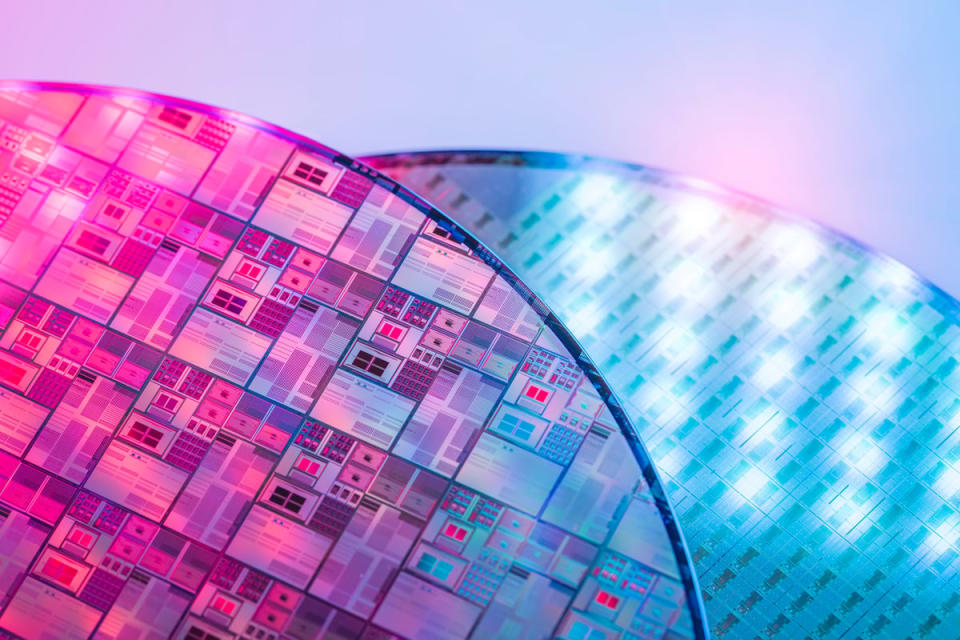

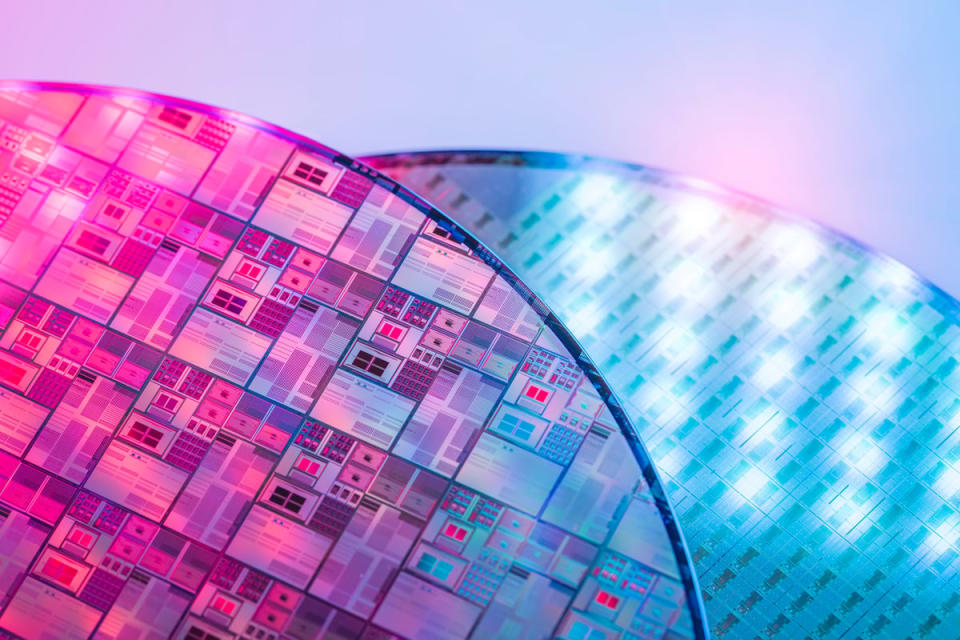

TSMC is the biggest semiconductor factory, or fab, on the planet. When a firm like Nvidia develops a brand-new chip, it takes it to TSMC to in fact publish the style on a silicon wafer. That takes unbelievable accuracy and ingenious technological abilities. TSMC is the leading selection for several chip developers, consisting ofNvidia TSMC regulates over 60% of international costs at chip factories.

“We’re fabbing out of TSMC because it’s the world’s best,” Huang claimed. “And it’s the world’s best not by a small margin, it’s the world’s best by an incredible margin.”

That’s why Nvidia and practically any individual else that requires to create sophisticated chips selects TSMC over its rivals. Huang did state Nvidia might change to one more factory if it needed to. But he likewise claimed rivals’ abilities can not match TSMC’s and it would certainly cause much less efficiency or greater expense.

He likewise applauded TSMC’s capacity to scale its procedures. When Nvidia saw need for its chips increase, TSMC had the ability to assist it satisfy that expanding need so it might make use of the possibility. Any organization that requires to be able to scale up demands to deal with TSMC.

Importantly, TSMC’s placement as the marketplace leader, winning most of income in the sector, guarantees it’ll remain in its leading placement. It has even more cash to reinvest in R&D and produce the future generation of procedures. The virtuous cycle brings about increasingly more large agreements with large technology firms making incredibly premium chips in time.

TSMC still has a great deal of development left

TSMC could be the greatest business in the sector, yet there’s still a lots of development for it to catch.

Tech firms are all intending to increase their costs on AI systems in information facilities. Total costs on AI chip material and associated systems is anticipated to get to $193.3 billion in 2027, according to quotes from IDC. That’s up from $117.5 billion this year, equating right into an 18% substance yearly development price over the following 3 years.

Importantly, TSMC is extremely agnostic to that development. Whether that development originates from Nvidia, among its rivals, or custom chips designed by its biggest customers, TSMC is most likely winning the mass of those agreements. In reality, the virtuous cycle and TSMC’s management in sophisticated chips indicates it might expand that component of its organization also much faster than the sector. On top of that, TSMC has area to enhance its margins.

That’s all mirrored in experts’ projections for the business over the following 5 years. The typical expert anticipates TSMC to expand incomes over 20% each year for the following half-decade. But you do not need to compensate for that development. Shares presently profession at simply over 20 times the agreement 2025 incomes projection.

Few various other firms provide that exact same degree of possible development at that cost. So, not just is it the globe’s ideal fab by an extraordinary margin, financiers can acquire a risk in it now at an extraordinary cost.

Should you spend $1,000 in Taiwan Semiconductor Manufacturing now?

Before you acquire supply in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for financiers to acquire currently … and Taiwan Semiconductor Manufacturing had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $722,320! *

Stock Advisor supplies financiers with an easy-to-follow plan for success, consisting of assistance on constructing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since September 16, 2024

Adam Levy has placements inTaiwan Semiconductor Manufacturing The Motley Fool has placements in and advises Nvidia andTaiwan Semiconductor Manufacturing The Motley Fool has a disclosure policy.

Nvidia’s CEO Just Explained Why This Is the Artificial Intelligence (AI) Chip Stock to Own was initially released by The Motley Fool