It’s clear that semiconductor supplies have actually been especially huge victors amidst the expert system (AI) transformation. With share rates escalating, a number of top-level chip business have actually gone with stock splits this year. Some AI chip stock-split supplies you may acknowledge consist of Nvidia ( NASDAQ: NVDA), Super Micro Computer ( NASDAQ: SMCI), and Broadcom ( NASDAQ: AVGO)

Indeed, each of these supplies has actually done marvels for lots of profiles over the last number of years. However, I see among these chip supplies as the remarkable selection over its peers.

Let’s damage down the complete photo at Nvidia, Supermicro, and Broadcom and establish which AI chip stock-split supply can be the very best buy-and-hold chance for lasting capitalists.

1. Nvidia

For the last 2 years, Nvidia has actually not just been the greatest name in the chip area however additionally basically became the best scale of AI need at huge. The business focuses on developing innovative chips, called graphics refining devices (GPUs), and information facility solutions. Moreover, Nvidia’s compute unified device architecture (CUDA) gives a software program element that can made use of together with its GPUs, offering the business with an excellent and profitable end-to-end AI community.

While all that looks fantastic, capitalists can not pay for to be starry-eyed as a result of Nvidia’s existing supremacy. The table listed below breaks down Nvidia’s income and free-cash-flow development fads over the last a number of quarters.

|

Category |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|---|---|---|---|---|---|

|

Revenue |

101% |

206% |

265% |

262% |

122% |

|

Free capital |

634% |

Not product |

553% |

473% |

125% |

Data resource: Nvidia Investor Relations.

Admittedly, it’s difficult to toss color on a firm that is regularly providing triple-digit income and revenue development. My worry about Nvidia is not associated with the degree of its development however instead its rate.

For the business’s 2nd quarter of monetary 2025 (finished July 28), Nvidia’s income and cost-free capital climbed 122% and 125% year over year, specifically. This is a noteworthy stagnation from the last a number of quarters. It’s reasonable to explain that the semiconductor sector is intermittent, and an aspect like that can affect development in any type of provided quarter. Unfortunately, I believe there’s even more under the surface area with Nvidia.

Namely, Nvidia encounters increasing competitors from straight sector pressures, such as Advanced Micro Devices, and digressive dangers from its clients– particularly, Tesla, Meta, andAmazon In concept, as competitors in the chip area increases, clients will certainly have extra choices.

This leaves Nvidia with much less utilize, which will likely lessen a few of its prices power. In the future, this can take a significant toll on Nvidia’s income and revenue development. For these factors, capitalists may intend to take into consideration some options to Nvidia.

2. Super Micro Computer

Supermicro is an IT design business concentrating on developing web server shelfs and various other framework for information facilities. In current years, skyrocketing need for semiconductor chips and information facility solutions has actually worked as a bellwether forSupermicro Moreover, the business’s close partnership with Nvidia has actually confirmed especially advantageous.

That stated, I have some interest inSupermicro As a facilities company, the business depends greatly on various other business’ capital investment demands. This makes Supermicro’s development at risk to outside variables, such as need for information facility solutions, chips, web server shelfs, and extra. Furthermore, Supermicro is much from the only IT design expert on the market.

Competition from Dell, Hewlett Packard, and Lenovo (simply among others) bring their very own degrees of experience to the industry. As an outcome of completing in such a commoditized ambience, Supermicro can be required to contend on rate– which takes a toll on revenue generation.

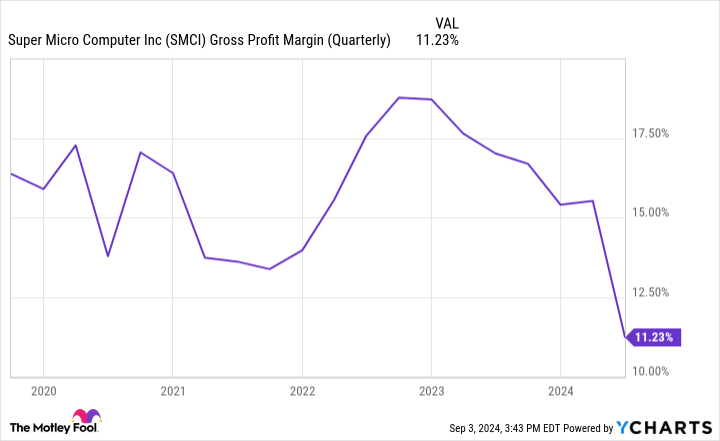

Infrastructure companies do not bring the very same margin account as software application business, as an example. Given that the business’s gross margins are rather reduced and in decrease, capitalists should beware. While Supermicro’s monitoring attempted to guarantee capitalists that the margin degeneration is the outcome of some logjams in the supply chain, extra current information may signify that gross margin is the least of the business’s issues.

Supermicro was just recently the target of a brief record released byHindenburg Research Hindenburg declares that Supermicro’s audit methods have some imperfections. Following the brief record, Supermicro reacted in a news release laying out that the business is postponing its yearly declare 2024.

Given the changability of need leads, an ever-changing margin and revenue dynamic, and the accusations bordering its audit methods, I believe capitalists currently have much better choices in the chip area.

3. Broadcom

By procedure of removal, it’s clear that Broadcom is my leading buy-and-hold selection amongst chip supplies now. This is not because Broadcom’s returns this year have actually delayed its equivalents, however. The underlying factors Broadcom’s shares have actually faded contrasted to various other chip supplies can why I believe its finest days are in advance.

I see Broadcom as an extra varied company than Nvidia andSupermicro The business runs throughout a host of development markets, consisting of semiconductors and framework software application. Grand View Research approximates that the overall addressable market for systems framework in the united state was valued at $136 billion back in 2021 and was readied to expand at a compound yearly development price of 8.4% in between 2022 and 2030.

Systems framework consists of possibilities in information facilities, interactions, cloud computer, and extra. Considering firms of all dimensions are progressively counting on electronic framework to make data-driven choices, I see the function Broadcom plays in network protection and connection as a significant chance and believe its current purchase of VMware is especially smart and will certainly assist open brand-new development capacity.

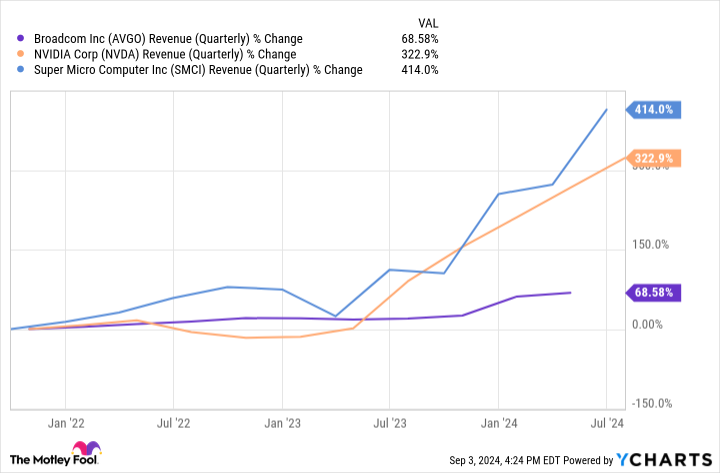

If you take a look at the development fads in the graph above, it’s evident that Broadcom is not experiencing the very same degree of need as Nvidia and Supermicro now. I believe this is since Broadcom’s placement in the more comprehensive AI world is yet to experience proportionate development contrasted to getting chips and storage space services in droves.

While I’m not stating Nvidia or Supermicro are bad options, I believe their futures look cloudier than Broadcom’s now. I think Broadcom remains in the extremely onset of a brand-new development frontier including several motifs (with AI being simply among them). For these factors, I see Broadcom as the very best alternative checked out in this item and believe lasting capitalists have a profitable chance to scoop up shares and hang on limited.

Should you spend $1,000 in Broadcom now?

Before you get supply in Broadcom, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to get currently … and Broadcom had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $630,099! *

Stock Advisor gives capitalists with an easy-to-follow plan for success, consisting of support on constructing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 because 2002 *.

*Stock Advisor returns since September 3, 2024

John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Randi Zuckerberg, a previous supervisor of market growth and spokesperson for Facebook and sibling to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. Adam Spatacco has settings in Amazon, Meta Platforms, Nvidia, andTesla The Motley Fool has settings in and advises Advanced Micro Devices, Amazon, Meta Platforms, Nvidia, andTesla The Motley Fool advisesBroadcom The Motley Fool has a disclosure policy.

Nvidia, Super Micro, or Broadcom? Meet the Artificial Intelligence (AI) Stock-Split Stock I Think Is the Best Buy and Hold Over the Next 10 Years. was initially released by The Motley Fool

&w=100&resize=100,70&ssl=1)