Despite a rough beginning in August, capitalist belief has actually stayed durable, with the S&P 500 rallying virtually 9% considering that its August fifth reduced.

This upwards energy has actually been driven by a collection of favorable financial information launches, consisting of better-than-expected preliminary unemployed insurance claims and solid retail sales numbers.

Wall Street additionally responded positively to Federal Reserve Chair Jerome Powell’s discuss Friday, signaling that the Fed is prepared to reduce rates of interest as the labor market softens and rising cost of living comes close to the Fed’s 2% yearly target.

With this favorable rise in play, the vital inquiry is: just how can you find the following warm supply in this setting? One efficient approach is to concentrate on high-upside supplies recommended by experts from top-tier financial investment financial institutions likeMorgan Stanley These specialists bring important experience and thorough expertise to the table.

In reality, the experts at Morgan Stanley have actually highlighted 2 supplies they think are positioned for substantial gains in the coming year– with possible benefit as high as 220% in one instance. If that’s not tempting sufficient, according to the TipRanks database, both supplies are additionally ranked as Strong Buys by the expert agreement. Let’s see what’s driving the consentaneous appreciation from experts.

COMPASS Pathways ( CMPS)

The initially Morgan Stanley choice we’ll check out is COMPASS Pathways, a biopharma company creating ingenious therapies for hard-to-treat psychological wellness conditions by leveraging the psychedelic impact of psilocybin. As the energetic substance in ‘magic mushrooms,’ psilocybin has actually amassed interest in psychological circles for its possible to efficiently deal with a large range of psychological wellness problems.

COMPASS has actually created an artificial psilocybin solution, referred to as COMP360, made to be made use of along with mental assistance and treatment. The therapy procedure entails a preliminary collection of sessions where the individual and specialist develop connection, adhered to by regulated medication management sessions where the individual obtains psilocybin. During these sessions, the individual is carefully checked, and post-session conversations with the specialist aid refine the experience.

Currently, COMPASS’s most sophisticated test program concentrates on making use of psilocybin to deal with clients with treatment-resistant anxiety (TRD), a serious psychological wellness problem that dramatically reduces lifestyle. The business is examining the COMP360 therapy in 2 Phase 3 medical tests (COMP005 and COMP006); COMP005 is examining the results of a single-dose monotherapy in 255 individuals, with top-line information anticipated by Q4 2024 or very early 2025. Meanwhile, COMP006 is concentrating on set repeat dosage monotherapy in a bigger friend of 568 individuals, with top-line outcomes expected by mid-2025.

In enhancement to this late-stage research on TRD, the business’s COMP360 therapy has actually additionally been the topic of an open-label Phase 2 research in the therapy of PTSD. The research included 22 clients, concentrated on safety and security and tolerability, and favorable outcomes were revealed throughout the 2nd quarter of this year. Building on these outcomes, the business is currently examining the most effective method to progressing its PTSD therapy.

Morgan Stanley expert Vikram Purohit, that covers the supply, sees CMPS as offering an engaging risk-reward chance. He highlights the business’s leading medical program, mentioning, “Progress continues with the PhIII program for COMP360 in TRD, where the next fundamental milestone is top-line data from the PhIII COMP005 trial in 4Q24… The PhII data for COMP360 in TRD is competitive, KOL feedback on the data and uptake potential for COMP360 is positive, and the commercial opportunity in TRD is well-defined.”

“Based on the data generated & stage of development for COMP360, CMPS appears significantly undervalued and we find the risk/reward skewed positive into data catalysts in 2024/2025 that we believe could drive significant appreciation in shares,” the expert included.

To this end, Purohit prices CMPS shares an Overweight (i.e. Buy), and his $23 cost target factors towards a durable 1 year benefit possibility of ~ 220%. (To watch Purohit’s record, click here)

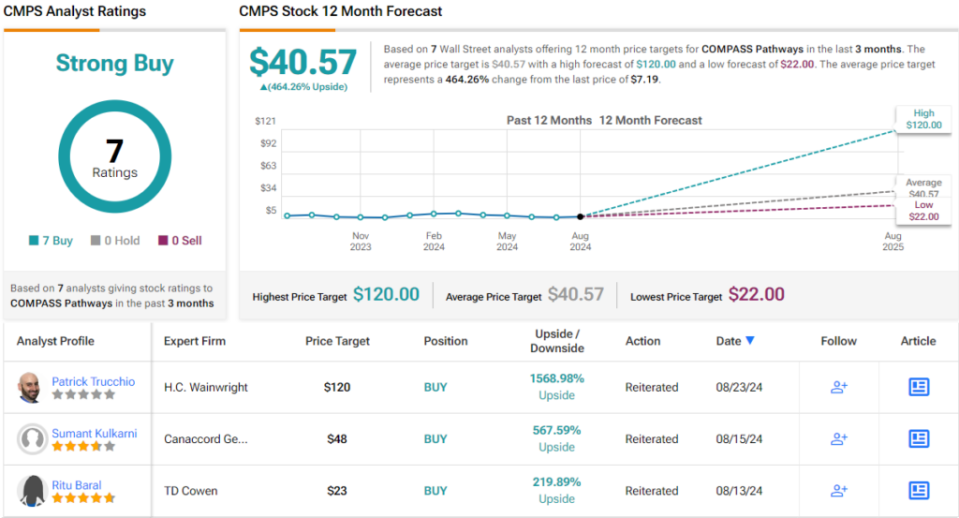

The more comprehensive expert area shares Purohit’s positive outlook. Based only on Buy suggestions– 7 in complete– experts jointly price CMPS as aStrong Buy With the supply presently trading at $7.19, the ordinary cost target of $40.57 suggests an excellent benefit possibility of 464% over the following year. (See CMPS stock forecast)

Rocket Pharmaceuticals ( RCKT)

Next up on Morgan Stanley’s listing is Rocket Pharmaceuticals, a biotech business at the center of genetics treatment. Rocket utilizes adeno-associated (AAV) and lentiviral (LVV) vectors to leader therapies for complicated, unusual hematologic and cardio problems, locations with substantial unmet clinical demands and restricted therapy choices.

Rocket’s most sophisticated programs concentrate on hematology. The business is progressing LV RP-L102, a medicine prospect made to deal with Fanconi anemia, and Kresladi, a prospective therapy for LAD-1.

On the Fanconi track, Rocket just recently launched favorable information from its Phase 1/2 research and validated that regulative filings continue to be on time.

Conversely, the business encountered an obstacle in June when the FDA released a Complete Response Letter for the Biologics License Application for Kresladi, asking for added CMC details to finish its testimonial. Rocket’s monitoring has actually guaranteed that the testimonial procedure is continuous which they are proactively teaming up with elderly leaders and customers at the FDA’s Center for Biologics Evaluation and Research to settle the concern.

On the cardio front, Rocket’s research study programs are proceeding well. Among one of the most popular prospects are PR-A501 and RP-A601. PR-A501, a prospective therapy for Danon illness, is presently in a Phase 2 critical research, while RP-A601, targeting PKP2 arrhythmogenic cardiomyopathy, is signing up clients for a Phase 1 research.

Rocket’s big and different pipe has actually captured the interest of Morgan Stanley expert Michael Ulz, that is especially excited by the cardio improvements.

“Our Overweight rating is based on Rocket’s position as a leader in the gene therapy field combined with a robust pipeline and experienced management team. We view RP-A501 (AAV) in Danon disease as a key driver with blockbuster potential and see broader potential from the cardiovascular pipeline (PKP2 and BAG3). While we expect focus on the cardiovascular pipeline, we believe the more advanced hematology (LV) franchise provides near term opportunity,” Ulz said.

Ulz enhances his Overweight (i.e. Buy) ranking on RCKT with a $45 cost target, suggesting a 142% gain for the supply in the coming twelve month. (To watch Ulz’s record, click here)

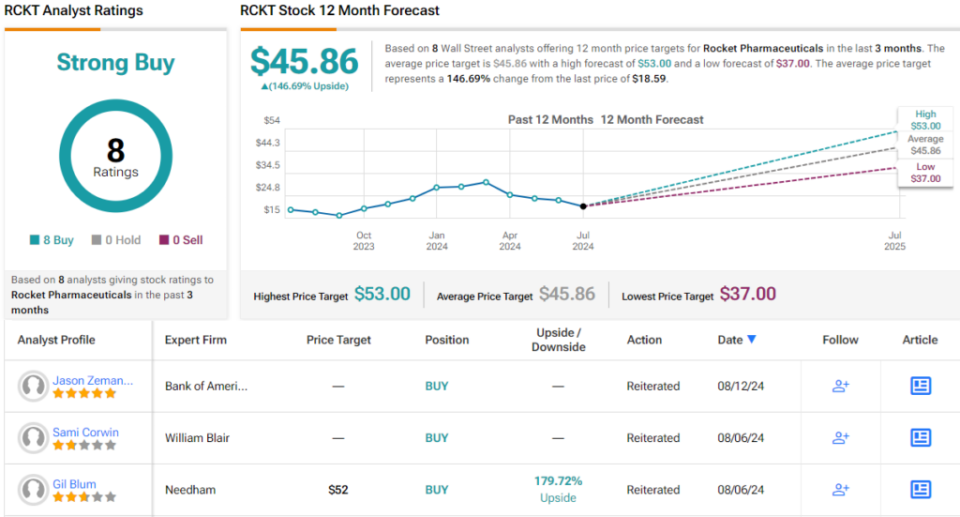

No one is suggesting with that said tackleWall Street The supply’s Strong Buy agreement ranking is based upon Buy suggestions just– 8, in total amount. The projection requires 1 year gains of ~ 147%, thinking about the ordinary cost target stands at $45.86. (See RCKT stock forecast)

To locate excellent concepts for supplies trading at appealing appraisals, go to TipRanks’ Best Stocks to Buy, a device that joins every one of TipRanks’ equity understandings.

Disclaimer: The point of views shared in this post are only those of the included experts. The material is planned to be made use of for informative objectives just. It is extremely crucial to do your very own evaluation prior to making any type of financial investment.