Palantir Technologies ( NYSE: PLTR) is swiftly ending up being the best supplier of expert system (AI) software application systems for firms and federal governments around the world. Evidence of this can be seen in the current velocity in the business’s development along with its enhancing income pipe. Both metrics aim towards far better times in advance.

Investors are observing and have actually been purchasing Palantir supply hand over hand. The supply is up a remarkable 76% until now in 2024, and the complying with conversation supplies hints regarding why that has actually held true.

Palantir’s AI software application system has actually obtained excellent grip

When Palantir launched its second-quarter outcomes last month, the business reported a year-over-year rise of 27% in income to $678 million. That was a strong renovation over the 13% year-over-year development the business supplied in the exact same duration in 2015, along with a velocity over its Q1 income development of 21%.

There was a nice jump in the business’s consumer base, along with the dimension of the bargains that it has actually stood out with consumers. Palantir administration attributed its enhancing development account to the expanding fostering of its Artificial Intelligence Platform (AIP). This is a software application system that aids ventures and federal governments incorporate generative AI right into their procedures to assist enhance functional performance.

From aiding consumers develop their very own large language model (LLM)- powered applications to aiding them increase their day-to-day process with the assistance of generative AI, the efficiency of Palantir’s AIP appears to have actually struck home with consumers. This describes why the business elevated its 2024 income development projection and anticipates its leading line to raise by 24% this year to $2.75 billion.

More notably, Palantir appears with the ability of maintaining its exceptional development in the long-term, thinking about that it finished the previous quarter with $4.3 billion in continuing to be offer worth (RDV). The statistics describes the overall continuing to be worth of Palantir’s agreements at the end of a duration, and it increased 26% year over year in Q2.

This AI equipment titan is making strides in the AI software application market

So, Palantir appears well on its means to maximizing the significant end-market chance readily available in the generative AI software application market. However, there is an additional means for capitalists to maximize the flourishing need for AI software application, and a closer appearance might lead capitalists to believe that it might be a far better AI software application supply than Palantir.

Nvidia ( NASDAQ: NVDA) has actually been the best selection for firms aiming to buy premium AI equipment to ensure that they can educate AI versions, causing exceptional development in the business’s income and incomes in current months. What’s fascinating is that CFO Colette Kress’ discuss the current incomes teleconference recommend that Nvidia is beginning to make a damage in the business AI software application market also. According to Kress, “We expect our software, SaaS, and support revenue to approach a $2 billion annual run rate exiting this year, with Nvidia AI Enterprise notably contributing to growth.”

CHIEF EXECUTIVE OFFICER Jensen Huang additionally commented, mentioning that consumers can release Nvidia AI Enterprise software application for $4,500 per graphics refining device (GPU) each year. Given that Nvidia’s AI GPUs are valued at $30,000 or even more for a solitary chip relying on the arrangement, business consumers aiming to develop and release AI versions are obtaining a bargain via Nvidia’s AI software application system.

Nvidia gives consumers with several AI software application offerings. For instance, the business’s AI Foundry system, which was released in July this year, is an end-to-end remedy with which consumers can develop and release custom-made generative AI versions. Nvidia supplies prominent structure versions that can be fine-tuned by its consumers and swiftly relocate AI applications (consisting of chatbots, material production devices, and paper handling devices) right into the manufacturing stage.

Nvidia additionally gives pretrained personalized AI process that can be made use of for removing information from PDFs or released for producing client service process, speeding up medication exploration in the area of medication, or structure custom-made generative AI applications matched to a company’s demands. What’s worth keeping in mind is that the fostering of Nvidia’s software application services is enhancing at an excellent rate many thanks to AI.

In its February incomes teleconference, Nvidia administration explained that its software application and solutions offerings got to a yearly income run price of $1 billion in the 4th quarter of monetary 2024. So, the business’s software application and solutions income run price is readied to increase in the area of simply one year. That’s considerably faster than the rate at which Palantir’s leading line is readied to expand this year.

Throw in the truth that Nvidia advantages majorly from the flourishing need for its AI chips, which caused 122% year-over-year development in the business’s income in the 2nd quarter of monetary 2025 to $30 billion, and it is very easy to see that the chipmaker is the much more varied use AI. Another factor worth keeping in mind right here is that Nvidia supply professions at 28 times sales, which is less than Palantir’s sales multiple of 29.

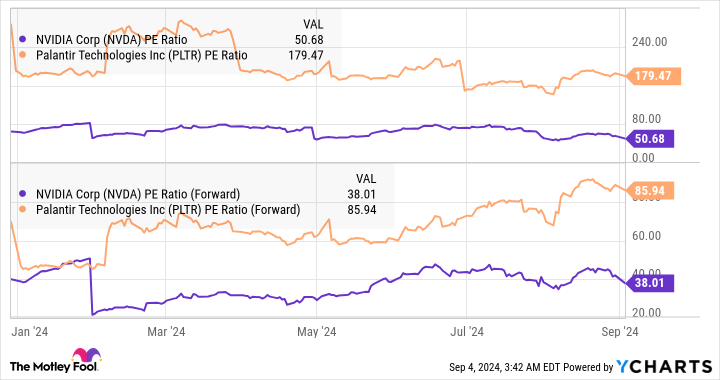

What’s much more, Nvidia is the much more appealing AI supply when we contrast the incomes multiples of both firms.

So, capitalists trying to find a less expensive option to Palantir to make use of the AI software application market’s development would certainly succeed to take a better check out Nvidia, specifically thinking about that the last currently has a growing AI equipment service that makes it a far better development supply to acquire now.

Should you spend $1,000 in Nvidia now?

Before you acquire supply in Nvidia, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to acquire currently … and Nvidia had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $630,099! *

Stock Advisor gives capitalists with an easy-to-follow plan for success, consisting of assistance on developing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since September 3, 2024

Harsh Chauhan has no placement in any one of the supplies stated. The Motley Fool has placements in and suggests Nvidia andPalantir Technologies The Motley Fool has a disclosure policy.

Meet the Artificial Intelligence (AI) Stock That Could Become the Next Palantir, or Even Better was initially released by The Motley Fool

&w=100&resize=100,70&ssl=1)