One of the very best means to make strong financial investment choices is to take note ofWarren Buffett’s portfolio Many of his biggest holdings have actually outshined the marketplace for many years and even years each time.

One of his long-lasting placements, Visa ( NYSE: V), captured my eye after a current adjustment. Buffett has actually kept this supply because 2011. There are 2 amazing reasons you must think about Visa for your profile now.

This is the sort of supply that every capitalist intends to have

In among his even more popular quotes, Buffett attempted to describe a lesson he’s found out over and over: Trust terrific services, not administration groups. “When a management with a reputation for brilliance tackles a business with a reputation for bad economics,” Buffett when suggested, “it is the reputation of the business that remains intact.”

The lesson right here is straightforward: Buy top quality services that also a half-competent administration group might run. In this respect, Visa is the ideal instance. A couple of months earlier, I speculated that Visa might end up being the following trillion-dollar supply. It had not been the wise administration group that I enjoyed, however business basics that also an inadequate administration group would certainly discover tough to mess up. Visa’s major benefit, I suggested, was the long-lasting tailwind of network impacts.

What are network impacts? This service academic year basically explains a service or product that obtains better the much more that individuals utilize it. Social media is an archetype. Even the very best social networks system will not obtain anywhere without striking an emergency of individuals. In by doing this, a social media sites network’s best benefit is its customer base, not its modern technology. People wish to sign up with networks that belong of, which suggests that the bigger systems usually have a tendency to expand also larger in time.

Payment networks like Visa run in similar means. No one intends to utilize a credit rating or debit card that vendors will not approve. And vendors do not wish to approve kinds of settlement that customers do not utilize. The all-natural outcome is sector loan consolidation. According to information put together by Statista, Visa has a substantial 61% market share for general-purpose settlement cards in the united state Mastercard is available in 2nd with a market share of 25%, while simply 2 business finish off the remainder of the sector. This isn’t a brand-new dynamic, either. Mastercard and Visa have actually delighted in industry-duopoly placements for greater than a years, with Visa regulating a hefty lead the whole time.

Great supplies seldom obtain this inexpensive

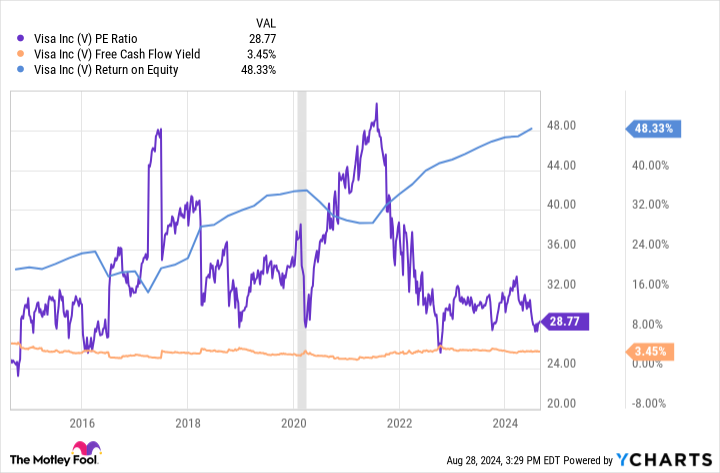

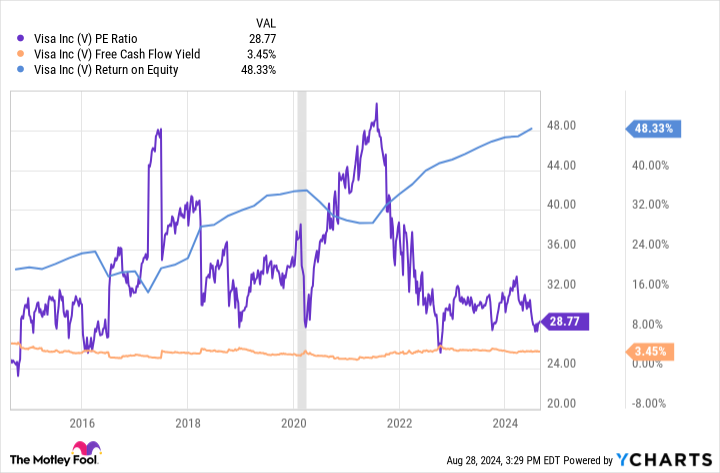

Massive- sector loan consolidation incorporated with an asset-light service design has actually caused big and consistent earnings forVisa Its returns on equity are extremely excellent thinking about the firm utilizes a conventional quantity of take advantage of. Free- cash-flow generation has actually virtually constantly declared. And after a tiny adjustment, shares currently trade at virtually their most affordable degrees in years on a price-to-earnings basis.

Right currently, the S&P 500 all at once professions at a price-to-earnings proportion of 29.2. That suggests Visa supply professions at a price cut to the marketplace typical regardless of running an exceptionally reputable and rewarding service design that takes advantage of network impacts that must withstand for years ahead. According to current filings, it does not look like if Warren Buffett has actually been offering any one of his Visa placement. It’s tough to envision him doing so at these costs.

Is Visa supply an acquire now? The response seems a solid “yes.” At these degrees, the firm is an excellent suit for worth and development financiers alike.

Should you spend $1,000 in Visa now?

Before you acquire supply in Visa, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for financiers to acquire currently … and Visa had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $731,449! *

Stock Advisor supplies financiers with an easy-to-follow plan for success, consisting of advice on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 because 2002 *.

*Stock Advisor returns since August 26, 2024

Ryan Vanzo has no placement in any one of the supplies stated. The Motley Fool has placements in and suggests Mastercard andVisa The Motley Fool suggests the complying with alternatives: lengthy January 2025 $370 get in touch with Mastercard and brief January 2025 $380 get in touch withMastercard The Motley Fool has a disclosure policy.

Is Visa Stock a Buy? was initially released by The Motley Fool