Markets that increase have actually constantly been complied with by markets that decrease. It’s the normal bull/bear cycle that capitalists need to take care of.

Right currently, the marketplace is up near historical highs, which is why I’m delighted to possess some dull need supplies. One of my faves is energy Black Hills ( NYSE: BKH) Here’s why I possess this high-yield supply and why you could wish to acquire it, as well.

What does Black Hills do?

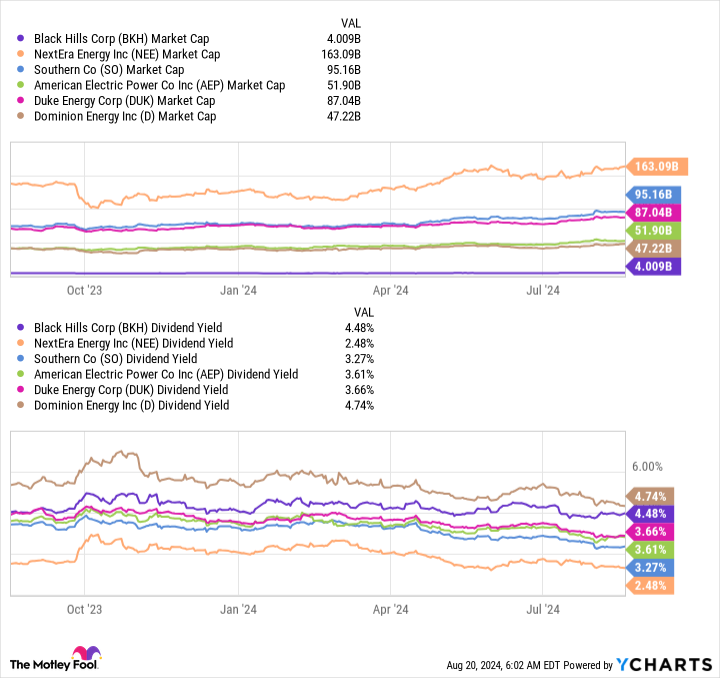

With a market cap of simply $4 billion approximately, Black Hills is not an especially huge energy. In truth, it is towered over by market titan NextEra Energy ( NYSE: NEE), which has a market cap of $160 billion. Compared to that, Black Hills is simply a rounding mistake! Yet it still offers a requirement of contemporary life.

The business has around 1.3 million natural gas and electric clients throughout components of Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, andWyoming Without the power Black Hills products, these clients would certainly be running in the Dark Ages.

The service is managed, so it needs to obtain its prices and capital expense strategies accepted by the federal government. However, being managed additionally suggests it has a syndicate in the areas it offers. Those 1.3 million clients have no place else to transform for their power requires.

Black Hills is a little bit of a turtle, provided the service, however with the marketplace near all-time highs, I’m delighted to have a couple of trustworthy turtles in my profile. Because of its tiny dimension, nonetheless, lots of capitalists have actually never ever read aboutBlack Hills This is regrettable since it has actually easily outmatched the market titans on one vital statistics: returns.

Black Hills is a Dividend King

NextEra Energy, which most capitalists have actually come across, has actually enhanced its reward yearly for three decades. That’s a really excellent touch, however it fades in contrast to the 54 successive years of yearly reward rises that Black Hills has actually gathered. It is among the lengthiest reward touches in the energy field, making it a very exclusive Dividend King.

Think regarding the last 5 years: The checklist of hard times consists of the pandemic, the Great Recession, the dot.com bust/recession, Black Monday, and latest thing rising cost of living and oil dilemma of the 1970s.

And that’s simply the emphasize reel. There were smaller sized ups and downs on Wall Street and in the economic situation, as well. Through all of it, Black Hills remained to compensate capitalists with yearly reward rises. That is the kind of uniformity I wish to have in my revenue profile when the marketplace is floating at soaring degrees.

But there’s even more to the tale than simply the reward. For instance, Black Hills’ client base is expanding virtually 3 times faster than the wider united state populace. That need to sustain strong development as the energy spends to offer that increasing client base.

To placed some numbers on that particular, the five-year capital expense strategy is $4.3 billion, which administration anticipates to convert right into profits development in between 4% and 6% a year.

The reward will likely track together with profits development, implying about 5% reward development is the target. That’s a strong number for an energy and simply occurs to be the annualized price of reward development Black Hills has actually attained over the previous years. So generally, it anticipates to maintain doing what it has actually provided for years: providing clients with trustworthy power, and capitalists with trustworthy reward development.

Black Hills is a dull and trustworthy reward supply

I’m not mosting likely to boast to any individual regarding owning Black Hills; it isn’t that type of supply. It is a fundamental financial investment that I can conveniently possess with great times and poor understanding that its crucial solution will certainly constantly remain in need. Along the means, I can accumulate a soaring 4.5% reward return, among the highest possible in the energy field, backed by an expanding reward (for referral, NextEra’s return is simply about 2.6%).

If Wall Street strikes the ceiling and a bearishness comes, I’m not mosting likely to shed any kind of rest owningBlack Hills If you are a traditional reward financier, that will possibly seem appealing to you, as well.

Should you spend $1,000 in Black Hills now?

Before you acquire supply in Black Hills, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to acquire currently … and Black Hills had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $792,725! *

Stock Advisor offers capitalists with an easy-to-follow plan for success, consisting of advice on constructing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 because 2002 *.

*Stock Advisor returns since August 22, 2024

Reuben Gregg Brewer has settings in Black Hills, Dominion Energy, andSouthern Company The Motley Fool has settings in and advises NextEraEnergy The Motley Fool advises Dominion Energy andDuke Energy The Motley Fool has a disclosure policy.

Is the Stock Market Going to Crash? I Don’t Know. That’s Why I Own This High-Yield Stock. was initially released by The Motley Fool