Following an excellent begin to the year, Super Micro Computer‘s ( NASDAQ: SMCI) supply graph has actually undertaken a plain turnaround over the previous 6 months. It has actually shed near 60% of its worth from its height, and current growths appear to have additional dinged up capitalist self-confidence in the business.

First, the financial 2024 fourth-quarter outcomes it launched onAug 6 weren’t up to Wall Street’s expectations, and monitoring’s support was frustrating. Second, short-seller Hindenburg Research launched a record affirming accountancy abnormalities atSupermicro Then, Supermicro monitoring revealed that it was postponing the declaring of its yearly record, which just included in the unfavorable press.

Those aspects clarify why Wall Street experts have actually been devaluing the supply recently. But considered that shares of this web server and storage space systems supplier are currently trading at an appealing 22 times tracking profits and 13 times onward profits, opportunistic capitalists might be attracted to acquireSupermicro Should they be doing that because of the current growths?

Addressing the elephant in the space

Investors must keep in mind that Hindenburg is a short-seller, and it has an economic passion in seeing Supermicro’s supply rate loss. In that context, we can not make certain that the accusations that Hindenburg is making stand, particularly thinking about that the short-seller has actually been incorrect in the past. That stated, Supermicro was billed by the Securities and Exchange Commission (SEC) for accounting infractions in August 2020, when it was discovered to have actually too soon acknowledged income and underrated its costs over a three-year duration.

However, the business has actually recouped incredibly ever since, clocking exceptional gains over the previous number of years many thanks to the appearance of a brand-new stimulant in the type of expert system (AI). Its income in its financial 2024 greater than increased to $14.9 billion from $7.1 billion in the previous year. Non- GAAP profits soared to $22.09 per share, from $11.81 per share in financial 2023.

Addressing the hold-up in Supermicro’s yearly declaring, monitoring cleared up that “we don’t anticipate any material changes in our fourth quarter or fiscal year 2024 financial results.” It included that the business is anticipating a “historic” 2025 with “a record number of orders, a strong and growing backlog of design wins and leading market positions across a number of areas.”

Supermicro claims that the current growths will not influence its manufacturing capacities, and it gets on track to satisfy the need for its AI web server remedies. It’s worth keeping in mind that Supermicro is anticipating its financial 2025 income to land in between $26 billion and $30 billion. That would certainly be one more year of exceptional development from its $14.9 billion in financial 2024.

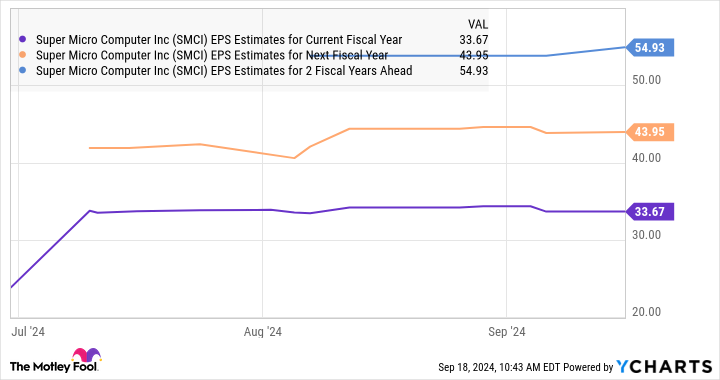

Though it is dealing with margin obstacles as a result of the raised financial investments it’s making as it enhances capability to satisfy the solid need for its liquid-cooled web server remedies, monitoring is positive that it will certainly go back to its regular margin variety prior to the finishes. Analysts’ agreement price quotes additionally show that Supermicro’s profits get on track to enhance at an amazing speed in the present , complied with by healthy and balanced enter the following number of years too.

What should capitalists do?

The hold-up in Supermicro’s yearly declaring led JPMorgan to downgrade the supply from obese to neutral and to reduce its rate target to $500 from $950. Even Barclays reduced the supply to equivalent weight from obese, pointing out the margin stress that Supermicro deals with along with the declaring hold-up. However, JPMorgan’s downgrade had not been an outcome of the Hindenburg record neither a representation of its capacity to end up being certified, yet as a result of the near-term unpredictability that borders the business and the absence of an engaging disagreement to acquire the supply.

So, risk-averse capitalists would certainly succeed to wait on even more quality prior to purchasing this AI supply. However, those with greater threat cravings that are seeking to include a fast-growing business to their profiles can think about purchasing Supermicro currently. It appears efficient in maintaining its outstanding development over time many thanks to the massive possibilities offered to it in the AI web server market.

Analysts anticipate Supermicro’s profits to expand at an annualized price of 62% over the following 5 years. If the business can surpass its present problems, it might end up being a strong financial investment thinking about the appraisal at which it is trading now.

Should you spend $1,000 in Super Micro Computer now?

Before you acquire supply in Super Micro Computer, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to acquire currently … and Super Micro Computer had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $710,860! *

Stock Advisor supplies capitalists with an easy-to-follow plan for success, consisting of support on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since September 16, 2024

JPMorgan Chase is a marketing companion of The Ascent, a Motley Fool business. Harsh Chauhan has no placement in any one of the supplies discussed. The Motley Fool has placements in and suggests JPMorganChase The Motley Fool suggestsBarclays Plc The Motley Fool has a disclosure policy.

Is Super Micro Computer Stock a Buy Now? was initially released by The Motley Fool