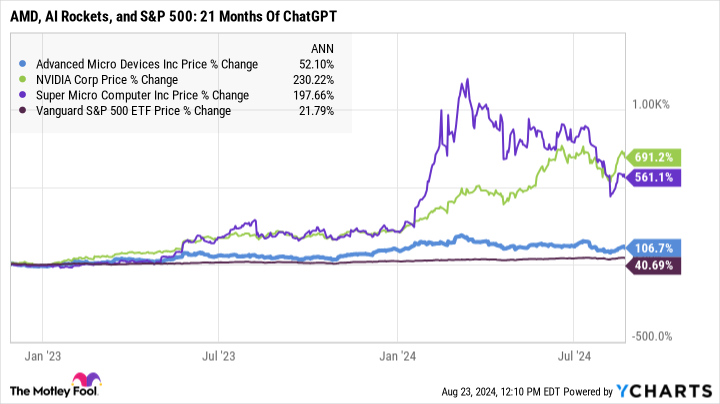

Advanced Micro Devices ( NASDAQ: AMD) has actually been a large champion in expert system (AI) boom. The chip developer’s supply has actually acquired 107% considering that OpenAI releasedthe game-changing ChatGPT platform While that cost climb can not contrast to AI market beloveds Nvidia ( NASDAQ: NVDA) and Super Micro Computers ( NASDAQ: SMCI), it’s a market-stomping efficiency.

Less than 30 supplies amongst the 503 participants of the S&P 500 ( SNPINDEX: ^ GSPC) index have actually done much better in this duration, and the index itself “only” got 41%. The index gain exercises to a compound yearly development price (CAGR) of 21.8%. If I might match that skyrocketing rate over a complete years, I’d transform a $1,000 financial investment right into a $7,200 return. And AMD is smoking that wealth-building S&P 500 return now.

But that’s currently old information. Past outcomes are no assurance of future success. The melting inquiry existing and possible AMD capitalists ought to ask today is whether the supply has space to run any kind of greater from this soaring perch.

How AMD’s Instinct AI accelerator chip compares to Nvidia

AMD is no uninitiate in the high-performance computer market. The AMD Instinct MI250X accelerator chip Is located in 10 systems on the most up to date checklist of the globe’s 500 biggest and most effective supercomputers.

Nvidia controls that system checklist, led by at the very least 48 systems utilizing the V100 accelerator and greater than 80 relying upon some variation of the A100 chip. But when you check out the efficiency numbers, the leading AMD chip with a 2% share of system counts supplies an astonishing 21.4% of the whole checklist’s number-crunching efficiency.

The Instinct MI250X really did not do it via unequalled efficiency per chip. This success was improved substantial setup numbers. The AMD Instinct systems have 12.7 million cpu cores at the workplace in those 10 substantial supercomputers, led by 8.7 million Instinct cores in the best entertainer of them all– the Frontier system at theOak Ridge National Laboratory The biggest Nvidia- based systems quit about 2 million cpu cores.

I say sorry if that obtained a little bit unpopular with cpu information and huge numbers. In short, a great deal of less costly chips can do the exact same work as a couple of costly, state-of-the-art cpus. I’m attempting to make a basic factor, though:

AMD’s AI accelerators are extremely affordable, specifically if you consist of system rates. Throwing great deals of lower-priced equipment at AI issues can offset any kind of side Nvidia’s chips may have in regards to simple efficiency.

In various other words, AMD might should have a larger piece of the AI market than it obtains credit score for today. CFO Jean Hu and CHIEF EXECUTIVE OFFICER Lisa Su like to concentrate on the complete expense of possession (TCO) when contrasting AMD’s items to Nvidia’s, and the firm is currently winning system bargains from that angle. This idea consists of chip rates, power intake, assistance for even more memory per chip, and various other complete system elements that can exceed Nvidia’s lead in pure efficiency per chip.

Is AMD’s cost costs warranted?

So AMD ought to get on your checklist of AI equipment service providers to enjoy. Should it be your following buy in the AI room?

As it ends up, AMD’s supply may currently have the marketplace regard it is entitled to. As kept in mind earlier, AMD’s supply graph makes the wider market appearance stagnant and delayed. Moreover, these shares are a lot more highly valued than Nvidia’s in lots of means:

|

Valuation Metric |

AMD |

Nvidia |

|---|---|---|

|

Price to revenues (P/E) |

183 |

72 |

|

Price to totally free capital (P/FCF) |

183 |

80 |

|

Enterprise worth to revenues prior to passion and tax obligations (EV/EBIT) |

275 |

63 |

Data from Finviz and Morningstar, existing since 8/23/2024.

AMD’s shares are a lot more economical in regards to cost to sales or the cost to revenues to development proportion, so it’s not a bang dunk in either instructions. Still, it’s tough to call AMD’s supply “affordable” at all, form, or type.

Can AMD take a rewarding AI specific niche?

Longtime AMD capitalists ought to be made use of to annoyingly high evaluation proportions. This supply has a lengthy background of skyrocketing to soaring evaluation proportions.

Due to AMD’s propensity towards reduced revenue margins, the mathematics obtains a bit ridiculous occasionally. P/FCF and P/E proportions were gauged in the thousands in 2004, as the K2 line of computer cpus installed a perky battle versus Intel‘s ( NASDAQ: INTC) Celeron and Pentium 4 schedules. AMD supply was likewise a lot more expensive than Nvidia’s from 2018 to 2021, when both business had unanticipated production benefits over a having a hard time Intel.

So the genuine inquiry is, will AMD have the ability to take a rewarding specific niche for itself in this age of hefty AI passion?

I’m assuming that it can. Nothing appears difficult under the management of Lisa Su, that likewise appears to have a great take care of on just how to maximize this game-changing minute. AMD isn’t attempting to be Nvidia 2.0, yet picking a various course with considerably various strategies and layouts.

So the supply is costly, yet after that it sort of constantly is. And I assume there’s a lot of space for a various technique to AI computer from a business (or numerous) not calledNvidia Check your risk tolerance prior to going any kind of better, yet AMD might be an intriguing purchase for development capitalists that value Lisa Su’s management.

Should you spend $1,000 in Advanced Micro Devices now?

Before you acquire supply in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for capitalists to acquire currently … and Advanced Micro Devices had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $792,725! *

Stock Advisor supplies capitalists with an easy-to-follow plan for success, consisting of assistance on constructing a profile, routine updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since August 22, 2024

Anders Bylund has settings in Intel andNvidia The Motley Fool has settings in and suggests Advanced Micro Devices andNvidia The Motley Fool suggests Intel and suggests the adhering to choices: brief August 2024 $35 get in touch withIntel The Motley Fool has a disclosure policy.

Is It Too Late to Buy AMD Stock? was initially released by The Motley Fool