Nvidia’s (NVDA) ultra-bullish fad in the initial fifty percent of the year has actually stopped, with the supply stopping working to get to brand-new tops over the previous couple of months. Following the extremely prepared for Q2 incomes record at the end of August, Nvidia supply experienced a pullback as a result of raised financier assumptions for hypergrowth, in spite of the solid outcomes it published. I think this cost adjustment supplies an engaging chance. In this post, I will certainly describe 5 factors for my favorable sight on Nvidia, concentrating on solid income development (in spite of challenging compensations), AI supremacy, appraisal, technological indications, and Wall Street expert agreement.

Let’s dive in.

1. Nvidia’s Strong Revenue Growth Despite Tough Comparisons

The initial factor sustaining an extended favorable thesis for Nvidia is the strong income development showed in its Q2 results, in spite of tough contrasts.

Nvidia published 122% year-over-year development in one of the most current quarter, getting to profits of $30 billion– an amazing accomplishment provided the business’s currently considerable income base. Although this development price is less than the 200% rise from the previous quarter, the outright triple-digit top-line development continues to be outstanding. This highlights Nvidia’s capability to scale its income dramatically also when established versus it’s previous efficiency.

While the post-Q2 supply pullback can be credited to assumptions being established too expensive, it’s essential to keep in mind that Nvidia remains to supply consecutive quarterly income development, signifying durable need for its items, specifically in AI and information facilities. This degree of continual development at such a huge range highlights Nvidia’s capability to record market share and drive long-lasting income growth. Nvidia’s Q3 sales support of $32.5 billion additional mirrors the business’s self-confidence in keeping its development trajectory.

2. Nvidia’s Dominance in AI and Data Center Market

The 2nd favorable factor is Nvidia’s proceeded supremacy in the information facility GPU area, where it holds a 98% market share in this quickly expanding field, according to HPCwire

Demand for AI-driven options is flourishing throughout sectors, with Nvidia’s H100 Hopper GPU ending up being essential for venture cloud applications that call for enormous computer power. Beyond equipment, Nvidia controls AI via its software application community, consisting of CUDA and cuDNN, providing a detailed AI service. As highlighted in Nvidia’s incomes phone call, the business intends to change the $1 trillion information facility market by changing from conventional to sped up computer utilizing innovative information handling collections.

Looking in advance, Nvidia prepares to release its Blackwell design in Q4 of Fiscal 2025, providing better power and performance thanHopper Designed to satisfy the needs of hyperscalers and AI designers, Blackwell will certainly give thorough options, consisting of chips, systems, networking, and software application. This launch is a crucial driver that will certainly additionally strengthen Nvidia’s management in AI.

3. Nvidia Appears Attractively Priced When Adjusted for Growth

The 3rd factor problems Nvidia’s evaluations. At initially glimpse, its P/E proportion of 54.7 x and onward P/E of 42.5 x might appear high, specifically contrasted to the semiconductor market standard of 23.7 x. However, my favorable position is enhanced by Nvidia’s development leads, with the business anticipated to attain 106% income development and 119% EPS development this year.

Furthermore, experts anticipate Nvidia’s EPS to expand at a CAGR of 36.6% over the following 3 to 5 years. This outstanding development price, incorporated with the present onward P/E, leads to an affordable onward price-to-earnings-to-growth (PEG) proportion of 1.16.

Traditionally, underestimated supplies have a PEG proportion listed below one, yet NVIDIA’s PEG proportion is a lot more beneficial than those of all various other Magnificent 7 supplies. Among this team, Alphabet (GOOGL) and Meta (META) have the following most affordable PEG proportions at 1.28 and 1.48, specifically. While this does not always indicate NVIDIA is underestimated contrasted to its Big Tech peers, it does recommend that, according to this statistics, the supply does not show up excessively costly.

4. NVDA’s Moving Averages Suggest a Bullish Trend

The 4th factor enhancing the favorable thesis is very closely linked to the view surrounding Nvidia’s supply efficiency. Despite current changes, the business’s triple-digit income development shows that it is still in a hypergrowth stage. However, with an astonishing 2,700% supply cost rise over the previous 5 years, problems concerning a prospective bubble continue to be.

In this context, I think that concentrating on long-lasting relocating standards is vital for evaluating energy. This offers a more clear sight of Nvidia’s fad amidst day-to-day volatility, specifically provided the supply’s 48% annualized volatility. NVDA supply’s higher fad is sustained by a present trading cost over its 200-day relocating standard of $92.80.

5. Wall Street Remains Overwhelmingly Bullish on NVDA

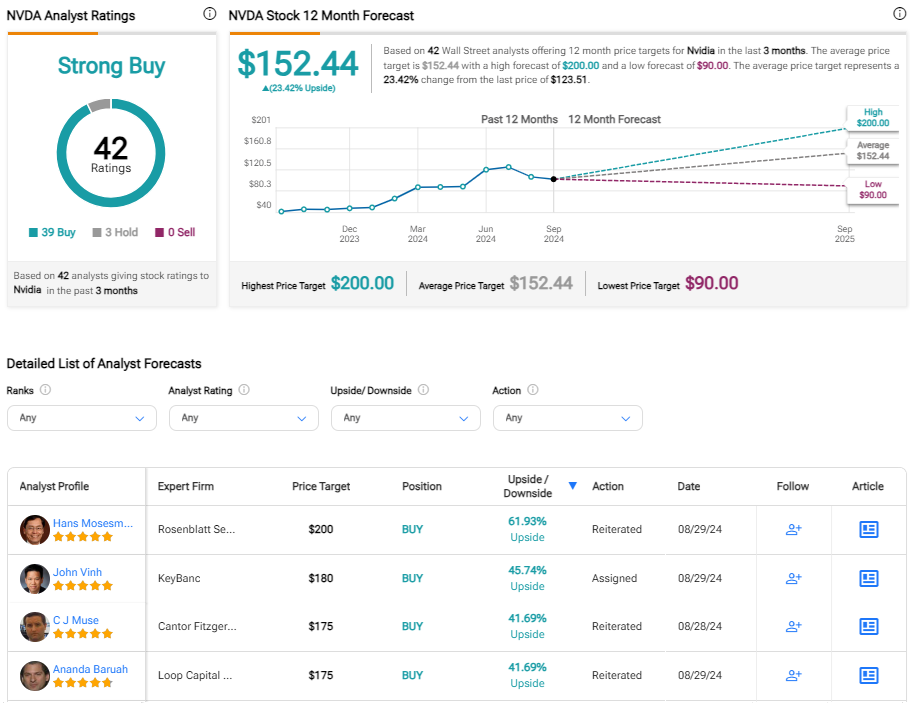

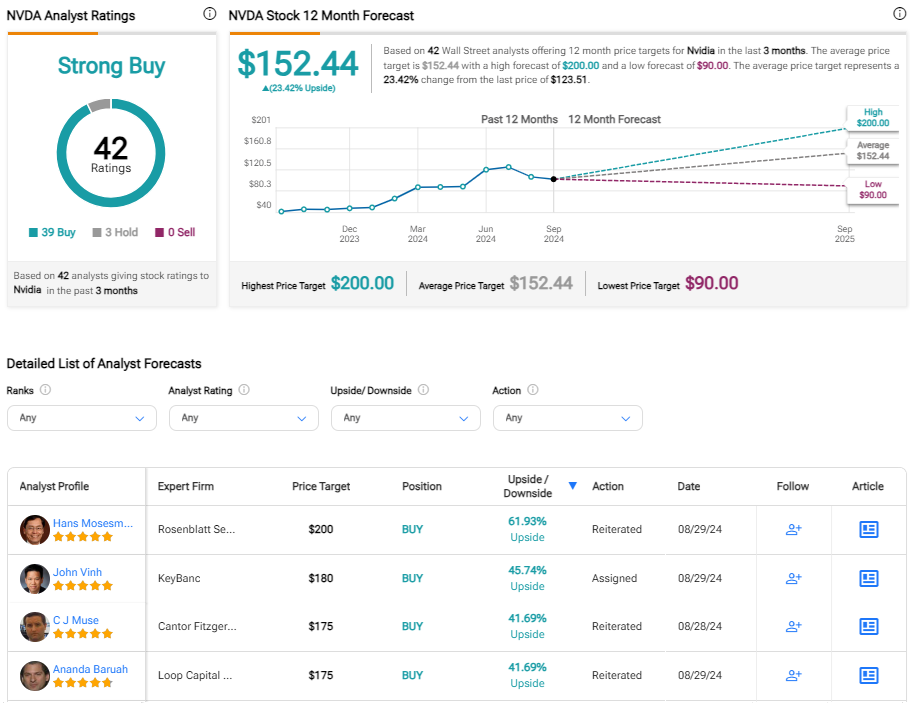

Finally, the 5th factor adding to my beneficial overview for Nvidia is the extremely favorable agreement amongst Wall Street experts. Of the 42 experts covering the supply, 39 have actually released Buy referrals, while the continuing to be 3 have a Hold ranking. Moreover, the typical cost target amongst these experts is $152.44, suggesting possible advantage of virtually 25%.

A standout is Rosenblatt expert Hans Mosesmann, that has the highest possible cost target on Wall Street for Nvidia at $200 per share. His positive outlook lingered after the Q2 results, which he regarded solid, driven by development in Hopper AI and networking. Although gross margins dipped a little as a result of updates on Blackwell chips targeted at boosting returns, Mosesmann continues to be certain. He highlights that in spite of possible temporary weak point in the share cost, the favorable view is sustained by a 44x P/E numerous based upon Fiscal 2027 EPS.

Conclusion

In this post, I have actually described 5 bottom lines sustaining my Buy position onNvidia I think that the supply’s current weak point provides an eye-catching acquiring chance for financiers anxious to profit from its solid development trajectory.

While some temporary missteps might continue, Nvidia’s Q2 outcomes recommend that its development tale is readied to proceed robustly as the business settles its market supremacy and gets ready for the upcoming launch of the Blackwell design. Given the capacity for additional development in the coming years, the present abundant appraisal can be warranted, and Wall Street thinks the exact same.

Disclosure

Disclaimer