Most financiers thinking about Energy Transfer ( NYSE: ET) are brought in to its high yield, which presently kicks back 7.9%. The business presently pays a $0.32 quarterly circulation and is wanting to boost that by in between 3% to 5% a year moving on.

That is eye-catching per se, however I additionally believe the pipe driver’s supply can almost fold the following 5 years.

This would certainly occur with a mix of development jobs, in addition to small numerous development, which is when financiers designate a greater evaluation statistics to a supply.

Let’s check out why I believe Energy Transfer’s supply can greater than dual in the following 5 years.

Growth possibilities

Energy Transfer is just one of the biggest midstream business in the united state, with an extensive incorporated system that goes across the nation. It’s associated with almost all elements of the midstream field, carrying, saving, and handling different hydrocarbons throughout its systems. The dimension and breadth of its systems offer it lots of development task possibilities.

This year, the business intends to invest in between $3 billion to $3.2 billion in development capital expenditures (capex) on brand-new jobs. Moving onward, costs in between $2.5 billion to $3.5 billion in development capex a year would certainly enable it to pay its circulation while having cash left over from its capital to pay for financial debt and/or redeem supply.

Given this, and the very early possibilities that Energy Transfer is seeing in power generation because of boosted power requirements from information facilities originating from the surge in expert system (AI), it’s possibly risk-free to claim that the business can invest concerning $3 billion in development capex a year over the following 5 years.

Most business in the midstream area are seeking a minimum of 8x develop multiples on brand-new jobs. This indicates that the jobs would certainly spend for themselves in concerning 8 years. For instance, a $100 million task with an 8x multiple would certainly produce an ordinary return of $12.5 million in EBITDA (incomes prior to rate of interest, tax obligations, devaluation, and amortization) a year.

Based on that particular sort of return on development jobs, Energy Transfer need to have to do with able to see its modified EBITDA surge from $15.5 billion in 2024 to around $17.4 billion in 2029 if it remains to invest $3 billion a year on development jobs.

Multiple development possibilities

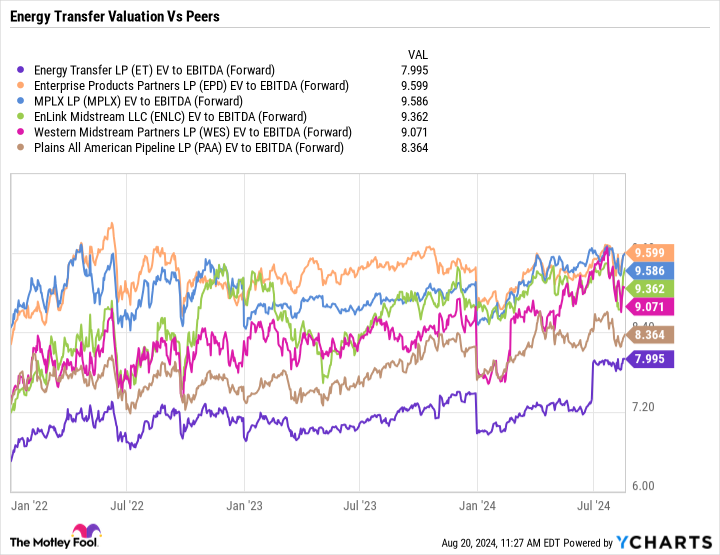

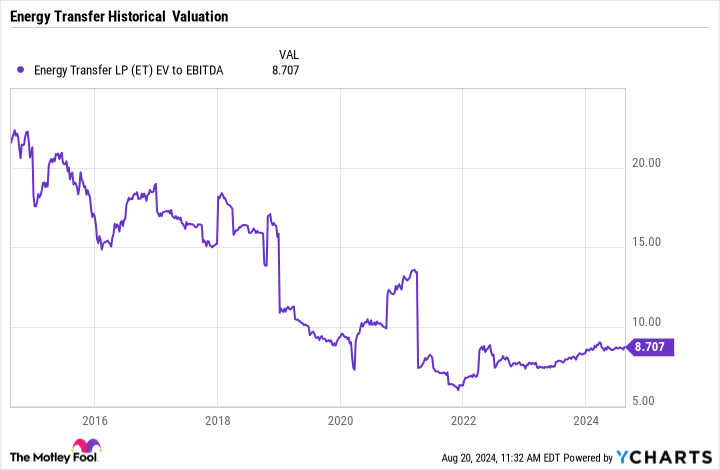

From an assessment point of view, Energy Transfer is the least expensive supply amongst its master minimal collaboration (MLP) midstream peers, trading at 8x on an onward venture value-to-adjusted EBITDA basis. This statistics takes into account a business’s internet financial debt while securing non-cash products and is one of the most utilized means to worth midstream business. At the exact same time, it trades at a much reduced evaluation than it has traditionally.

MLP midstream supplies balanced a 13.7 x EV/EBITDA numerous in between 2011 and 2016, so the market in its entirety has actually seen its numerous boiled down. However, with need for gas increasing because of AI and electrical car need subsiding, the shift to renewables resembles it might take a lot longer than anticipated. If this holds true, these supplies need to have the ability to regulate a greater numerous than they presently do, as this lowers the anxiety that hydrocarbon need will certainly begin to materially decrease in the years in advance.

How Energy Transfer supply almost increases

If Energy Transfer expands its EBITDA as anticipated, the supply can get to $30 in 2029 if it can regulate a 10x EV/EBITDA numerous. That is up from the 8x onward and 8.7 x routing numerous it presently regulates, however it’s still well listed below where the MLP midstream area has actually sold the past.

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

|

|---|---|---|---|---|---|---|

|

Adjusted EBITDA |

$ 15.5 billion |

$ 15.88 billion |

$ 16.25 billion |

$ 16.63 billion |

$ 17.0 billion |

$ 17.38 billion |

|

Price at 8x numerous |

$ 17 |

$ 18 |

$ 19 |

$ 20 |

$ 21 |

|

|

Price at 9x numerous |

$ 21.50 |

$ 22.50 |

$ 23.50 |

$ 24.50 |

$ 25.50 |

|

|

Price at 10x numerous |

$ 26 |

$ 27 |

$ 28 |

$ 29 |

$ 30 |

* Enterprise worth is based upon 3.42 billion shares exceptional, $57.6 billion in the red, $3.9 billion in recommended equity, $3.9 billion in financial investments in unconsolidated associates and money, and $11.6 billion in minority rate of interest.

However, Energy Transfer and numerous various other midstream business seem quite possibly placed to be stealth AI victors because of boosting gas power need. Power business and information facilities have actually currently been coming close to Energy Transfer concerning gas transmission jobs, and there can be a gas quantity boom coming. Given this development possibility, along with the business’s strengthened annual report and regular circulation development, I can see Energy Transfer’s numerous increase decently over the following 5 years and the supply almost increasing.

However, also if its numerous does not increase, financiers can still obtain an extremely strong return on their financial investment with a mix of circulations (presently $0.32 each a quarter) and much more small rate gratitude. With no numerous development and over $7 in circulations in between currently and completion of 2029 (thinking a 4% rise a year), the supply would certainly still produce an over 75% return throughout that stretch.

Should you spend $1,000 in Energy Transfer now?

Before you purchase supply in Energy Transfer, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for financiers to purchase currently … and Energy Transfer had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $792,725! *

Stock Advisor supplies financiers with an easy-to-follow plan for success, consisting of advice on constructing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since August 22, 2024

Geoffrey Seiler has settings in Energy Transfer, Enterprise Products Partners, andWestern Midstream Partners The Motley Fool advisesEnterprise Products Partners The Motley Fool has a disclosure policy.

Prediction: Energy Transfer Stock Will Nearly Double in 5 Years was initially released by The Motley Fool