-

Market volatility will certainly remain raised for several years ahead, Bank of America states.

-

The company advises staying clear of need to purchase the continuous dip in technology supplies.

-

BofA rather stated to try to find high-grade names, in addition to dividend-paying energy and realty supplies.

The market is obtaining extra unstable, and supplies will certainly remain uneven for several years in advance, according to Bank of America.

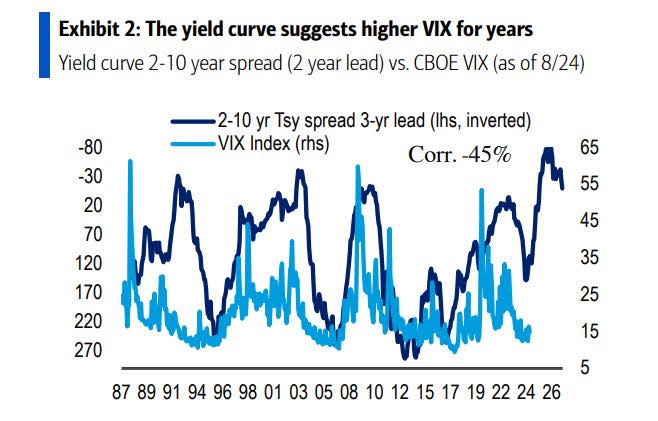

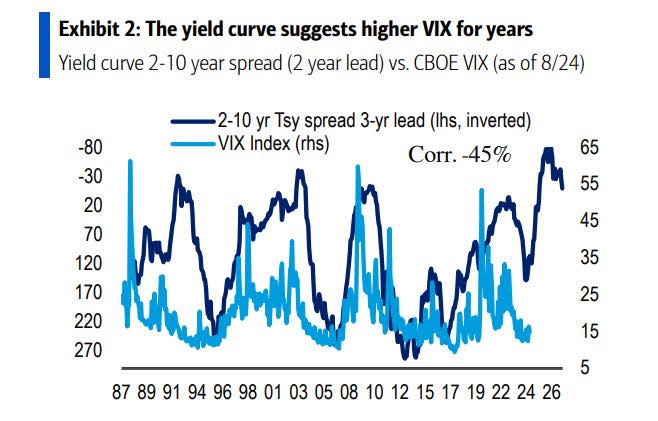

The company states that in the close to term, election-related plan unpredictability will certainly maintain the marketplace moving. Looking additionally out with completion of 2027, the return contour is indicating extra volatility in advance, as revealed by the graph listed below:

Further, an exclusive BofA “regime indicator” has actually turned right into decline region.

With those components in play, the company is advising protective supplies that normally surpass in times of unpredictability or weak point.

“Quality, stability and income have protected investors in prior volatile markets. We recalibrate our sector calls to augment these characteristics,” experts composed on Monday.

On the other side, financiers ought to stay clear of increasing direct exposure to the prominent technology field, the financial institution alerted.

Even if rate swings assist lower mega-cap market names, numerous top qualities still make this mate an undesirable financial investment, the financial institution stated.

“Don’t buy the tech dip,” experts stated. “We remain underweight Information Technology despite arguments that it has gotten so beaten up.”

The financial institution mentioned document highs in the field’s enterprise-value-to-sales proportion, a signal that these companies continue to be miscalculated. Meanwhile, technology funds can quickly encounter easy marketing stress as the S&P 500 prepares brand-new index-cap policies.

Specifically, the index is preparing to decrease the weightings of stock funds with $350 billion in assets, Bloomberg reported. In this occasion, easy financial investment cars would certainly need to reorganize their holdings at the upcoming quarterly rebalance.

As volatility grabs for the long-term, top quality and earnings ought to play a bigger function in profiles, experts composed.

Although development supplies made good sense when obtaining expenses were reduced with the 2010s, this is transforming– in the following years, the financial institution anticipates single-digit returns.

Quality direct exposure likewise makes good sense in the extra instant term, according to Savita Subramanian, BofA’s head people equity and quant approach.

“Don’t be a hero,” she informedCNBC on Friday “Just to park in safe total return type vehicles where you get paid to wait.”

In a note recently, Subramanian kept in mind that today’s top quality supplies are not costly, and those ranked B+ or much better are trading at a mild costs to their lower-quality peers.

Meanwhile, energies and realty rewards ought to bring in financier focus as Federal Reserve interest-rate cuts leave them searching for return chances.

“Real Estate dividends are likely more sustainable than during prior cycles, given that since 2008, the sector has doubled its proportion of high quality (” B+ or Better”) market cap to a whopping 70%,” experts composed.

Read the initial short article on Business Insider