-

Nasdaq 100 and S&P 500 decreases in September offer a purchasing possibility, claims Ned Davis Research.

-

Weak seasonality information and extreme pessimism analyses recommend a solid fourth quarter rally is in advance, NDR claimed.

-

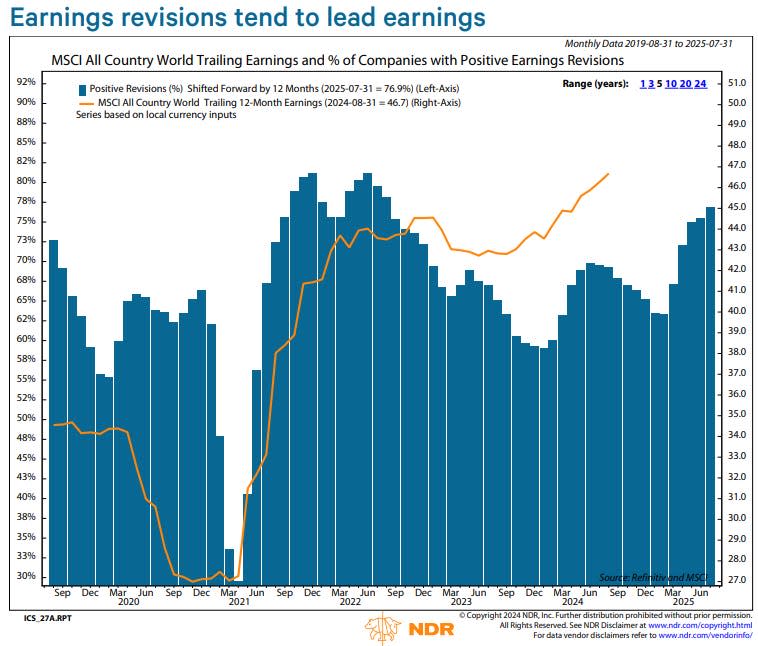

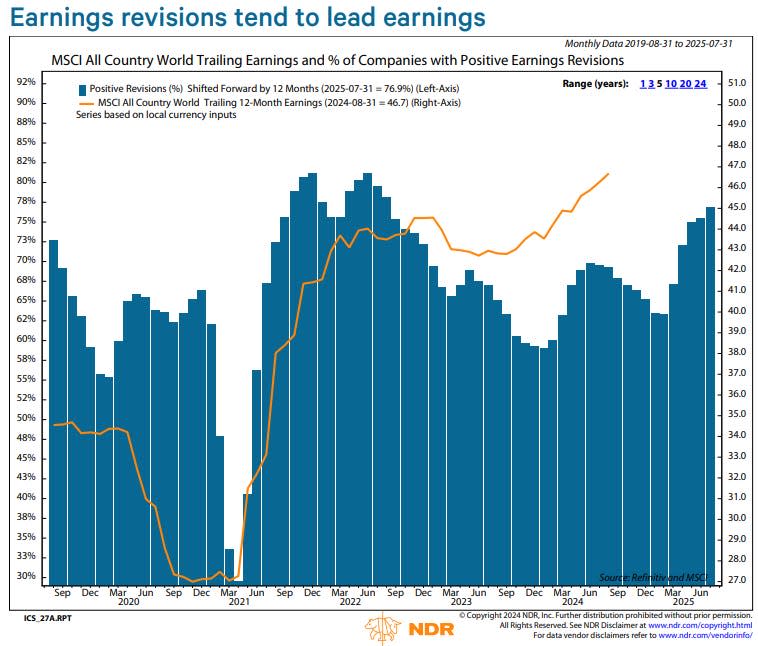

NDR sees no indicators of a sharp bearish market, with favorable incomes modifications and financial signs.

A 6% decrease in the Nasdaq 100 and 4% decrease in the S&P 500 considering that the beginning of September stands for an eye-catching acquiring possibility for capitalists, according to Ned Davis Research.

The study company claimed in a note on Friday that the weak point in supplies up until now this month is greater than common, given weak seasonality data — however it’s likewise a large possibility offered the marketplace is going to its ideal three-month stretch of the year.

“With the September weakness relieving the optimism and sending sentiment indicators to excessive pessimism readings, equities would be likely to launch a persistent ascent similar to the first quarter advance, supported by fourth quarter seasonal tendencies,” NDR planner Tim Hayes claimed.

He included: “Whereas a comparison of three-month declines shows that August – October has been the weakest, October – December has been the strongest.”

Hayes discovers it motivating that, based upon inner NDR analyses, the stock exchange, economic situation, and business incomes are revealing no indicators of being at risk to a sharp bearish market decrease comparable to what took place in 2022.

Analyst incomes modifications remain to trend greater, traditionally a leading sign for business incomes.

“As with revisions, economic performance is a leading indicator of earnings growth, currently supporting the earnings outlook. While the recession probability has risen from its lows of May and June, it hasn’t risen out of its bullish mode for equities,” Hayes discussed.

Altogether, that suggests the present stock exchange decrease is more probable to be an everyday improvement that eventually verifies to be healthy and balanced for the sustainability of the recurring bull rally that started in October 2022.

“The current choppiness will prove to be just that, not the sign of a new bear market. It should lead to a buying opportunity within the continuing bull market, ahead of renewed rallying in the fourth quarter,” Hayes claimed.

Read the initial short article on Business Insider