From looking via financier discussions and business filings to paying attention to revenues telephone calls and viewing meetings, obtaining a solid scale on a financial investment usually needs a great deal of job.

One point that I such as to do is evaluate13F filings These are kinds submitted by investment company taking care of over $100 million in supplies. One of the even more top-level bush funds isKen Griffin’s Citadel Last quarter, Citadel lowered its risk in Nvidia ( NASDAQ: NVDA) by 79%– unloading 9,282,018 shares. In enhancement, the company raised its placement by 1,140% in Palantir Technologies ( NYSE: PLTR), scooping up 5,222,682 shares.

Let’s go into what might have obliged Griffin and his profile supervisors to offer Nvidia and acquirePalantir Moreover, I’ll discover what drivers can aid sustain much more development for Palantir– and why currently can be a good time to adhere to Griffin’s lead.

Why sell Nvidia now?

On the surface area, marketing Nvidia supply may resemble a suspicious step. After all, isn’t expert system (AI) the following huge point?

Well, also if AI winds up being the generational chance it’s being proclaimed to be, that does not imply a great deal at stated value. There are numerous elements to the structures of AI, and Nvidia’s proficiency in the growth of sophisticated chipsets called graphics refining systems (GPU) is simply among numerous foundation sustaining expert system.

The most significant bear story bordering Nvidia originates from increasing competitors. At existing, items created by Advanced Micro Devices and Intel are one of the most apparent options toNvidia However, I see a larger danger in the affordable landscape.

Namely, Nvidia’s huge technology accomplices consisting of Tesla, Meta Platforms, Microsoft, and Amazon are allinvesting heavily into their own hardware development Considering that much of these firms are Nvidia’s very own consumers, I’m cautious that the business’s present development trajectory is lasting over time.

When even more GPUs concern market, there is a great chance this modern technology will certainly be deemed rather commoditized. Such a dynamic will likely bring about reduced rates for Nvidia, which will consequently bring slowing down profits, margins, and revenues.

All informed, I do not actually criticize Griffin for marketing such a big section of his Nvidia placement. Despite the business’s success until now, its future potential customers look possibly suspicious.

Why buy Palantir now?

In a various location of the AI landscape rests venture software program businessPalantir It provides 4 information analytics systems called Foundry, Gotham, Apollo, and AIP. The business’s software program is utilized throughout a host of usage instances throughout the united state armed forces and economic sector.

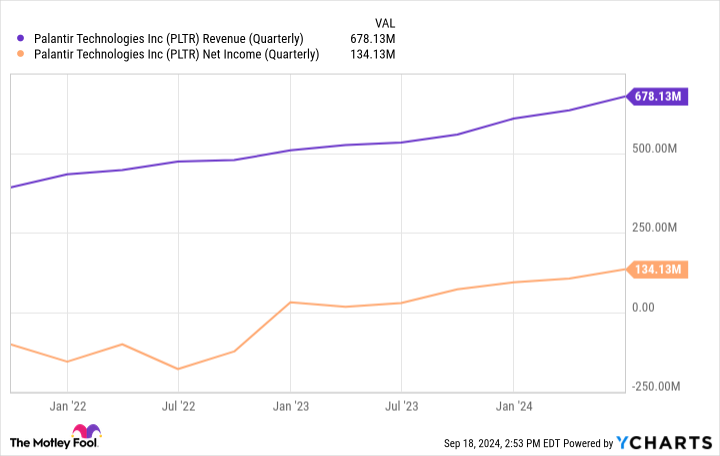

Investors can see that over the last number of years, Palantir’s profits increased on the background of a favorable AI story. More notably, the business’s operating take advantage of has actually enhanced substantially in the type of margin development and constant productivity.

Earlier this month, Palantir likewise accomplished the noteworthy turning point of incorporation in the S&P 500

Should you acquire Palantir supply now?

I can not claim for sure why Griffin raised his risk in Palantir a lot last quarter, however I do discover the timing fascinating for one certain factor. Palantir has actually been qualified for the S&P 500 prior to however was not at first picked. Perhaps some idea Palantir’s newly found development was simply an expansion of need for AI software program and would certainly not be lasting over time.

Whatever the situation, I believe those that have actually complied with Palantir for a long period of time comprehended that the business’s long-run potential customers looked strong– no matter the present AI story. Bearing that in mind, it was affordable to believe that the business would certainly be consisted of in the S&P 500 ultimately.

This leads me to a wider factor. Now that Palantir remains in the S&P 500, there is a great chance much more financial investment financial institutions and study experts will certainly start complying with the business much more very closely. In turn, this can bring about a rise in institutional capitalists purchasing the supply. Over time, this can enhance Palantir’s brand name and understanding in the financial investment neighborhood and bring the supply to also greater rates.

I believe there is a great chance Palantir will certainly witness an increase in institutional possession. The business is promptly becoming a pressure in the AI software program sector, and has actually also brought in the similarity Microsoft and Oracle— 2 partnerships that I believe will certainly bring also more development to the business.

I quite see also much better days in advance for Palantir, and believe currently is a good time to acquire shares. With a lot of drivers sustaining the business’s benefit, I see Griffin switching Nvidia for Palantir as an especially wise step.

Should you spend $1,000 in Palantir Technologies now?

Before you acquire supply in Palantir Technologies, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for capitalists to acquire currently … and Palantir Technologies had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $710,860! *

Stock Advisor offers capitalists with an easy-to-follow plan for success, consisting of advice on constructing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since September 16, 2024

John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Randi Zuckerberg, a previous supervisor of market growth and spokesperson for Facebook and sibling to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. Adam Spatacco has placements in Amazon, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, andTesla The Motley Fool has placements in and advises Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, Palantir Technologies, andTesla The Motley Fool advises Intel and advises the complying with choices: lengthy January 2026 $395 contact Microsoft, brief January 2026 $405 contact Microsoft, and brief November 2024 $24 contactIntel The Motley Fool has a disclosure policy.

Billionaire Ken Griffin Just Sold 9.3 Million Shares of Nvidia and Bought This Other Artificial Intelligence (AI) Stock That’s Headed to the S&P 500 Instead was initially released by The Motley Fool