Shares of Nvidia ( NASDAQ: NVDA) and Palantir Technologies ( NYSE: PLTR) have actually supplied magnificent gains of 152% and 133%, specifically, in 2024, as both firms have actually been taking advantage of the fast-growing fostering of expert system (AI) software and hardware. That is likewise why both of them are currently trading at pricey appraisals.

However, a better check out their leads shows that Nvidia and Palantir’s AI-powered development is right here to remain, as both of them stand to acquire from large end-market chances. Here, allow’s analyze which of these 2 AI supplies capitalists ought to take into consideration getting today following their magnificent gains thus far this year.

The instance for Nvidia

Nvidia has actually been providing durable development quarter after quarter many thanks to its market share of greater than 85% in AI chips, which experts at financial investment research study company Third Bridge think is lasting, many thanks to the arrival of the firm’s next-generation Blackwell cpus.

Nvidia’s income in the 2nd quarter of monetary 2025 (which finished July 28) skyrocketed 122% year over year to $30 billion. More significantly, the firm’s rates power assisted it raise its non-GAAP (typically approved bookkeeping concepts) gross margin by 4.5 portion factors last quarter to 75.7%. As an outcome, the development in the firm’s profits surpassed its income development.

Nvidia reported $0.68 per share in profits in monetary Q2, a rise of 152% from the year-ago duration. And currently, experts at Japanese financial investment financial institution Mizuho have actually increased their sales assumptions of Nvidia’s AI graphics cards for 2025. Mizuho is anticipating Nvidia to offer 8% to 10% even more AI graphics cards following year from its previous support released in July.

The firm is anticipated to offer in between 6.5 million to 7 million AI GPUs (graphics refining devices) following year, driven by a boosting supply chain that is anticipated to aid it make a lot more chips. Given that Nvidia has actually supposedly valued its forthcoming Blackwell cpus in between $30,000 to $40,000, which corresponds what it bills for its existing generation front runner cpu– the H200– there is a strong possibility its information facility income can rise majorly following year.

Assuming Nvidia offers also 6 numerous its AI GPUs in 2025 at a typical asking price (ASP) of $30,000, it can produce a tremendous $180 billion in income from the information facility service following year. Moreover, its information facility income can surpass $200 billion, at the greater end of Mizuho’s delivery projection. Given that Nvidia has actually produced near to $49 billion in income from the information facility service in the initial 6 months of the existing , which equates right into a yearly income run price of $98 billion, capitalists can wish for an additional outstanding year from this semiconductor gigantic following year.

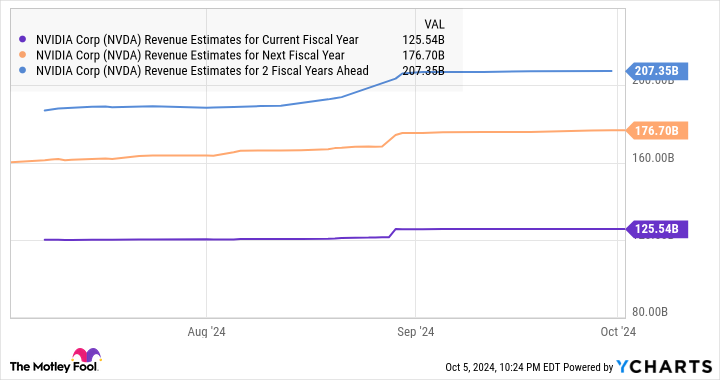

Consensus quotes are forecasting Nvidia’s income to strike $176 billion in monetary 2026 (which will certainly start in January following year) from this year’s degree of $125 billion.

However, if Nvidia can undoubtedly handle to deliver at the very least 6 million AI GPUs following year at the ASP reviewed, it can effectively coastline previous agreement assumptions. As such, Nvidia can stay a leading AI supply also after the outstanding gains it has actually tape-recorded in 2024.

The instance for Palantir Technologies

Just like Nvidia is the leading gamer in the AI equipment market, Palantir has actually been promoted to be the leading company of AI software application systems by marketing research companies. Forrester, for example, identifies Palantir as a leader in “artificial intelligence and machine learning (AI/ML) software platforms.” Similarly, Dresner Advisory Services claims that Palantir is a “top performer” in its AI, information scientific research, and artificial intelligence market research.

With the AI systems software application market projection to clock a yearly development price of 40% via 2028, producing $153 billion in yearly income, Palantir appears to be on the cusp of a significant development chance. More significantly, Palantir’s development price has actually begun boosting as even more consumers have actually begun releasing its Artificial Intelligence Platform (AIP) to incorporate generative AI right into their procedures.

The firm’s income in the initial 6 months of 2024 enhanced by 23% from the very same duration in 2014. Its profits have actually skyrocketed fivefold over the very same duration to $0.10 per share. For contrast, Palantir’s income in the initial 6 months of 2023 enhanced at a slower rate of 15% from the year-ago duration.

Palantir administration made it clear on the firm’s August earnings conference call that its AIP is bring about more powerful offer task by bring in brand-new consumers, and by likewise aiding it acquire a lot more service at existing consumers. According to Palantir primary income policeman Ryan Taylor:

One of one of the most remarkable signs of our distribution is the quantity of existing consumers that are authorizing development offers, a number of which are a straight outcome of AIP.

The solid grip of Palantir’s AIP has actually motivated the firm to elevate its full-year support to simply under $2.75 billion from the earlier assumption of $2.68 billion. Analysts, nonetheless, are anticipating Palantir to supply $2.76 billion in income in 2024, which would certainly be a 24% boost from in 2014. However, it will not be unusual to see it upload more powerful development than that due to a healthy and balanced income pipe that stands at $4.3 billion (its continuing to be offer worth at the end of Q2, a statistics that describes the overall worth of agreements it is yet to meet).

Time to decide

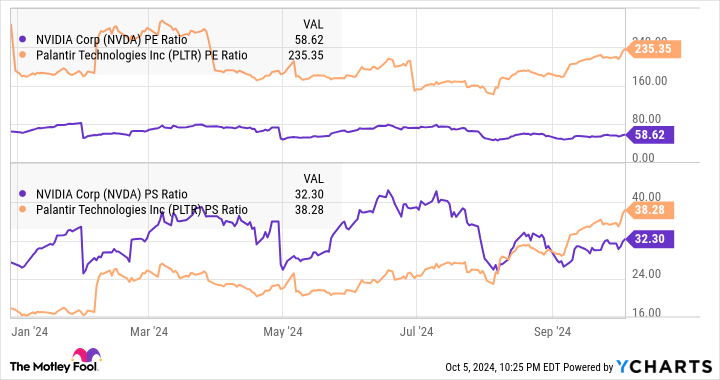

The directs reviewed suggest that both Palantir and Nvidia are heading right into 2025 with bright leads, many thanks to strong need for their AI offerings. However, Nvidia is expanding at a dramatically much faster rate thanPalantir Also, a consider the evaluation of both firms, Nvidia ends up being the fairly less expensive wager.

Investors ought to likewise keep in mind that Nvidia is perhaps straddling Palantir’s area, as Nvidia has actually been observing strong grip in its software application service. So, based upon the evaluation, the rate of development, and Nvidia’s moat in AI equipment and its concentrate on branching out right into the software application side, it resembles the much better AI financial investment of both high-flying firms reviewed right here.

Don’ t miss this 2nd possibility at a possibly rewarding chance

Ever seem like you failed in getting one of the most effective supplies? Then you’ll intend to hear this.

On unusual celebrations, our specialist group of experts problems a “Double Down” stock referral for firms that they believe will stand out. If you’re stressed you have actually currently missed your possibility to spend, currently is the most effective time to get prior to it’s far too late. And the numbers promote themselves:

-

Amazon: if you spent $1,000 when we increased down in 2010, you would certainly have $20,363! *

-

Apple: if you spent $1,000 when we increased down in 2008, you would certainly have $41,938! *

-

Netflix: if you spent $1,000 when we increased down in 2004, you would certainly have $378,539! *

Right currently, we’re providing “Double Down” signals for 3 unbelievable firms, and there might not be an additional possibility such as this anytime quickly.

*Stock Advisor returns since October 7, 2024

Harsh Chauhan has no placement in any one of the supplies pointed out. The Motley Fool has placements in and suggests Nvidia andPalantir Technologies The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stock: Nvidia vs. Palantir Technologies was initially released by The Motley Fool