Super Micro Computer (SMCI) left to an extraordinary beginning this year as shares greater than quadrupled from January to mid-March This rise made Super Micro eligible for S&P 500 incorporation, with the modern technology equipment supply (with web links to AI) being included to the index on March 18, 2024. In knowledge, that would certainly have been a fun time to take earnings or Short the supply, as shares are down by greater than 50% ever since.

One of the significant advancements has actually been the record by Hindenburg Research, which had troubling accusations concerning the business’s monetary coverage. In analyzing those accusations in addition to Super Micro’s principles I hold a neutral ranking on the supply.

Hindenburg Casts Doubts About Super Micro

The Hindenburg record is really the major factor I am neutral rather than favorable on SMCI supply, and I think it has actually triggered hesitancy amongst lots of AI supply experts and capitalists.

The allegations are quite simple. According to Hindenburg, Super Micro participated in audit control that included “sibling self-dealing and evading sanctions” Anyone that believes this seems much brought might desire to keep in mind that the SEC billed Super Micro with extensive audit infractions in August 2020. Hindenburg’s record additionally suggested that many of the individuals included with that said audit negligence are back on Super Micro’s group.

Hindenburg’s group talked to numerous Super Micro salesmen and staff members when assembling their record. It does not aid that Super Micro postponed its 10-K declaring to examine inner controls soon after Hindenburg went public with its issues. While this could just be a coincidence, the timing is uneasy. Looking back numerous years, Super Micro had actually fallen short to submit monetary declarations in 2018 and was quickly delisted from the Nasdaq therefore.

Near the start of this month, Super Micro openly provided a rejection of the allegations, with chief executive officer Charles Liang countering, mentioning that Hindenburg’s record had,“misleading presentations of information” Super Micro hasn’t offered any kind of added declarations ever since.

Artificial Intelligence Growth Is Undeniable

Super Micro’s standing as component of the quick relocating globe of AI is just one of minority factors that I am neutral rather than bearish SMCI supply. The amazing leads for the business’s service and the significant nature of the Hindenburg accusations primarily counter each various other.

It’s difficult to recognize what’s genuine and what’s incorrect right here, yet the majority of people yield that the AI market all at once deals engaging development leads. Nvidia (NVDA) has actually been publishing triple-digit year-over-year income development for numerous quarters. Other technology titans have actually included expert system right into their core companies and provided remarkable outcomes for their investors. For circumstances, Alphabet (GOOGL) saw its cloud income surge by 28.8% year-over-year as lots of companies hurried to develop their very own AI devices.

The expert system market is additionally forecasted to keep a 19.3% intensified yearly development price from currently up until 2034, according toPrecedence Research The AI market need to proceed to expand, which need to raiseSuper Micro The business needs to take advantage of Nvidia’s development, which is why the business uploaded outstanding income and earnings development throughout Nvidia’s climb. That’s what we saw for numerous quarters. We simply do not recognize exactly how precise all the numbers were, if the accusations targeting the company have quality.

Super Micro Has Strong Financials at Face Value

While it’s difficult to neglect Hindenburg’s accusations versus Super Micro, it’s still beneficial analyzing the business’s previous quarterly outcomes. Shares were going down also prior to Hindenburg launched its record. While in March 2024 I suggested that SMCI supply encountered threats, I really felt that shares provided a significant acquiring possibility in late-summer, up until Hindenburg muddied that positive outlook.

For its last documented quarter, Super Micro uploaded internet sales of $5.31 billion, standing for a 143% year-over-year dive. Meanwhile, earnings increased by 82% year-over-year, getting to $353 million. At the moment of the launch, my main problem was Super Micro’s decreasing internet revenue margin. Super Micro presently trades at a 20x tracking P/E proportion, relatively sufficient to make up for any kind of additional disintegration in revenue margins. SMCI supply has a extremely reduced 13.6 x ahead P/E proportion, yet with the current speedbumps (the Hindenburg record and DOJ examination) capitalists appears unwilling to bid the assessment numerous any kind of greater now.

We do not yet have substantial evidence that Super Micro has actually participated in any kind of misbehavior, as affirmed byHindenburg Their record, nevertheless, has actually absolutely cast a shiner on the supply. I anticipate that Super Micro would certainly have dramatically outshined its monetary 2023 outcomes also omitting any kind of misdealings.

The Department of Justice Is Probing Super Micro Computer

The Super Micro debate included a brand-new phase on September 26, as information went across the cables that the united state Department of Justice is currently penetrating the business. SMCI supply rolled an extra 12% on this information, and shares were just recently trading at much less than one-third of their perpetuity high inMarch There’s a high risk/reward on the shares now, yet the raised threats have actually delegated me to the sidelines with a neutral ranking.

Super Micro shares recovered by greater than 4% on Friday, September 27, recommending that lots of capitalists think that the lasting possibility for business deserves the increased unpredictability.

Is Super Micro Stock Rated a Buy?

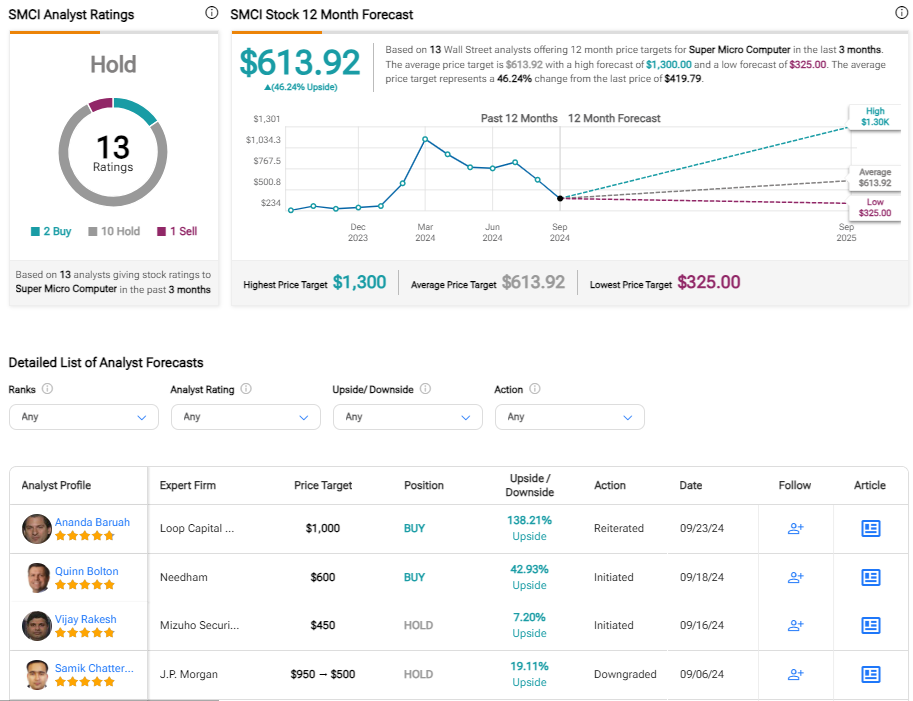

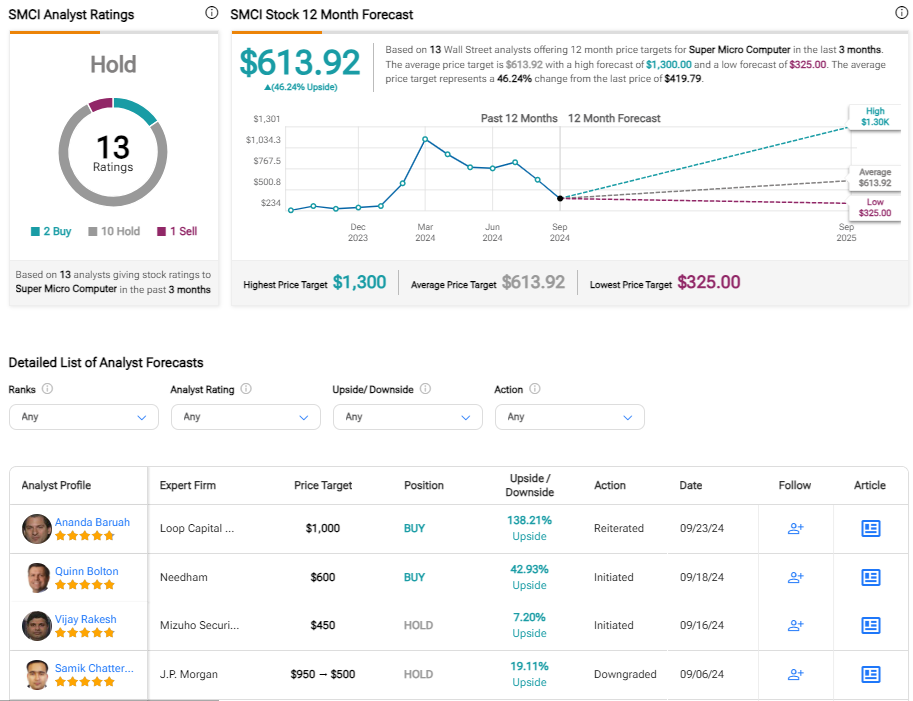

Although the rankings for this supply can transform promptly, Super Micro presently has 2 Buy rankings, 10 Hold rankings, and 1 Sell ranking from the 13 experts that cover the supply. The ordinary cost target for SMCI is $613.92, which suggests possible benefit of almost 50%. Again however, it’s fairly feasible that numerous research study broker agents have actually put their SMCI rankings under testimonial. SMCI supply does have a couple of small cost targets consisting of $ 454, $375 and $325 from CFRA, Wells Fargo (WFC), and Susquehanna specifically. All of these cost targets were developed prior to the DOJ probe was introduced, so also they can go down reduced.

The Bottom Line on SMCI Stock

There’s an old saying that recommends,“You either die a hero or live long enough to be the villain” That quote appears apropos for this business. Super Micro made lots of capitalists significant earnings throughout its surge over a supply cost of $1,000 per share. Those that went into the tale late, consisting of after SMCI supply was included in the S&P 500, have actually not prospered. Many capitalists are remaining on substantial losses now. Depending on what those capitalists do, it’s difficult to inform just how much extra drawback Super Micro shares might have up until even more clearness on the challenges is offered.

If the business’s current financials are precise, SMCI shares look fairly eye-catching right here. Shares can rise promptly if the Hindenburg record sheds importance, although that result hard to anticipate. I’m a huge follower of Super Micro’s market and service possible pertaining to AI, which avoids me from being downright bearish. I have a neutral position right here. Meanwhile, I do not anticipate shares of SMCI to rebound over $460 (the approximate cost before information of the DOJ probe) with no resolution to both major risks to investor worth.

Disclosure