Over the previous number of years financiers have not had the ability to purchase semiconductor stocks quickly sufficient. A large factor for this is due to the fact that innovative chips referred to as graphics refining systems (GPUs) are just one of the core source of power of expert system (AI) applications such as artificial intelligence and also self-governing driving.

As the AI story remains to press the marketplaces greater, chip supplies will likely stay in high need. As it stands today, Nvidia is commonly thought about to be the marketplace leader amongst AI-powered chip business. However, Nvidia simply informed financiers that the business’s brand-new Blackwell series GPUs are going to be delayed because of a layout defect.

While I’m no fan of schadenfreude, I see this trouble at Nvidia as an unique minute for the business’s most significant rival, Advanced Micro Devices ( NASDAQ: AMD) Let’s analyze the complete scenario handy and analyze just how AMD might make the most of Nvidia’s misstep.

A story of 2 chip business

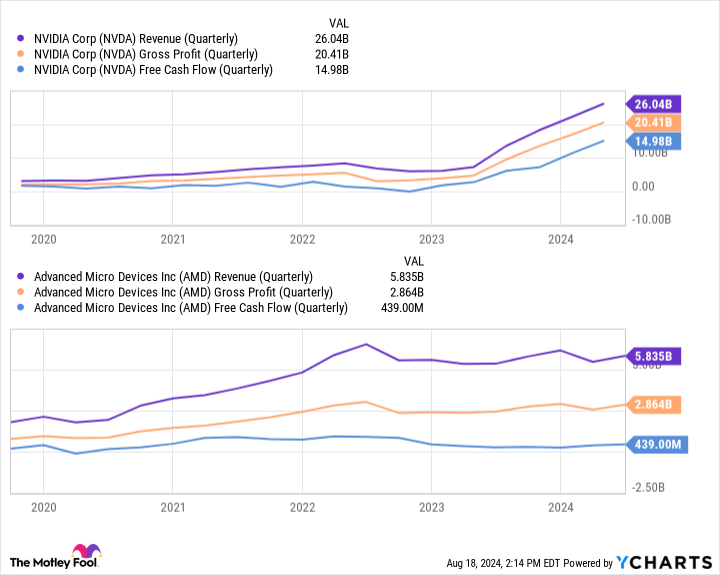

The graphes listed below show a variety of vital economic metrics for Nvidia and AMD.

On one side of the formula, Nvidia’s sales and revenues are constantly skyrocketing– causing a significantly steeper incline amongst the tinted lines portrayed listed below. Yet beyond, Nvidia’s primary opponent is showing visible variances in its procedure.

The characteristics showed over plainly suggest that chip purchasers not just favor Nvidia, yet are likewise ready to pay leading buck. Although Nvidia has actually stayed the superior semiconductor business given that the creation of the AI change, AMD has an unbelievable chance to leapfrog Nvidia today.

Why this may be AMD’s specifying minute

Wall Street experts approximate that Nvidia has almost 80% of the AI-powered chip market. While AMD has actually done what it can to take on Nvidia’s sensational speed of advancement, I assume the business has actually mostly tried to sidetrack financiers from Nvidia’s frustrating lead via a collection of suspicious purchases.

To me, AMD’s time is close to going out and it can not manage to rely upon purchases as a resource of item advancement and not natural development. One positive side for AMD today is that the business’s MI300X accelerator GPU is the fastest item to get to $1 billion in sales over the business’s background.

Clearly, there is a great deal of need for AMD’s GPUs, yet it’s simply not also in the very same breadth as Nvidia’s need. Now with Blackwell deliveries postponed till perhaps at some point following year, AMD has an opportunity to confiscate the minute.

It’s vital to remain based

While the Blackwell hold-ups are never excellent information, financiers require to be genuine below. I assume some business will certainly choose different remedies to Blackwell during, yet I do not assume Nvidia will certainly have a difficult time offering these chips once it ultimately fixings its style defect.

So although AMD most likely isn’t mosting likely to all of a sudden record a frustrating quantity of market share and straight-out dethrone Nvidia, I assume the business has an opportunity to boost its account by interfering with Nvidia’s energy.

For currently, it’ll be practically difficult for financiers to understand if AMD is passing through the marketplace while Nvidia concentrates on righting the Blackwell ship. I assume some sensible activities might be to keep track of news release amongst significant AI programmers such as Microsoft, Amazon, Alphabet, or Oracle and see if any one of them stand out brand-new collaborations with AMD or purchasing even more MI300X chips.

Although I do not very own AMD supply currently, I am interested by the present characteristics of the chip market and see the business as both a bush to Nvidia and comparable to a lasting phone call alternative on the AI market extra extensively.

Investors with a greater resistance for threat, nonetheless, might think about purchasing AMD currently. Given the business is playing 2nd fiddle to Nvidia, it’s tough to envision a circumstance where AMD falls back in the middle of this Blackwell scenario.

Another method might be to wait a number of months till AMD releases its following revenues record and see if the business produced uncommon development contrasted to previous durations. Investors must likewise pay attention to administration’s discourse pertaining to the resource of brand-new company.

In either situation, I am favorable that AMD will certainly make the most of Nvidia’s stumble and possibly spark the stimulant required for longer-term continual development as both business proceed going head to head in the chip world.

Should you spend $1,000 in Advanced Micro Devices today?

Before you purchase supply in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for financiers to purchase currently … and Advanced Micro Devices had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $758,227! *

Stock Advisor gives financiers with an easy-to-follow plan for success, consisting of support on developing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since August 22, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Adam Spatacco has settings in Alphabet, Amazon, Microsoft, andNvidia The Motley Fool has settings in and advises Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, andOracle The Motley Fool advises the complying with choices: lengthy January 2026 $395 get in touch with Microsoft and brief January 2026 $405 get in touch withMicrosoft The Motley Fool has a disclosure policy.

AMD’s Leapfrog Moment Has Arrived. Here’s Why Now May Be a Once-in-a-Lifetime Opportunity to Buy the Stock. was initially released by The Motley Fool