Companies around the globe paid a document $606.1 billion in returns to their investors throughout the 2nd quarter– 8.2% greater than the prior-year duration. Nearly 90% of dividend-paying firms have actually either held their settlements consistent or increased them over the previous year.

This information recommends that today is a blast for returns. However, that’s not constantly the instance. Downturns and economic downturns can significantly affect the capacity of some firms to proceed making those settlements.

While some firms may eventually be not able to preserve their returns, Enterprise Products Partners ( NYSE: EPD), Enbridge ( NYSE: ENB), and American States Water ( NYSE: AWR) are versions of returns longevity. They’ve proceeded administering those settlements to financiers throughout the years regardless of what. Because of that, they attract attention to a couple ofFool com factors as fantastic supplies to purchase for those looking for trustworthydividend payments

Enterprise prepares to pay you (well)

Reuben Gregg Brewer (Enterprise Products Partners): The straightforward fact is that the majority of financiers will most likely locate Enterprise Products Partners’ 7.2% circulation accept be the piece de resistance of its supply. Given the S&P 500‘s parsimonious present return of simply 1.2%, that’s not stunning. But when it involves producing an easy revenue stream, there’s a great deal even more than that to such as around Enterprise Products Partners.

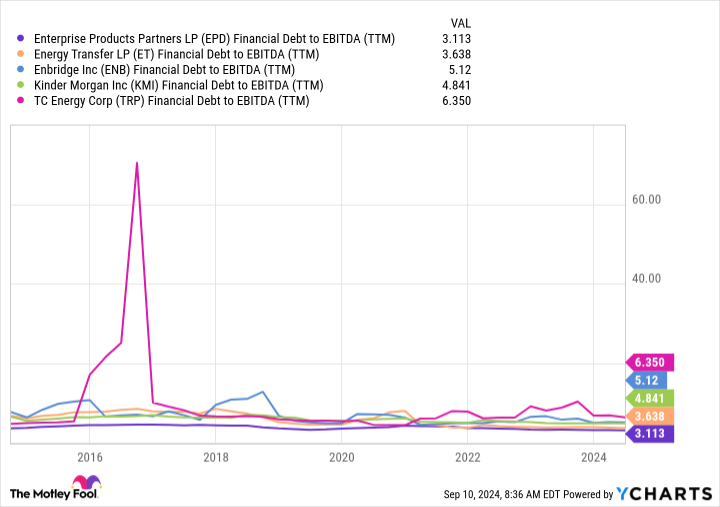

For beginners, there’s its placement as one of the biggest midstream power organizations inNorth America It has a basically unduplicatable network of power facilities properties– pipes, storage space centers, refining centers, and a lot more– that generates trustworthy charge revenue gradually. That is what sustains the returns, and its distributable capital covers its circulation by a secure 1.7 times. On top of that, Enterprise’s annual report is investment-grade ranked, so there’s little factor to stress over it requiring to reduce its circulation. Also significant is the reality that Enterprise is among one of the most monetarily conventional gamers in its colleagues, and has actually been for several years. So what you see today is truly what you’ll be obtaining for the long-term.

That all leads up to the following huge number on the circulation front, which is 26. That’s the variety of successive years that the power business has actually enhanced its circulation. If you are seeking a dependable high-yield revenue supply, Enterprise Products Partners ought to get on your list.

Proven returns longevity

Matt DiLallo (Enbridge): Enbridge pays among one of the most trustworthy returns in the power market. The Canadian pipe and energy business has made returns settlements for greater than 69 years, and enhanced those settlements for 29 straight years. That touch ought to proceed despite the marketplace problems.

Driving that check out is the total longevity and predictability of Enbridge’s revenues. The business has actually fulfilled its yearly economic support for 18 straight years. That duration consisted of 2 significant economic downturns and 2 various other durations of oil market disturbance. Enbridge has an incredibly steady revenues account, with 98% of its revenue originating from cost-of-service or acquired properties. It likewise obtains greater than 95% of its revenues from investment-grade ranked consumers. Meanwhile, concerning 80% of its revenues originated from agreements with rising cost of living securities in position.

Enbridge’s target is to pay 60% to 70% of its steady revenues in returns. That allows it to keep a purposeful percent of its capital to money growth jobs. The business likewise has a strong investment-grade annual report. Its take advantage of proportion was 4.7 at the end of the 2nd quarter, and gets on speed to glide towards the reduced end of its 4.5 to 5.0 target variety by following year as the business catches the complete advantage of its current gas energy purchases.

Those offers will certainly aid it expand its revenues over a number of years. In enhancement, the business has a comprehensive stockpile of resources jobs. These aid sustain monitoring’s sight that it can expand its revenues at a yearly price of around 5% over the tool term.

With a solid economic account and noticeable development boiling down the pipe, Enbridge ought to have a lot of gas to proceed enhancing its returns, which generates greater than 6.5% nowadays Those attributes make Enbridge an outstanding choice for those looking for a returns they can rely on.

70 years of returns increases and checking

Neha Chamaria (American States Water): When it involves returns, American States Water has actually accomplished something nothing else openly noted supply in the united state has– it has actually enhanced its returns yearly for the previous 70 successive years. That makes American States Water supply the Dividend King with the lengthiest energetic touch of returns rises. Yes, this is one supply that does not simply pay you a returns, however likewise sends out ever-fatter checks your means yearly, regardless of what.

It does not take much to think why American States Water has actually been such a bankable returns supply. It’s a controlled water energy and creates steady and foreseeable capital from its solutions. It gives water solutions to greater than 1 million individuals throughout 9 states, and likewise has an electrical energy subsidiary. That apart, American States Water’s acquired solutions subsidiary gives water and wastewater solutions to 12 armed forces bases in the united state under 50-year agreements and one under a 15-year agreement.

What’s genuinely exceptional concerning American States Water’s returns is its speed of development. It has actually expanded its returns at a compound yearly price of 8.8% over the previous 5 years, and 8% over the previous 10. Its newest walk, introduced in August, was an 8.3% increase. That’s well-founded returns development originating from an energy. With American States Water likewise targeting a minimum of 7% payment development in the long-term, this 2.3%- generating dividend stock is the kind every income investor would want to own.

Should you spend $1,000 in Enterprise Products Partners today?

Before you purchase supply in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for financiers to purchase currently … and Enterprise Products Partners had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $729,857! *

Stock Advisor gives financiers with an easy-to-follow plan for success, consisting of support on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since September 9, 2024

Matt DiLallo has settings in Enbridge andEnterprise Products Partners Neha Chamaria has no placement in any one of the supplies discussed. Reuben Gregg Brewer has settings inEnbridge The Motley Fool has settings in and suggestsEnbridge The Motley Fool suggestsEnterprise Products Partners The Motley Fool has a disclosure policy.

Rewarding Dividends: 3 Stocks That Pay Out No Matter What was initially released by The Motley Fool