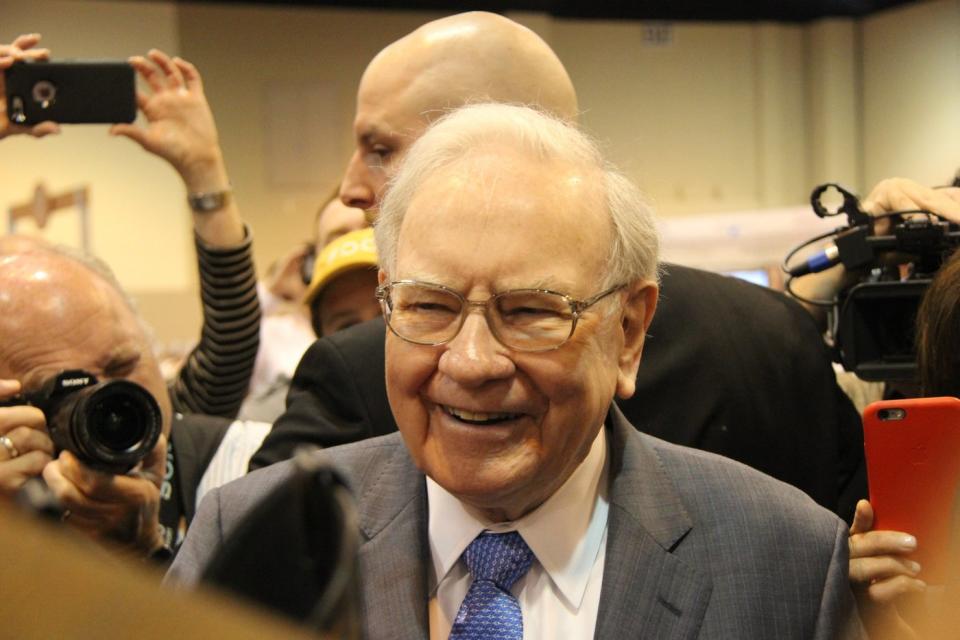

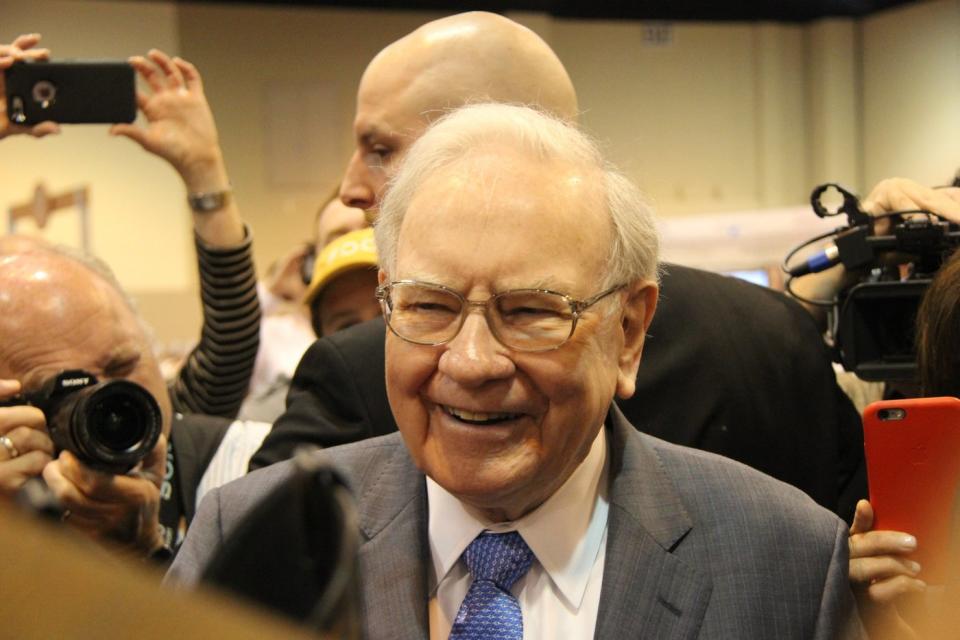

Warren Buffett has actually gone to the helm of the Berkshire Hathaway ( NYSE: BRK.A)( NYSE: BRK.B) investment firm because 1965. During his 59 years of management, Berkshire Hathaway supply has actually provided a substance yearly return of 19.8%, which would certainly have sufficed to transform a financial investment of $1,000 at that time right into greater than $42.5 million today.

Buffett’s financial investment approach is basic. He seeks expanding business with durable success and solid administration groups, and he specifically suches as those with shareholder-friendly programs like returns repayments and stock-buyback strategies.

One point Buffett does not concentrate on is the most recent stock exchange fad, so you will not discover him stacking cash right into expert system (AI) supplies now. However, 2 supplies Berkshire currently holds are ending up being considerable gamers in the AI sector, and they make up concerning 29.5% of the complete worth of the empire’s $305.7 billion profile of openly traded supplies and protections.

1. Apple: 28.9% of Berkshire Hathaway’s profile

Apple ( NASDAQ: AAPL) is the globe’s biggest firm with a $3.3 trillion market capitalization, however it deserved a portion of that when Buffett began acquiring the supply in 2016. Between after that and 2023, Berkshire invested concerning $38 billion developing its risk in Apple, and many thanks to an astonishing return, that setting had a worth of greater than $170 billion previously this year.

However, Berkshire has actually marketed majority of its risk in the apple iphone manufacturer throughout the previous couple of months. Its continuing to be setting is still worth $88.3 billion, so it’s still the biggest holding in the empire’s profile, and I believe the current sales mirror Buffett’s careful sight on the more comprehensive market rather than Apple itself. After all, the S&P 500 is trading at a price-to-earnings ratio (P/E) of 27.6 now, which is substantially a lot more costly than its standard of 18.1 returning to the 1950s.

Besides, Apple is planning for among one of the most crucial durations in its background. With greater than 2.2 billion energetic gadgets worldwide– consisting of apples iphone, iPads, and Mac computer systems– Apple can come to be the globe’s greatest representative of AI to customers.

The firm introduced Apple Intelligence previously this year, which it established in collaboration with ChatGPT developer OpenAI. It’s ingrained in the brand-new iphone 18 os, and it will just be offered on the most recent apple iphone 16 and the previous apple iphone 15 Pro designs since they are fitted with next-generation chips developed to refine AI work.

Considering Apple Intelligence is mosting likely to change much of the firm’s existing software application applications, it can drive a large upgrade cycle for the apple iphone. Apps like Notes, Mail, and iMessage will certainly include brand-new writing devices with the ability of quickly summing up and producing message web content on command. Plus, Apple’s existing Siri voice aide is mosting likely to be improved by ChatGPT, which will certainly strengthen its data base and its abilities.

Although Apple’s profits development has actually been slow-moving in current quarters, the firm still ticks almost all of Buffett’s boxes. It’s extremely successful, it has an extraordinary administration group led by Chief Executive Officer Tim Cook, and it’s returning truckloads of cash to investors with rewards and buybacks– actually, Apple lately introduced a brand-new $110 billion supply buyback program, which is the biggest in company American background.

There is no assurance Berkshire has actually completed marketing Apple supply, however the surge of AI will likely drive a restored stage of development for the firm, to ensure that’s a great factor to continue to be favorable whatever Buffett does following.

2. Amazon: 0.6% of Berkshire Hathaway’s profile

Berkshire purchased a reasonably little risk in Amazon ( NASDAQ: AMZN) in 2019, which is presently worth $1.7 billion and stands for simply 0.6% of the empire’s profile. However, Buffett has actually typically shared remorse for not acknowledging the possibility rather, since Amazon has actually broadened past its origins as an ecommerce firm and currently has a leading visibility in streaming, electronic advertising and marketing, and cloud computer.

Amazon Web Services (AWS) is the biggest business-to-business cloud system on the planet, supplying thousands of options developed to assist companies run in the electronic period. But AWS likewise intends to be the best supplier of AI options for companies, which can be its biggest economic possibility ever before.

AWS established its very own information facility chips like Trainium, which can use expense financial savings of approximately 50% contrasted to completing equipment from distributors likeNvidia Plus, the cloud supplier likewise constructed a household of huge language designs (LLMs) called Titan, which designers can utilize if they do not wish to develop their very own. They come with Amazon Bedrock, together with a profile of third-party LLMs from leading AI startups likeAnthropic LLMs go to the structure of every AI conversation crawler application.

Finally, AWS currently supplies its very own AI aide called Q. Amazon Q Business can be educated on a company’s information so workers can quickly discover response to their questions, and it can likewise create web content to enhance efficiency. Amazon Q Developer, on the various other hand, can debug and create code to assist speed up the conclusion of software application tasks.

According to getting in touch with company PwC, AI can include a tremendous $15.7 trillion to the worldwide economic situation by 2030, and the mix of chips, LLMs, and software application applications will certainly assist Amazon risk its insurance claim to that substantial pie.

Amazon was regularly shedding cash when Berkshire purchased the supply, and it does not use a reward neither does it have a supply buyback program, so it does not tick much of Buffett’s boxes (thus the little setting). But it may be one of the most varied AI supply capitalists can purchase now, and Berkshire will likely be pleased with its long-lasting return from below also if Buffett desires it had a larger risk.

Should you spend $1,000 in Apple now?

Before you purchase supply in Apple, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for capitalists to purchase currently … and Apple had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $630,099! *

Stock Advisor gives capitalists with an easy-to-follow plan for success, consisting of support on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 because 2002 *.

*Stock Advisor returns since September 9, 2024

John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Anthony Di Pizio has no setting in any one of the supplies pointed out. The Motley Fool has settings in and suggests Amazon, Apple, Berkshire Hathaway, andNvidia The Motley Fool has a disclosure policy.

29.5% of Warren Buffett’s $305.7 Billion Portfolio Is Invested in 2 Artificial Intelligence (AI) Stocks was initially released by The Motley Fool