It’s been an additional wonderful year for the securities market. As of this writing, the benchmark index, the S&P 500, is up almost 18%.

Yet, if you understand where to look, there are also much better lasting buy-and-hold chances around. Let’s cover 2 technology supplies that are each up greater than 50% year to day.

Spotify Technologies

Spotify Technologies ( NYSE: PLACE) covers the listing of technology supplies you can purchase and hold for the following years. The firm, which runs the globe’s l argest audio streaming system, remains to excite.

Since the beginning of 2023, shares of Spotify are up 339%, making it among the top-performing supplies over that duration. The secret to its securities market success? Spotify has actually integrated earnings development with cost-cutting. When done right, that’s an effective mix.

Spotify’s trailing-12-month earnings has actually raised to $15.7 billion, up from $13.6 billion one year back. Similarly, 12-month net income has raised to $500 million versus an almost $800 million loss a year previously.

In regards to earnings, the firm relies upon its costs individuals to supply about 90% of its sales. Those individuals pay a membership charge for accessibility to ad-free songs, podcasts, and audiobooks. Meanwhile, the firm acquires concerning 10% of its overall earnings from ad-based listening.

Regarding its expenditures, Spotify has actually started a collection of cost-cutting steps over the last couple of years, consisting of minimizing personnel degrees, cutting its advertising spending plan, and terminating some material jobs.

In turn, the firm is shooting on all cyndrical tubes. Granted, Spotify runs in an affordable area, with Apple, Amazon, and Alphabet all using their very own kind of audio streaming

However, Spotify has greater than held its very own. With over 600 million audiences and practically 250 million clients, Spotify has actually developed itself within the audio streaming market. Investors seeking a development supply with legs ought to think about Spotify.

Meta Platforms

Next is Meta Platforms ( NASDAQ: META), the driver of Facebook and Instagram.

Granted, I’ve had my worry about Meta, especially around the 10s of billions of bucks the firm picked to invest in theMetaverse However, one truth is obvious: Meta creates cash money at a practically amazing degree. This firm can pay for to take some costly dangers. And I’m certain that is among the factors Meta CHIEF EXECUTIVE OFFICER Mark Zuckerberg really felt comfy putting $46 billion right into the firm’s Reality Labs sector — cash that heretofore has not produced any type of return.

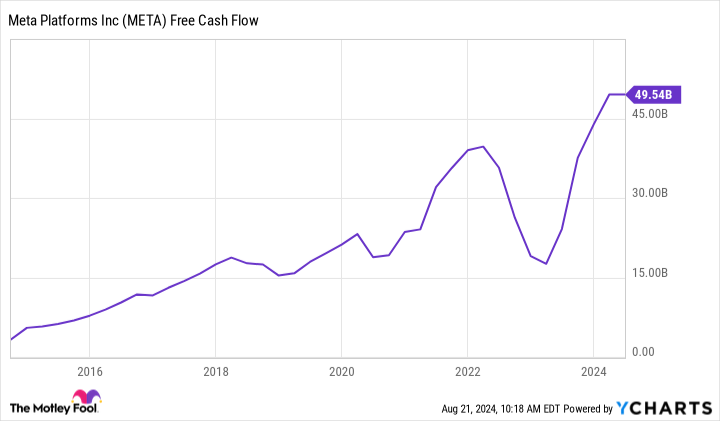

At any type of price, allow’s take a closer take a look at Meta’s capital. In the last one year, the firm has actually produced $ 50 billion in cost-free capital.

META Free Cash Flow information by YCharts

It’s an astonishing amount, and it places Meta right into rarified air. Its $50 billion in free cash flow, as an example, approaches the overall cost-free capital from power titans ExxonMobil and Chevron— integrated

No question the firm started its first-ever routine reward repayment this year. After all, discovering the cash money to spend for those returns is no worry. The brand-new payment plan reveals that Facebook has lots of excess cash money earnings handy, trying to find a shareholder-friendly cash money administration plan.

What’s a lot more, as long as Meta Platforms stays regimented in its investing, there’s lots a lot more capital en route Analysts anticipate the firm to expand its sales by 20% this year and an additional 13% in 2025. Those increasing earnings numbers ought to sustain much more cost-free capital and probably also greater reward payments at some time All of this ought to make financiers pleased to possess Meta Platforms for the following years.

Should you spend $1,000 in Meta Platforms today?

Before you purchase supply in Meta Platforms, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for financiers to purchase currently … and Meta Platforms had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $792,725! *

Stock Advisor supplies financiers with an easy-to-follow plan for success, consisting of advice on developing a profile, routine updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 because 2002 *.

*Stock Advisor returns since August 22, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. Randi Zuckerberg, a previous supervisor of market growth and spokesperson for Facebook and sis to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Jake Lerch has settings in Alphabet, Amazon, ExxonMobil, andSpotify Technology The Motley Fool has settings in and suggests Alphabet, Amazon, Apple, Chevron, Meta Platforms, andSpotify Technology The Motley Fool has a disclosure policy.

2 Tech Stocks You Can Buy and Hold for the Next Decade was initially released by The Motley Fool