It’s difficult to defeat the development capacity of cryptocurrencies. Ark Invest owner Cathie Wood, as an example, thinks that Bitcoin has greater than 2,000% in long-lasting advantage. But some supplies have equally as much area for development. If you’re trying to find optimum upside, these 2 supplies are for you.

This AI supply has actually been a rocket

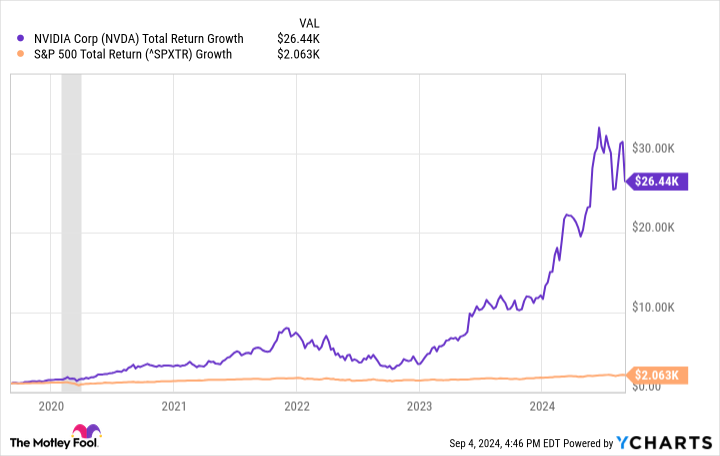

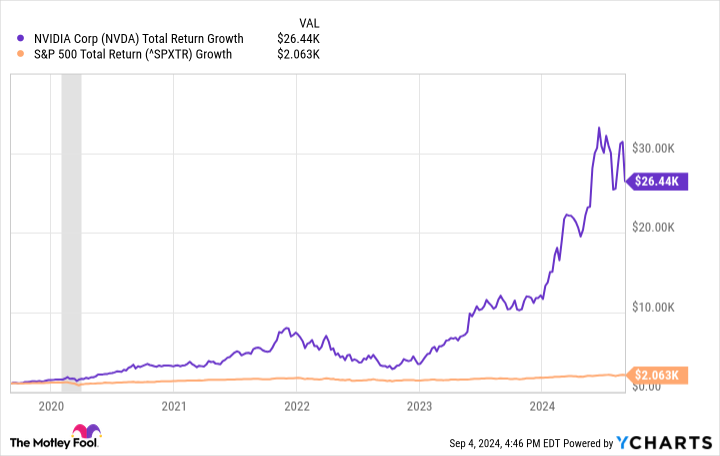

No checklist of supplies with substantial advantage would certainly be total without a reference of Nvidia ( NASDAQ: NVDA) Few financial investments have actually ever before increased as rapidly as the chipmaker. A $1,000 financial investment made 5 years back would certainly currently deserve greater than $26,000. Yet Wall Street experts still think there’s greater than 30% in gains to find in the following twelve month. Given that Nvidia’s market cap is currently around $2.6 trillion, it can be difficult to imagine just how it would certainly provide more substantial gains in the close to term. But there are numerous factors for positive outlook.

The exact same stimulant that has actually sent out Nvidia supply rising will certainly not just remain in area for the following numerous years, yet need to reinforce substantially in time. In numerous means, the tale of Nvidia is still quite in its very early innings. That’s due to the fact that the business’s largest resource of development is the fast surge of AI technologies that rely upon its premium graphics refining systems (GPUs) to work.

Gone are the days when Nvidia’s economic circumstance was determined by pc gaming and little usage instances. Today, there’s an arms race for the parts that make it possible for AI research study and technology– and Nvidia’s obtained the items everybody desires.

According to price quotes from BIS Research, the AI market’s investing on semiconductors completed around $15 billion in 2014. But investing has actually currently gotten considerably in 2024, giving a tailwind that has actually greater than increased Nvidia’s incomes over the previous twelve month.

BIS Research anticipates that investing to raise by virtually 32% over the following numerous years, with plenty even more development anticipated past that. Nvidia has actually an approximated 90% market share in AI GPUs, placing it to catch the lion’s share of this long-lasting development fad. Nvidia need to additionally straight take advantage of the surge of crypto, as it particularly develops a lot of its GPUs for cryptocurrency mining.

What’s the one classification that could surpass the whole worth of the crypto market? AI. And because sector, Nvidia is the supply to bank on.

Diversify your profile with this fintech

Nvidia’s market cap will likely stop it from climbing by one more 1,000% anytime quickly. But there’s one fintech supply that has the possible to do so: Nu Holdings ( NYSE: NU)

Most capitalists have actually never ever come across Nu, despite the fact that it has a market cap of virtually $70 billion. That’s due to the fact that the financial institution runs specifically in Latin America, and the only means to access its solutions is by means of smart devices. Its approach overthrew Latin America’s financial market a years back. Instead of structure and running expensive physical branches, Nu supplied its solutions straight to customers online. This reduced prices, permitting it to contend boldy on rate and offerings.

Moreover, it permits Nu to introduce faster than the competitors. When the business introduced its Nu Cripto system– a solution that permits individuals to get, market, and negotiate in numerous cryptocurrencies– it obtained 1 million individuals in an issue of months. Innovations similar to this assistance discuss just how Nu has actually gone from basically absolutely no consumers a years back to greater than 100 million today.

But Nu is much from done expanding. There are greater than 650 million individuals in Latin America, and Nu has actually shown its capacity to permeate markets rapidly. More than fifty percent of all Brazilian grownups are currently Nu consumers, and Nu has actually been duplicating its playbook in brand-new markets like Mexico and Colombia.

Analysts anticipate sales development to be around 44% this year, adhered to by one more 30% in 2025, and there’s a great chance that Nu will certainly keep double-digit percent development prices with the following years and past. This is a long-lasting tale, yet Nu has the possible to match or go beyond the efficiency of many significant cryptocurrencies.

Should you spend $1,000 in Nvidia today?

Before you get supply in Nvidia, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to get currently … and Nvidia had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $630,099! *

Stock Advisor supplies capitalists with an easy-to-follow plan for success, consisting of assistance on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since September 3, 2024

Ryan Vanzo has no placement in any one of the supplies pointed out. The Motley Fool has settings in and suggestsNvidia The Motley Fool suggestsNu Holdings The Motley Fool has a disclosure policy.

2 Tech Stocks With More Potential Than Any Cryptocurrency was initially released by The Motley Fool