In the globe of financing, 10 years is the blink of an eye. Want evidence? Take a close consider the table listed below:

|

Company |

2014 Market Cap (in billions) |

2024 Market Cap (in billions) |

|---|---|---|

|

IBM |

$ 182 |

$ 178 |

|

Nvidia |

$ 10 |

$ 2,965 |

In August 2014, IBM‘s market cap was approximately 18 times bigger than Nvidia‘s ( NASDAQ: NVDA) But oh, exactly how the tables have actually transformed. Today, Nvidia flaunts a market cap of regarding $3 trillion– approximately 17 times bigger than IBM.

So, expecting the following 10 years, what are the business that could exceed Apple‘s huge market cap? Here are 2 that might draw it off.

Microsoft

If a firm is mosting likely to exceed Apple over the following years, it will certainly require a big market cap. Even thinking Apple’s market cap holds constant, that would certainly indicate a firm would certainly require to get to a market cap of $3.4 trillion to capture Apple.

That’s an extremely uphill struggle, and there are just numerous business that might do it. Microsoft ( NASDAQ: MSFT) is among them.

For beginners, Microsoft currently has a market cap of $3.1 trillion since this writing As just recently as June, Microsoft did have a market cap bigger thanApple What’s extra, Microsoft holds a couple of affordable benefits that should, gradually, assist the firm’s market cap convenience pastApple

First, Microsoft has a much more varied organization. The firm has its hands in cloud computer, video gaming, advertising and marketing, equipment, software application, social networking, and expert system (AI). In short, Microsoft has several paths to success. Apple, on the various other hand, has actually typically taken advantage of its superb equipment development. And while Apple solutions and AI might enhance the firm’s earnings, flagging apple iphone sales might provide a genuine obstacle to Apple over the following years.

In my publication, that indicates a benefit forMicrosoft

Nvidia

I havereservations about Nvidia right now Its overpriced evaluation makes it at risk to a horrible modification if the firm’s sales reveal any type of indicators of slowing down. That claimed, this write-up has to do with what might occur over the following one decade. And because instance, I assume Nvidia is well placed to exceed Apple.

That’s since Nvidia’s core organization– making the graphics refining systems (GPUs) that perseverance advanced AI systems for the following years– gets on a lasting development trajectory that Apple just can not match.

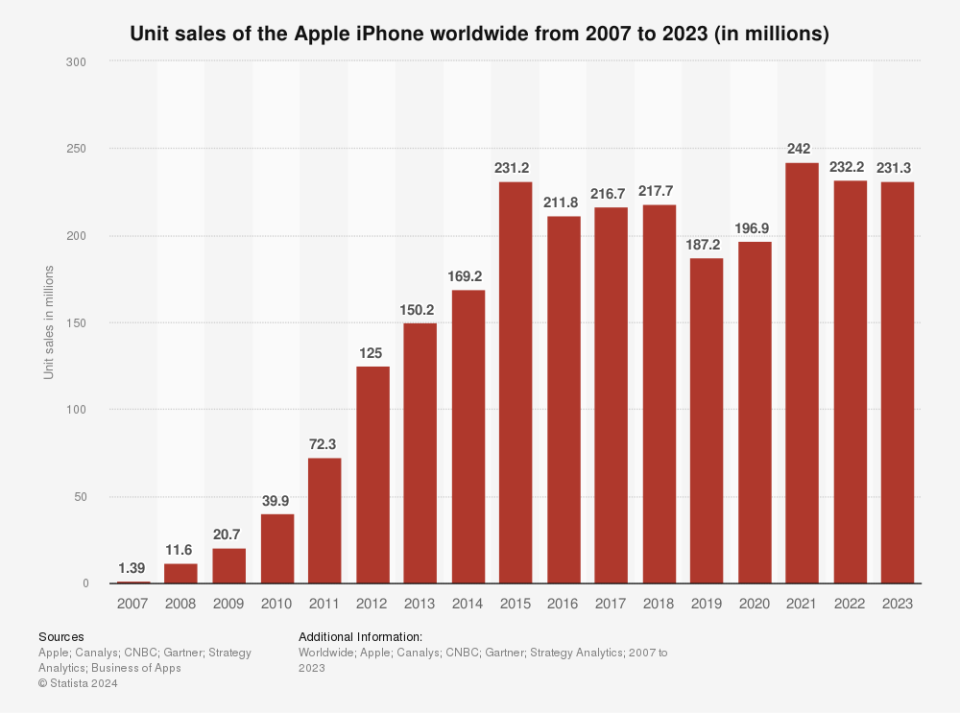

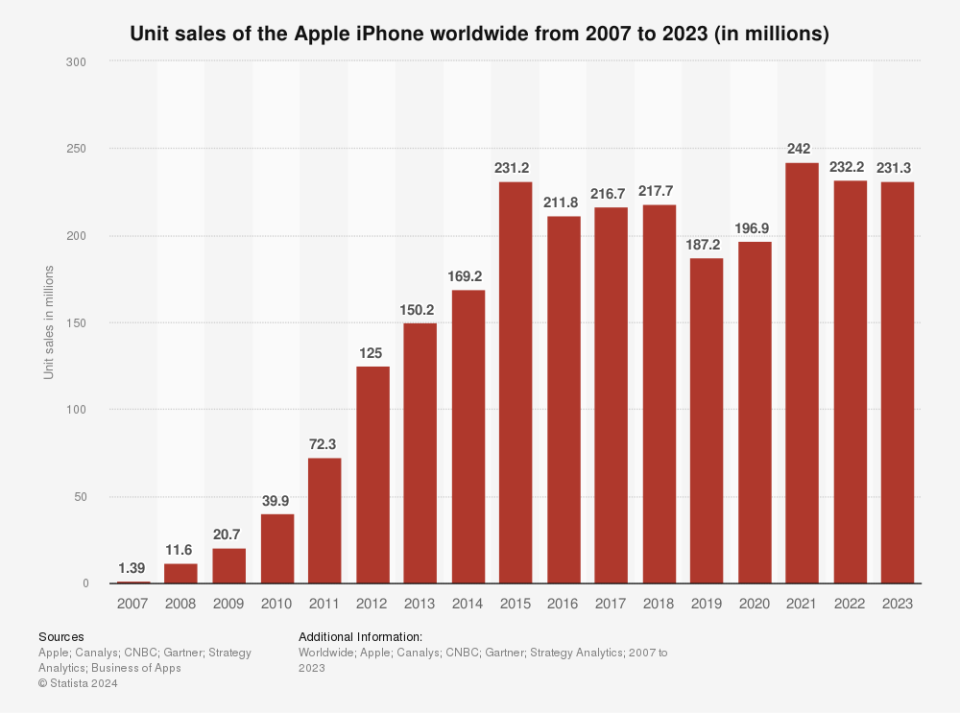

Sales of Apple’s trademark item– the apple iphone– expanded yearly in between 2007 and 2015, yet they have actually been level ever since.

Nvidia, on the various other hand, is still expanding. Over the last 2 years, the firm has actually tripled its earnings as GPUs have actually marketed like pancakes. That development isn’t most likely to slow-moving in the following couple of years. Most experts anticipate Nvidia’s sales to increase once more to around $160 billion by 2026.

Sure, there are most likely to be some bumps in the roadway as the rivals take some market share from Nvidia in the heated AI chips market. But also if Nvidia’s sales development slows down, it might quickly shut the $500 billion market cap distinction in between it and Apple over the following years.

Should you spend $1,000 in Microsoft today?

Before you get supply in Microsoft, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for financiers to get currently … and Microsoft had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $758,227! *

Stock Advisor supplies financiers with an easy-to-follow plan for success, consisting of support on developing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since August 22, 2024

Jake Lerch has settings in International Business Machines andNvidia The Motley Fool has settings in and suggests Apple, Microsoft, andNvidia The Motley Fool suggests International Business Machines and suggests the adhering to alternatives: lengthy January 2026 $395 get in touch with Microsoft and brief January 2026 $405 get in touch withMicrosoft The Motley Fool has a disclosure policy.

Prediction: 2 Stocks That’ll Be Worth More Than Apple 10 Years From Now was initially released by The Motley Fool

&w=100&resize=100,70&ssl=1)