Many business have actually seen an incredible rise in their share costs over the previous number of years many thanks to the expanding fostering of expert system (AI), which is not shocking as this innovation has actually developed large need for both software and hardware.

The excellent component is that AI is presently in its very early stages of development. IDC approximates that worldwide AI investing might boost at a yearly price of 29% over the following 5 years, striking $632 billion in worth in 2028.

This durable rise in the fostering of AI might aid make business like Nvidia ( NASDAQ: NVDA) and Snowflake ( NYSE: SNOW) make an allegorical step, which describes the fast increase in the supply rate of a firm quickly (similar to the ideal side of an allegorical contour).

Nvidia supply has actually currently acquired profoundly in the previous number of years many thanks to its introducing duty in the AI equipment market, yet Snowflake has actually headed southern as a result of its slowing down development. More particularly, Snowflake supply is down over 42% in 2024, while Nvidia has actually leapt 152%.

Let’s take a look at the reasons that AI might aid among these names make an allegorical dive and head also greater while additionally permitting the beaten-down Snowflake to climb swiftly.

Nvidia’s brand-new Blackwell chips might sustain its rally

The durable need for Nvidia’s information facility graphics refining devices (GPUs) based upon the Hopper design has actually played a crucial duty in the firm’s exceptional development in current quarters. Demand for its H100 Hopper AI GPUs was so strong that the chip apparently regulated a waiting duration of as lengthy as a year.

The firm adhered to up this chip with the extra effective H200 cpu, whose manufacturing ramp and deliveries began in the previous quarter.

Nvidia mentions that the deliveries of its Hopper- based GPUs will increase in the second half of the existing many thanks to boosted supply and accessibility, recommending that the H200 might remain to generate extra company for the firm. However, all eyes are established on Nvidia’s future generation of AI chips based upon the Blackwell system.

The firm began tasting the Blackwell cpus to consumers last quarter. Nvidia claims that the manufacturing ramp of the Blackwell chips will certainly start in the 4th quarter of the . More notably, Nvidia declares that the “demand for Blackwell platforms is well above supply, and we expect this to continue into next year.”

Additionally, CHIEF EXECUTIVE OFFICER Jensen Huang lately informed CNBC that Blackwell is observing “insane” need. That’s not shocking as the firm has actually currently aligned numerous consumers that consist of the similarity Microsoft, OpenAI, Meta Platforms, and others for this chip that’s apparently mosting likely to supply a 4 times enter efficiency over the Hopper chips.

Morgan Stanley approximates that Nvidia might market $200 billion well worth of Blackwell- based web server systems following year. While that appears like an enthusiastic target, the speed at which Nvidia’s information facility income is expanding recommends that it might without a doubt strike that mark. More particularly, Nvidia’s information facility income has greater than tripled in the initial 6 months of financial 2025 to $49 billion from $14.6 billion in the exact same duration in 2015.

The existing run price recommends that Nvidia might finish the year with $98 billion in information facility income. That would certainly be greater than increase its financial 2024 information facility income of $47.5 billion. Morgan Stanley’s projection recommends that Nvidia might have the ability to increase its information facility income once more in the following . If that’s without a doubt the instance, the semiconductor titan’s leading line might land well in advance of the $178 billion income that experts are getting out of the firm next .

That might reignite Nvidia’s stupendous rally once more adhering to a level efficiency in the previous 3 months and might also aid the supply take place an allegorical run.

AI is assisting Snowflake construct a strong income pipe

Snowflake is a cloud-based information system service provider on which consumers save and combine information to make sure that they can obtain understandings utilizing that information, construct applications, and also share that information. And currently, Snowflake is including AI-focused capacities to its information shadow system.

The firm has actually been renting out GPUs to make sure that it can “fulfill customer demand for our newer product features,” recommending that Snowflake’s AI offerings are collecting energy. Snowflake allows its consumers to create AI applications utilizing large language models (LLMs) and release those versions within the safe and secure atmosphere of its information shadow system.

Snowflake consumers can construct custom-made chatbots, utilize the firm’s Copilot function to accelerate their jobs and essence information from papers, to name a few points. Snowflake administration explained on the August profits teleconference that greater than 2,500 consumers were utilizing its AI offerings in its financial 2025’s 2nd quarter (finished July 31).

It deserves keeping in mind that Snowflake finished the quarter with simply over 10,000 consumers, showing that it is well-placed to upsell its AI solutions to a huge client base. The excellent component is that the expanding fostering of its AI devices is bring about boosted investing by existing consumers.

The firm’s internet income retention price stood at 127% in financial Q2, a statistics that contrasts the investing by its consumers at the end of a certain duration to the investing by the exact same client base in the year-ago duration. So, an internet income retention price of greater than 100% suggests that it is winning a larger share of consumers’ pocketbooks.

Even much better, the high quality of Snowflake’s client base appears to be boosting also. This appears from the reality that the variety of consumers that have actually created greater than $1 million in item income for the firm boosted by 28% year over year to 510 in the previous quarter, as contrasted to the 21% development in the total client base.

This mix of greater investing by its existing consumers along with the enhancement of brand-new consumers describes why Snowflake’s staying efficiency commitments (RPO) soared an exceptional 48% year over year last quarter to $5.2 billion. That went beyond the 30% year-over-year development in the firm’s item income.

As RPO describes the complete worth of a firm’s future agreements that are yet to be met, the faster development in this statistics as contrasted to its income development recommends that Snowflake’s income development is most likely to speed up in the future. Of training course, the financial investments that the firm is making are evaluating on its margins, with its non-GAAP (modified) operating margin going down to 5% last quarter from 8% in the year-ago duration.

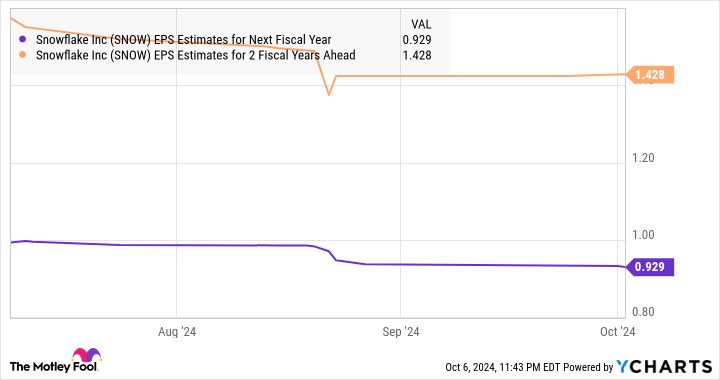

That’s why experts are anticipating Snowflake’s profits to diminish to $0.61 per share in financial 2025 from $0.98 per share in the previous year. However, it is anticipated to go back to fantastic fundamental development from the following .

As such, capitalists need to think about acquiring Snowflake supply while it is down, as the introduction of AI and the velocity in its development many thanks to the fostering of this innovation might send out the supply flying.

Should you spend $1,000 in Nvidia now?

Before you get supply in Nvidia, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to get currently … and Nvidia had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $814,364! *

Stock Advisor offers capitalists with an easy-to-follow plan for success, consisting of support on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since October 7, 2024

Randi Zuckerberg, a previous supervisor of market advancement and spokesperson for Facebook and sibling to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. Harsh Chauhan has no placement in any one of the supplies stated. The Motley Fool has placements in and suggests Meta Platforms, Microsoft, Nvidia, andSnowflake The Motley Fool suggests the adhering to choices: lengthy January 2026 $395 get in touch with Microsoft and brief January 2026 $405 get in touch withMicrosoft The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was initially released by The Motley Fool