Technology supplies shed several of their radiance on the marketplace as increased assumptions concerning the expansion of expert system (AI) innovation placed business in this industry under stress to provide outsized development each quarter.

Shares of Nvidia, for example, retreated over the previous number of weeks regardless of the GPU leader providing better-than-expected quarterly outcomes and assistance that went beyond Wall Street’s quotes. However, a better consider the leads of the AI market shows that the technology industry’s slide might not last for long. After all, Bloomberg anticipates the generative AI market to create $1.3 trillion in yearly profits in 2032, with a compound yearly development price of 42% via completion of that duration.

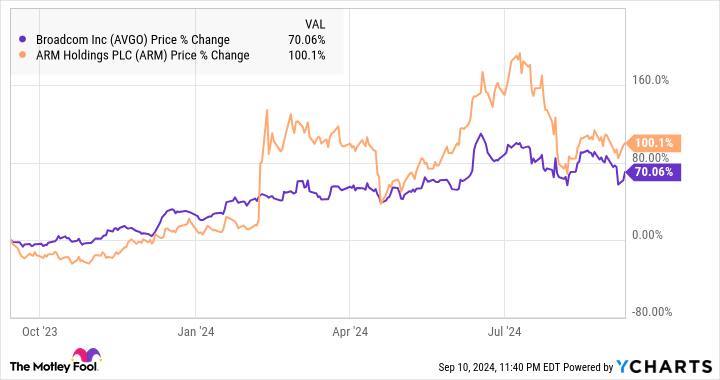

So, it will not be shocking to see AI stocks come back right into the great enhances of financiers quickly, as they can remain to provide healthy and balanced development for a very long time. That’s why it would certainly be an excellent concept for financiers to purchase shares of Broadcom ( NASDAQ: AVGO) and Arm Holdings ( NASDAQ: ARM), both of which have actually drawn back substantially given that the start of July.

Both business are playing main duties in the expansion of AI. More notably, their outcomes make it clear that AI is offering their services a good increase. It will not be shocking to see these supplies go allegorical on the back of their enhancing outcomes. In the investing globe, an allegorical step describes a quick increase in the supply rate of a firm quickly– comparable to the appropriate side of an allegorical contour– and both Broadcom and Arm took pleasure in such large rises in the past.

The instance for Broadcom

Broadcom is a varied technology firm that creates different sorts of chips, such as mobile phone connection chips, application-specific incorporated circuits (ASICs), and ethernet buttons, and currently additionally gives business cloud facilities services following its current procurement of VMware. But its semiconductor section stays its biggest resource of profits, generating 56% of its leading line last quarter.

More especially, Broadcom’s semiconductor company produced $7.3 billion in profits in the 3rd quarter of its financial 2024, converting right into a yearly profits run price of near $30 billion. The firm approximates that it will certainly create $12 billion in profits this year from sales of AI chips, recommending that the AI chip market can represent around 40% of its semiconductor profits.

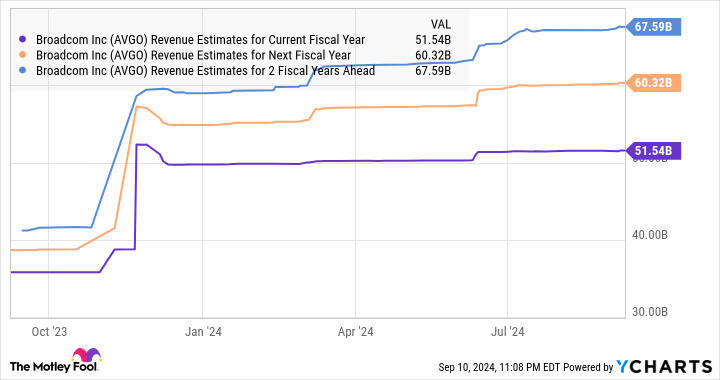

Based on Broadcom’s financial 2024 profits projection of $51.5 billion, AI gets on track to represent 23% of its leading line. But the great component is that Broadcom’s AI company can be at the start of a great development contour. That’s due to the fact that maybe resting on a prospective AI-related profits chance worth $150 billion that it can exchange profits over the following 5 years, according to JPMorgan

The financial investment financial institution explains that the firm’s AI profits can tape-record a substance yearly development price of 30% to 40% throughout that duration. This is possibly one reason experts enhanced their profits development assumptions for Broadcom for the following number of .

However, it would not be shocking to see those assumptions head greater taking into consideration the significant AI-related chance that Broadcom is resting on. Given that, financiers can succeed to make use of the 14% slide in Broadcom supply given that the start ofJuly It is presently trading at 26 times onward profits, and it might not be readily available at such an assessment for long.

2. Arm Holdings

Arm Holdings lost on the marketplace of late, shedding 23% of its worth given that mid-July However, the crucial duty that Arm plays in the worldwide semiconductor market places it in a strong setting to gain from the expansion of AI in several sectors.

The British firm certifies its chip style and styles to chipmakers, which pay it ahead of time licensing charges for using its copyright. Arm additionally obtains nobilities for every single delivery of items which contain chips produced utilizing its style and styles. With the marketplace for AI chips anticipated to clock a yearly development price of greater than 40% via 2032, Arm is resting on a gold development chance.

The firm’s AI-specific chip style is being utilized in applications varying from mobile phones to wise homes to shadow calculating to independent driving. Arm approximates that greater than 100 billion AI-ready chips used its style can be delivered by the end of the following , driven by the development in deliveries of AI tools such as mobile phones and computers.

For contrast, 28.6 billion Arm- based chips were delivered in its financial 2024, which upright March 31. So, Arm’s projection of 100 billion-plus chip deliveries in financial 2025 and 2026 recommends that its top-line development is most likely to speed up substantially. Management’s profits assistance array for its financial 2025 is $3.8 billion to $4.1 billion. If it strikes the omphalos of that array, that would certainly be a top-line dive of 22%.

However, Arm supply rose by 7% onSept 9 adhering to Apple‘s launch of the apple iphone 16. That’s due to the fact that Apple apparently utilized the British firm’s AI-focused Arm v9 style to develop the cpu powering the brand-new mobile phone design. Arm administration declares that the Arm v9 style regulates two times the nobilities of its previous Arm v8 style, so apple iphone 16 sales can drive some severe development for it.

Apple’s apple iphone deliveries are anticipated to expand at a durable speed when the brand-new versions appear, as they can sustaining generative AI functions on-device. As such, there is a likelihood that Arm can provide faster development than it is presently anticipating this year, and more powerful development in the future also.

Given all that, the opportunity of Arm supply making an allegorical step can not be eliminated. That’s why financiers must take into consideration acting promptly and capitalizing on the current dip in the firm’s share rate.

Should you spend $1,000 in Broadcom now?

Before you purchase supply in Broadcom, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for financiers to purchase currently … and Broadcom had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $716,375! *

Stock Advisor gives financiers with an easy-to-follow plan for success, consisting of assistance on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

*Stock Advisor returns since September 9, 2024

JPMorgan Chase is an advertising and marketing companion of The Ascent, a Motley Fool firm. Harsh Chauhan has no setting in any one of the supplies discussed. The Motley Fool has settings in and suggests Apple, JPMorgan Chase, andNvidia The Motley Fool suggestsBroadcom The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was initially released by The Motley Fool