Energy Transfer ( NYSE: ET) is providing financiers an ultra-high 8% circulation return. Enterprise Products Partners ( NYSE: EPD) has a return of 7.2%. Although both come from the midstream power field, they are not compatible financial investments. Here’s why lower-yielding Enterprise deserves acquiring hand over clenched fist and most will possibly be much better off preventing Energy Transfer.

The issue with Energy Transfer

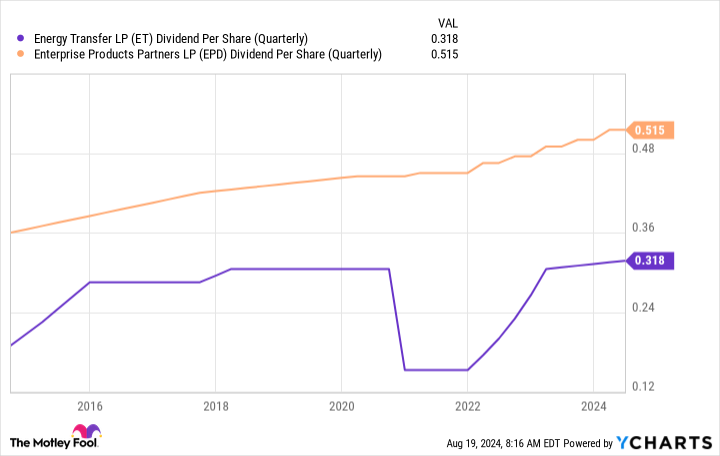

When power rates dove early in the coronavirus pandemic, Energy Transfer reduced its circulation 50%. That 2020 circulation cut was, possibly, warranted by the unpredictability the globe encountered at the time, yet it definitely was not the circulation result the financiers were expecting. And while the master limited partnership‘s (MLP) circulation has actually begun to climb once again and is really more than it was prior to the cut, financiers that appreciate earnings uniformity should not overlook the option that administration made in 2020. It opens the extremely genuine danger that the following power sector recession will certainly cause the exact same result.

Still, a circulation cut in the face of power sector misfortune is reasonable. What’s more challenging to discuss with Energy Transfer is the unsuccessful 2016 contract to acquireWilliams Companies Energy Transfer launched the bargain, yet a power recession led to the MLP obtaining cool feet. Energy Transfer after that functioned to scuttle the bargain, declaring that consummating it would certainly call for taking on as well much financial debt, reducing the reward, or both. The initiative to leave the contract consisted of providing exchangeable protections, which is where the genuine issue can be found in.

The chief executive officer got a big section of the exchangeable protections at the time. The protection would certainly have efficiently shielded the chief executive officer from the effect of a returns cut if the bargain underwent as prepared while leaving unitholders to really feel the complete burden of a cut. It was a complicated affair, yet that’s a high-level, and upsetting, sight. That CHIEF EXECUTIVE OFFICER, Kelcy Warren, is currently “just” the chairman of the board, so there’s still excellent factor to be bothered with what took place virtually a years back.

Overall, if you are searching for a dependable earnings stream, Energy Transfer is possibly not the area to look.

Enterprise Products Partners remains to place unitholders initially

Enterprise Products Partners is an additional huge North American midstream MLP. But it does not have the exact same circulation downsides hanging over it. For beginners, it’s boosted its circulation yearly for 26 successive years. Secondly, it has actually handled to make normal procurements without turning to hostile techniques in an initiative to finish a purchase prior to it has actually been finished.

But what’s fascinating right here is that Enterprise isn’t unsusceptible to the effect of power slumps. While its organization is greatly fee-based, 2016 was a reasonably challenging year, therefore was 2020. The organization kept downing along regardless of short-term weak point, and the circulation was elevated regardless of that weak point. A vital aspect there is the conventional nature of Enterprise’s administration, with the circulation backed by an investment-grade annual report and a solid circulation protection proportion (presently distributable capital covers the circulation by 1.7 times).

There’s additionally a lengthy background of unitholder-friendly choices to think about. For instance, in 2002 Enterprise minimized its motivation circulation civil liberties by 50%, liberating a lot more cash money to pay unitholders at the expenditure of the basic companion. In 2007, administration slowed down circulation development so it can spend a lot more greatly in organization growth to raise long-lasting returns. In 2011, the MLP removed motivation circulations and got its basic companion, efficiently coming to be an independent entity. And in 2018 Enterprise functioned to end up being a self-funding organization so it would not need to provide as numerous dilutive systems in the future.

Stick to the one you can rely on

It isn’t an interesting financial investment, yet Enterprise has actually plainly kept an eye out for unitholders in such a way that Energy Transfer hasn’t. If you are attempting to live off of the earnings your profile creates, trusted Enterprise, regardless of a somewhat reduced return, is most likely to be the much better alternative than Energy Transfer over the long run.

Should you spend $1,000 in Energy Transfer now?

Before you acquire supply in Energy Transfer, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 best stocks for financiers to acquire currently … and Energy Transfer had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $792,725! *

Stock Advisor offers financiers with an easy-to-follow plan for success, consisting of assistance on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since August 26, 2024

Reuben Gregg Brewer has no setting in any one of the supplies pointed out. The Motley Fool advisesEnterprise Products Partners The Motley Fool has a disclosure policy.

1 Ultra-High-Yield Energy Stock to Buy Hand Over Fist and 1 to Avoid was initially released by The Motley Fool