It had not been lengthy ago that almost every electrical car (EV) supply was skyrocketing in worth. In 2021, as an example, market buzz went to a high temperature pitch. Several EV business– consisting of Rivian Automotive and Lucid Group— debuted on the general public markets with fantastic excitement, while standard car manufacturers were flaunting concerning strategies to strongly increase their EV schedules.

A great deal has actually altered ever since. And after a high market sell-off, it’s time to go deal buying. One renowned EV supply specifically must be catching your focus today.

Is this renowned EV supply lastly a deal?

Tesla ( NASDAQ: TSLA), the car manufacturer led by the debatable Elon Musk, took the marketplace by tornado a years back. It’s considered given by some today, yet it needed to verify to a cynical customer base that EVs can be gorgeous, reputable, and downright enjoyable.

Its multibillion-dollar financial investments right into its billing network, at the same time, stimulated international need for a car group that, a minimum of at the time, still had a greater overall possession expense than standard internal-combustion choices.

Tesla’s very early moving company benefit provided it a solid grip in a sector that had structurally underinvested in its EV schedules. It had the employees, resources, follower base, and making abilities to scale up manufacturing quickly equally as EV need began to remove. From 2018 to 2022, for example, sales expanded by an impressive 357%.

But after that an interested point took place. EV sales in the united state remained to climb up, yet slower than anticipated. This placed a massive damage in the costs appraisals the marketplace had actually previously designated to EV supplies.

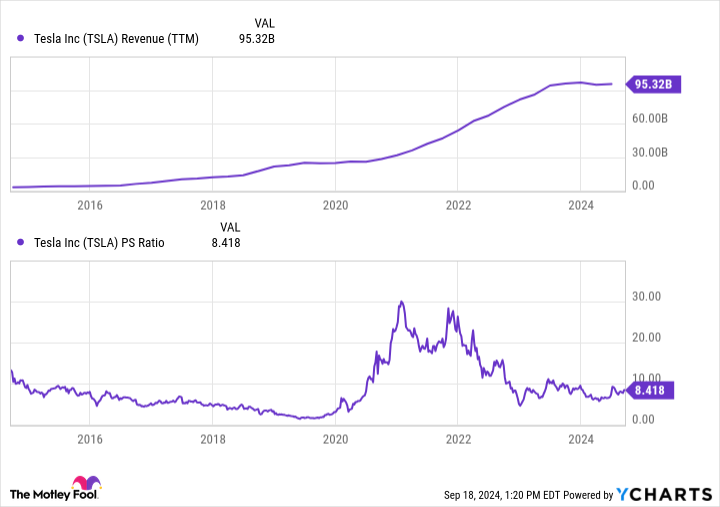

From 2022 to 2024, as an example, Tesla’s assessment dropped from almost 30 times sales to under 10 times sales– a two-thirds decrease over 24 months. Other EV manufacturers like Rivian and Lucid saw comparable assessment decreases.

More lately, Tesla’s income base has not just squashed, yet has likewise decreased in specific quarters. To be reasonable, the supply is still fairly costly at 8.4 times sales. But if you have actually been waiting to acquire right into this renowned EV supply, this can be your opportunity. One fact specifically needs to obtain you delighted.

Tesla is still the king of EVs

While Tesla is associated with various other organization endeavors, consisting of solar power and battery storage space, greater than 90% of its income base is still bound in its automobile section. Its future will certainly be made or damaged based upon the success of this organization, and a lot of its assessment is connected to its destiny.

It’s essential to remember that it still regulates a leading share of the united state EV market. Various approximates secure it with a 50% to 80% market share.

And need for EVs remains to expand regardless of a decrease in projections. Over the following 5 years, residential EV sales are currently anticipated to expand by greater than 10% every year, with market income for EVs in the united state going beyond $150 billion by 2029.

Globally, EV sales are anticipated to cover $1 trillion by 2029. That’s excellent information taking into consideration Tesla has actually a forecasted 39.4% market share internationally, above the following 8 rivals incorporated.

Put just, the EV market is still Tesla’s to shed. It has even more resources, even more brand-name acknowledgment, and much more making ability than any type of various other rival. And today, numerous standard car manufacturers are drawing back on their EV strategies, possibly enabling the business to keep its leading market setting for several years to find.

We could recall at 2024 as a clear outlier in Tesla’s long-lasting development trajectory. Sales are anticipated to decrease by 8.2% this year. But in 2025, experts are anticipating a rebound, with income leaping by 15.8%.

Is the supply still costly at 8.4 times sales?Absolutely But its long-lasting guarantee continues to be undamaged, and the existing assessment is a loved one deal contrasted to years past.

If you count on EVs long-term, it’s tough not to bank on the existing market leader, also if there are some near-term difficulties when driving in advance. It would certainly be a speculative wager, yet financiers that have actually been considering Tesla for several years while awaiting a pullback needs to think about a little financial investment. If shares remain to decrease, maybe a prime possibility for dollar-cost averaging.

Should you spend $1,000 in Tesla today?

Before you acquire supply in Tesla, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for financiers to acquire currently … and Tesla had not been among them. The 10 supplies that made it can generate beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $710,860! *

Stock Advisor supplies financiers with an easy-to-follow plan for success, consisting of support on developing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since September 16, 2024

Ryan Vanzo has no setting in any one of the supplies pointed out. The Motley Fool has placements in and advisesTesla The Motley Fool has a disclosure policy.

1 No-Brainer Electric Vehicle (EV) Stock to Buy With $200 Right Now was initially released by The Motley Fool

&w=324&resize=324,235&ssl=1)