Normally, capitalists trying to find returns development would not anticipate to locate it in the property investment company (REIT) industry. But in some cases there are treasures that obtain ignored since they do not satisfy the standards. Rexford Industrial Realty ( NYSE: REXR) is simply such a genre-defying supply. Here are 3 reasons that this is one spectacular high-yield returns development supply you’ll wish to think about getting and holding for life.

1. Rexford’s return is appealing

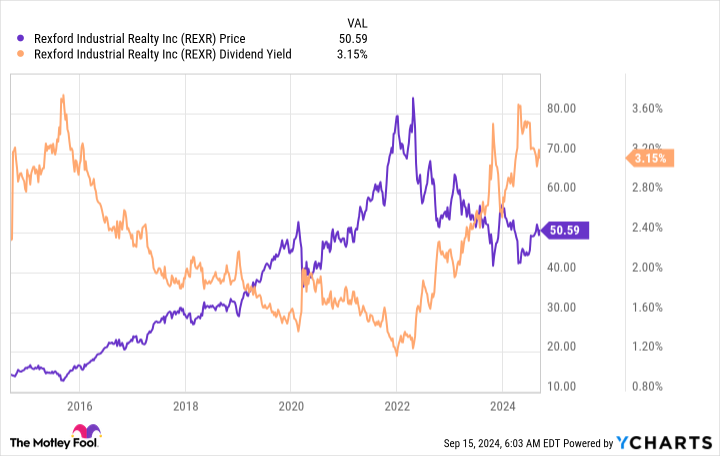

To obtain the problem out initially, Rexford Industrial’s return is a little below par for a REIT. Rexford’s dividend yield is 3.3% while the typical REIT has a return of approximately 3.7%. However, when you contrast Rexford to the more comprehensive market, it looks a lot far better. That 3.3% return is virtually 3 times bigger than the S&P 500 index’s modest 1.2% return.

And, many thanks to a remarkable pullback in Rexford’s supply rate, the returns return is additionally near its highest degree of the years. So you can locate higher-yielding REITs, yet Rexford’s return still looks rather appealing on both an outright basis and about its very own background.

2. Rexford’s returns development is extremely appealing

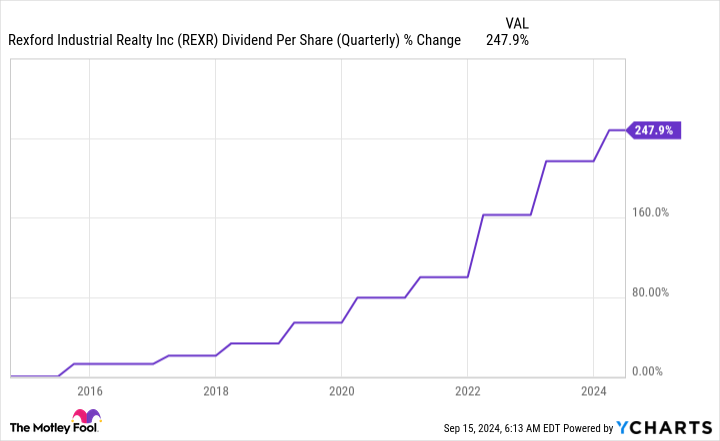

You can not simply check out Rexford Industrial’s return and stop. The REIT’s most outstanding returns fact is the price of returns development it has actually accomplished over the previous years. REITs are usually called slow-moving and constant farmers; a mid-single-digit returns development price is typically thought about rather excellent. Rexford’s returns broadened at an annualized price of 13% over the previous years. That would certainly be a massive number for any kind of business yet is downright remarkable for a REIT.

When you include the returns development to the return, it ends up being clear that Rexford is an extremely appealing development and revenue supply. In truth, over approximately the previous ten years the returns has actually expanded from $0.12 per share per quarter (in 2013) to $0.4175 per share (in 2024). That’s a virtually 250% jump, something that almost any kind of returns financier would certainly value.

3. Rexford’s company design is set apart

Rexford is a commercial REIT, which isn’t especially unique whatsoever. However, it has a special geographical emphasis that establishes it in addition to its peers. Unlike most commercial REITs, which concentrate on diversity, Rexford has actually gone done in on the Southern California market. That’s right– it just buys one area of theUnited States There is a clear danger in this strategy, yet offered the business’s solid returns background, the wager monitoring has actually made is settling.

That’s really not also surprising if you go back and analyze the Southern California market. It is the biggest commercial market in the United States and rates as theNo 4 market around the world. Notably, it is an essential portal for products concerning North America fromAsia Being an important gear in the international supply chain has actually led to high need, with the Southern California area having a substantially reduced job price than the remainder of the nation. Add in supply restrictions, and Rexford has actually had the ability to boost prices on running out leases in current quarters significantly.

Add that tailwind to the REIT’s advancement strategies and procurements, and you obtain a REIT that looks most likely to proceed fulfilling capitalists quite possibly for several years to find.

Dividend development capitalists should purchase Rexford while they can

So why is Rexford’s supply down 40% or two from its perpetuity highs? The response truly comes down to financier belief, which obtained a little bit overheated throughout the coronavirus pandemic as need for stockroom room boosted together with on the internet buying. Although the enjoyment has actually worn away, Rexford’s company remains to carry out well. If you are a reward development financier, you need to think about getting Rexford and hanging on to it for a long time.

Should you spend $1,000 in Rexford Industrial Realty now?

Before you purchase supply in Rexford Industrial Realty, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 best stocks for capitalists to purchase currently … and Rexford Industrial Realty had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $710,860! *

Stock Advisor gives capitalists with an easy-to-follow plan for success, consisting of support on developing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

*Stock Advisor returns since September 16, 2024

Reuben Gregg Brewer has no setting in any one of the supplies pointed out. The Motley Fool has placements in and advises Rexford Industrial Realty and Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.

1 Magnificent High-Yield Dividend Growth Stock Down 40% to Buy and Hold Forever was initially released by The Motley Fool