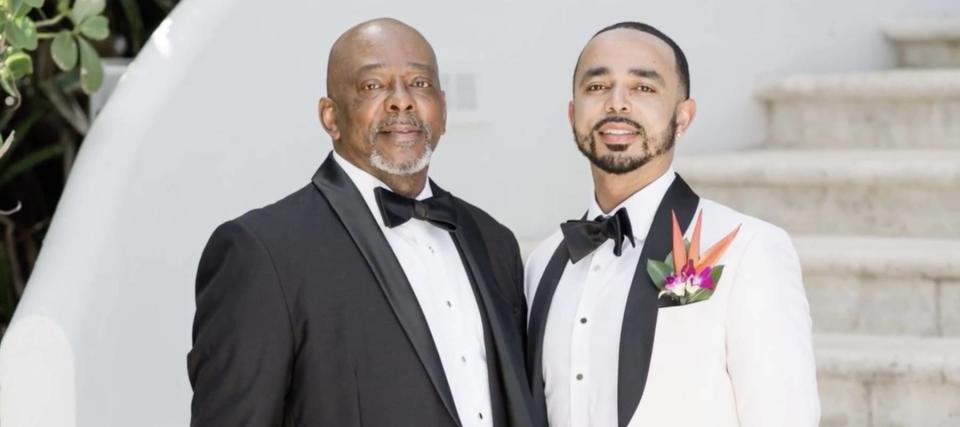

Most couples anticipate stand mixers, flatware, or brand-new sheets as typical wedding celebration presents. But for bride-and-groom Kiana and Aaron Andrews of Prince William County, Virginia, they obtained something a whole lot better.

Just prior to their April wedding celebration, Aaron’s daddy, a constant lotto gamer, acquired a ticket for the Virginia Lottery’s Cash4Life draw– and won. He had the option of either $1,000 weekly for the remainder of his life, or a $1 million round figure payment.

Don’t miss out on

-

Commercial realty has actually defeated the stock exchange for 25 years– yet just the extremely abundant might purchase in. Here’s exactly how also normal capitalists can end up being the proprietor of Walmart, Whole Foods or Kroger

-

Car insurance policy costs in America are via the roof covering– and just becoming worse. But 5 mins might have you paying just $29/month

-

These 5 magic cash relocations will certainly improve you up America’s web worth ladder in 2024– and you can finish each action within mins. Here’s exactly how

But as opposed to squandering the ticket, Aaron’s daddy determined to offer the winning ticket to his boy as a wedding event present. His father amusingly informed Fox 5, “This was the best way to get him out of my basement.”

Prior to obtaining the ticket, Aaron and Kiana had actually made a decision to relocate with Aaron’s daddy to aid them conserve cash. But currently, with the assistance of a monetary advisor, they have actually made a decision to take the lump-sum settlement of $1 million, which enables them to assist Aaron’s granny, established university funds for their future kids, and, someday, purchase a home.

“I have a great father who has done nothing but look out for me!” Aaron informed Virginia Lottery authorities as he retrieved the ticket.

Lump amount vs. once a week annuity settlements

After consulting with a monetary advisor, Aaron and Kiana determined to approve the $1 million round figure money payment as opposed to get $1,000 weekly for the remainder of their lives. There are numerous advantages of taking the round figure.

The $1,000-a-week settlement just lasts as lengthy as Aaron lives. If he takes place to pass away at a young age, for instance, the payments would certainly stop and could not be handed down to his beneficiaries. However, taking the money payment implies he has accessibility to the funds currently.

It’s additionally worth taking into consideration that, while $1,000 a week seems like a whole lot, the worth of that cash will certainly transform in time as a result of rising cost of living.

Additionally, if he took the $1,000-a-week settlement, Aaron would certainly require to live around an additional 19.23 years to get $1 million bucks– and he would certainly lose out on substance rate of interest in the meanwhile.

Of training course, there are tax obligation ramifications for the round figure choice. Taking the $1 million payment will certainly press Aaron right into a greater tax obligation brace, yet it additionally enables him to gain access to and spend the funds currently. Let’s consider what would certainly occur if Aaron spent that cash.

The ordinary yearly return of the S&P 500 is approximately 10% over twenty years. If Aaron spent his $1 million payment and gained a typical price of return, that $1 million would certainly deserve $5.7 million in the twenty years it would certainly take the $1,000 settlements to get to $1 million.

That being stated, Aaron will not have the complete $1 million to spend as a result of tax obligations. But also if he pays, allow’s state, fifty percent of the lotto payouts to the taxman, he would certainly still have $2.8 million after twenty years at a typical price of return.

By taking the round figure, Aaron can spend the cash, which might additionally secure it from rising cost of living.

For instance, acquiring a deposit slip (CD) or placing it in a high-yield interest-bearing account will certainly gain a typical 4% or somewhat much more, relying on which banks he selects.

Read much more: Car insurance policy prices have actually surged in the United States to a magnificent $2,150/ year– yet you can be smarter than that. Here’s exactly how you can conserve on your own as long as $820 yearly in mins (it’s 100% totally free)

How to take care of a monetary windfall

A huge increase of money, whether it’s from an inheritance, lotto payouts, or a few other resource, can be an interesting and demanding scenario. Planning your following actions very carefully will guarantee you construct lasting monetary wide range.

First, do not make any type of big acquisitions as soon as possible. Give on your own time to obtain made use of to the concept of having an increase of cash, and afterwards talk to a relied on monetary advisor. They can examine your individual scenario and deal advice. They’ll additionally consider your existing financial debts (if any type of) and aid you establish practical monetary objectives.

If you can aid it, prevent informing friends and family concerning the windfall. Many individuals that experience a money windfall uncover that family and friends are greater than delighted to aid them invest it.

Finally, take into consideration establishing a count on fund. This can aid secure your possessions from lawful difficulties and make it less complicated to disburse them upon your fatality.

Trusts can additionally have actually established dispersal regulations; for instance, they might just enable you to take out a collection quantity annually. This implies you will not be attracted to spend too much and can take advantage of your funds– and your lasting monetary objectives.

What to review following

This short article supplies info just and ought to not be understood as guidance. It is offered without guarantee of any type of kind.

&w=100&resize=100,70&ssl=1)