The market is up 1.8% over the recently and has actually climbed up 46% in the previous year, with profits anticipated to expand by 17% per year over the following couple of years. In this desirable setting, determining development firms with high expert possession can be especially helpful as it frequently indicates self-confidence from those that understand business best.

Top 10 Growth Companies With High Insider Ownership In India

|

Name |

Insider Ownership |

Earnings Growth |

|

Kirloskar Pneumatic (BSE:505283) |

30.4% |

30.1% |

|

Archean Chemical Industries (NSEI: ACI) |

22.9% |

35% |

|

Happiest Minds Technologies (NSEI: HAPPSTMNDS) |

32.5% |

21.8% |

|

Dixon Technologies (India) (NSEI: DIXON) |

24.6% |

36.6% |

|

Jupiter Wagons (NSEI: JWL) |

10.8% |

27.2% |

|

Paisalo Digital (BSE:532900) |

16.3% |

24.8% |

|

Apollo Hospitals Enterprise (NSEI: APOLLOHOSP) |

10.4% |

32.3% |

|

Rajratan Global Wire (BSE:517522) |

19.8% |

35.8% |

|

KEI Industries (BSE:517569) |

19.1% |

20.4% |

|

Pricol (NSEI: PRICOLLTD) |

25.5% |

24% |

Click below to see the complete checklist of 93 supplies from our Fast Growing Indian Companies With High Insider Ownership screener.

Underneath we offer an option of supplies strained by our display.

Simply Wall St Growth Rating: ★ ★ ★ ★ ★ ★

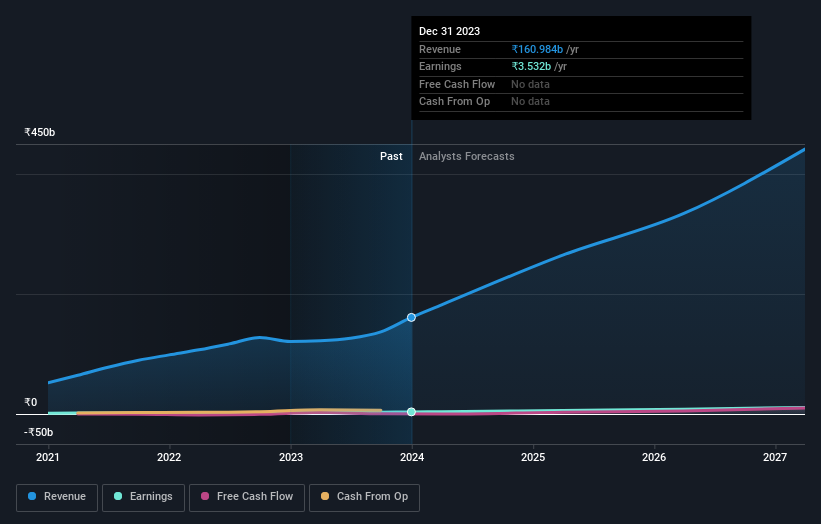

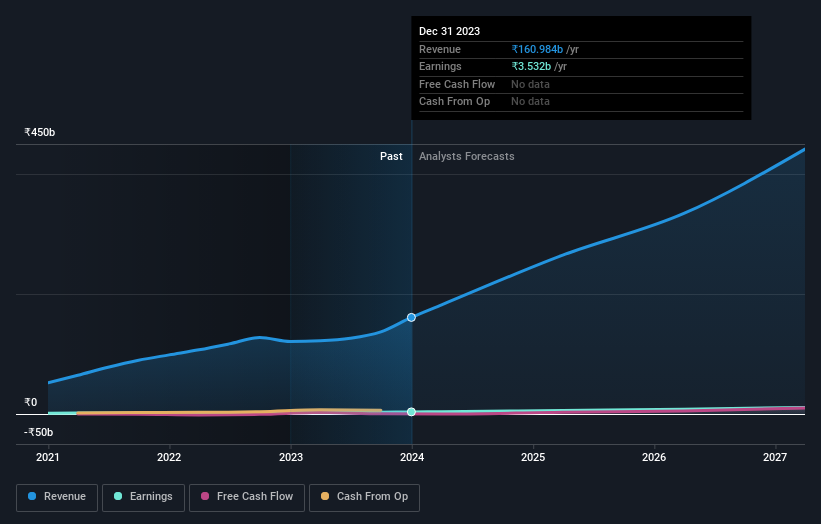

Overview: Dixon Technologies (India) Limited gives digital production solutions in India and has a market cap of 794.06 billion.

Operations: Dixon Technologies (India) Limited’s earnings sectors consist of Home Appliances (12.51 billion), Lighting Products (7.92 billion), Mobile & & EMS Division (143.16 billion), and Consumer Electronics & & Appliances (41.21 billion).

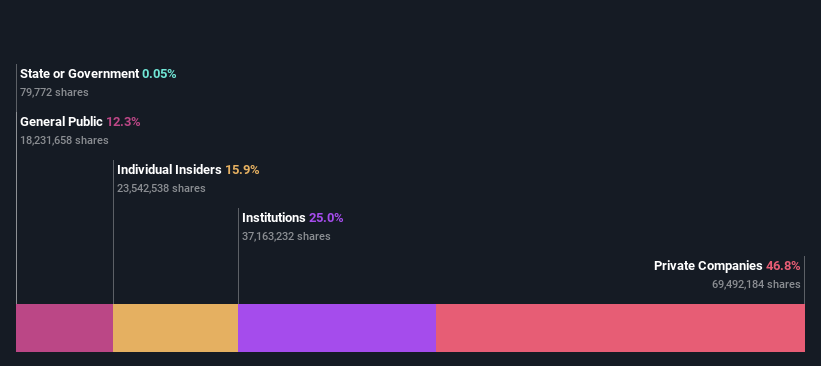

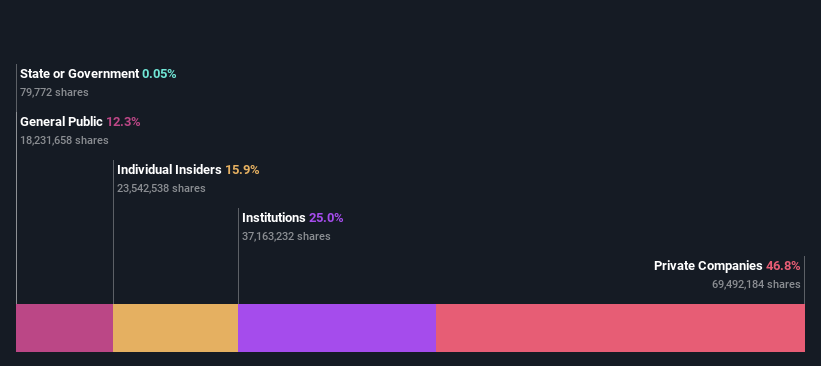

Insider Ownership: 24.6%

Revenue Growth Forecast: 23.6% p.a.

Dixon Technologies (India) displays solid development possibility with anticipated earnings development of 23.6% annually, outmatching the Indian market’s 10%. Its profits are anticipated to expand substantially at 36.6% each year over the following 3 years, exceeding market assumptions. Recent Q1 results revealed significant earnings and take-home pay boosts contrasted to in 2014. The business additionally designatedMr Sunil Ranjhan as Chief Human Resource Officer, improving its management group with his substantial human resources experience throughout APAC areas.

Simply Wall St Growth Rating: ★ ★ ★ ★ ☆ ☆

Overview: Quess Corp Limited is a company companies operating in India, South East Asia, the Middle East, and North America with a market cap of 108.75 billion.

Operations: The business’s earnings sectors consist of Workforce Management (138.44 billion), Operating Asset Management (28.43 billion), Global Technology Solutions omitting Product Led Business (23.87 billion), and Product Led Business (4.29 billion).

Insider Ownership: 15.8%

Revenue Growth Forecast: 13.5% p.a.

Quess Corp Limited reveals appealing development with profits anticipated to expand at 23% each year, outmatching the Indian market’s 17%. Recent Q1 results exposed considerable earnings and take-home pay boosts, with sales getting to 50.03 billion and take-home pay increasing to 1.04 billion. The consultation of Gurmeet Chahal as CHIEF EXECUTIVE OFFICER of Quess Global Technology Solutions highlights a critical concentrate on AI and electronic change, possibly improving future development leads.

Simply Wall St Growth Rating: ★ ★ ★ ★ ★ ☆

Overview: Varun Beverages Limited, with a market cap of 2.06 trillion, runs as the franchisee for PepsiCo’s carbonated sodas and non-carbonated drinks.

Operations: Revenue from the production and sale of drinks totaled up to 180.52 billion.

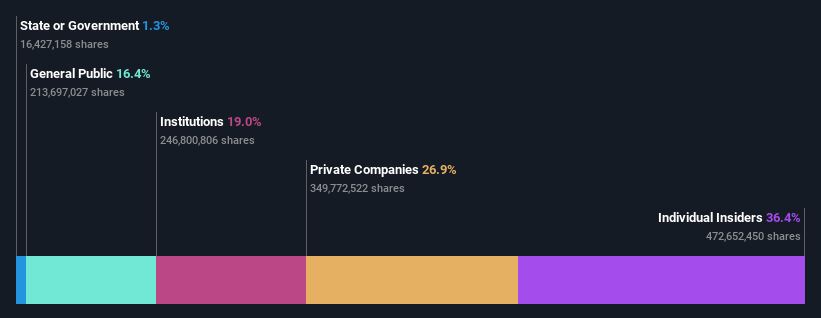

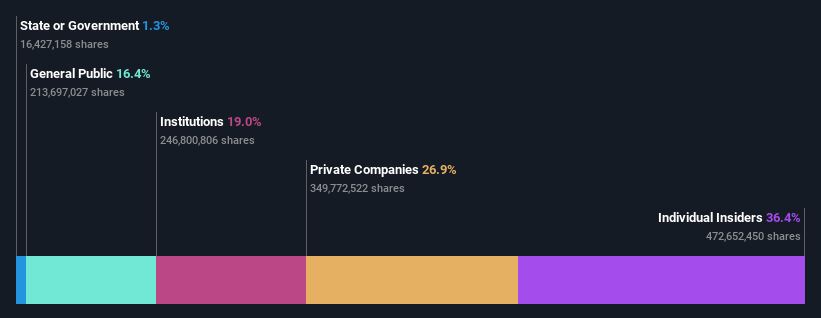

Insider Ownership: 36.3%

Revenue Growth Forecast: 15.4% p.a.

Varun Beverages shows solid development possibility with profits anticipated to expand at 22.27% each year, exceeding the Indian market’s 17%. Recent Q2 results revealed significant earnings and take-home pay boosts, with sales getting to 73.34 billion and take-home pay increasing to 12.53 billion. Despite high financial debt degrees, the business keeps a durable Return on Equity projection of 30.6%. The current reward affirmation and modifications in funding framework additionally show self-confidence in continual development.

Next Steps

Ready For A Different Approach?

This post by Simply Wall St is basic in nature. We supply discourse based upon historic information and expert projections just utilizing an impartial technique and our short articles are not meant to be monetary recommendations. It does not make up a referral to purchase or offer any kind of supply, and does not gauge your goals, or your monetary circumstance. We goal to bring you long-lasting concentrated evaluation driven by essential information. Note that our evaluation might not consider the current price-sensitive business statements or qualitative product. Simply Wall St has no placement in any kind of supplies discussed.The evaluation just thinks about supply straight held by experts. It does not consist of indirectly owned and operated supply with various other automobiles such as company and/or depend on entities. All projection earnings and profits development prices estimated remain in regards to annualised (per year) development prices over 1-3 years.

Companies talked about in this post consist of NSEI: DIXON NSEI: QUESS and NSEI: VBL.

Have responses on this post? Concerned concerning the material? Get in contact with us straight. Alternatively, e-mail editorial-team@simplywallst.com