The S&P 500 ( SNPINDEX: ^ GSPC) is an index of 500 business noted on united state stock market. It’s a respected accomplishment for any kind of firm to be confessed right into the index, and just the first-rate names make it.

Selection goes to the discernment of the Index Committee, yet business have to pay, and they likewise require a market capitalization of at the very least $18 billion. That number climbs with time, since the S&P 500 is weighted by market cap, which implies the biggest business in the index have a higher impact over its efficiency than the tiniest.

As an outcome, modern technology has actually ended up being the biggest field in the index with a weighting of 31.4%. It consists of trillion-dollar titans Microsoft, Apple, and Nvidia.

Meet the S&P 500 Growth index

The S&P 500 Growth index holds around 231 of the best-performing supplies in the routine S&P 500, and omits the remainder. It picks those supplies based upon variables like their energy and the sales development of the underlying business.

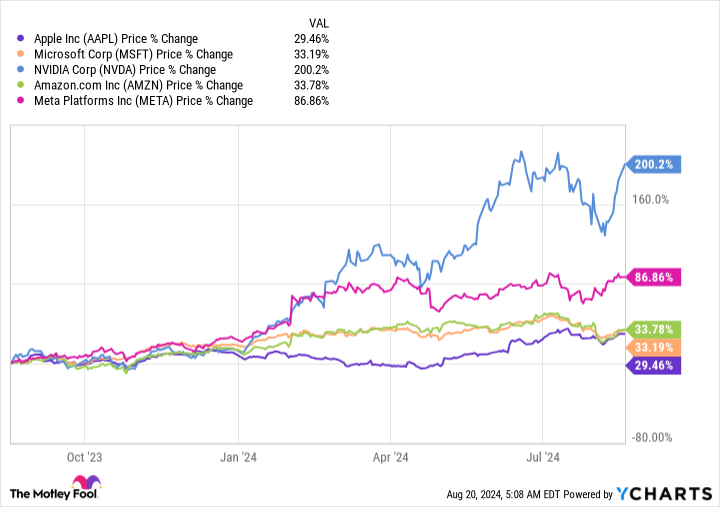

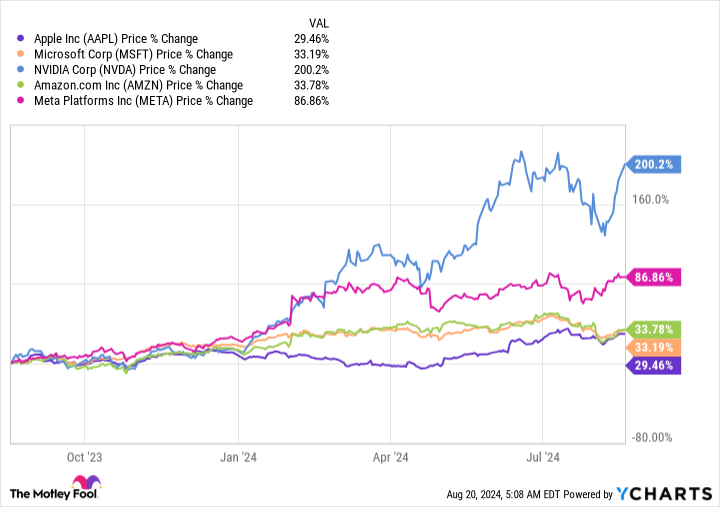

Therefore, it’s not a surprise the technology field has a monstrous 50.2% weighting in the Growth index. Nvidia, for instance, expanded its earnings by 262% year over year throughout its newest quarter, and its supply has actually risen 200% over the previous year alone.

But below’s the most effective component. The Growth index rebalances every quarter, which implies it gets rid of supplies that no more fulfill its requirements for incorporation and changes them with better prospects. As an outcome, this index has actually usually surpassed the routine S&P 500 over the long-term.

The Vanguard S&P 500 Growth ETF tracks the S&P 500 Growth index

The Vanguard S&P 500 Growth ETF ( NYSEMKT: VOOG) is created to track the efficiency of the S&P 500 Growth index by holding the very same supplies and preserving comparable weightings.

The listed below table reveals the leading 5 holdings in the Vanguard ETF, and exactly how their weightings contrast to the routine S&P 500:

|

Stock |

Vanguard ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

12.28% |

6.89% |

|

2. Microsoft |

11.93% |

6.70% |

|

3. Nvidia |

11.04% |

6.20% |

|

4. Amazon |

4.43% |

3.69% |

|

5. Meta Platforms |

4.17% |

2.24% |

Data resource:Vanguard Portfolio weightings are exact since July 31, 2024, and go through transform.

The Vanguard ETF supplied a return of 36.5% over the previous year, pleasantly exceeding the S&P 500, which is up 30.2%:

There were 2 variables at play:

-

The 5 supplies in the above table have actually supplied a typical return of 76.7% over the previous year, and considering that they have a much greater weighting in the Vanguard ETF about the S&P 500, that added to the outperformance of the ETF.

-

As I discussed previously, the Growth index (and by expansion, the Vanguard ETF), just holds the top-performing supplies from the S&P 500 and omits the laggards, which likewise added to the greater return in the ETF.

The Vanguard ETF can outmatch the S&P 500 over the long-term

The Vanguard ETF has actually supplied a substance yearly return of 15.9% considering that it was developed in 2010, defeating the typical yearly gain of 13.7% in the S&P 500 over the very same duration. While that 2.2 percent factor distinction every year does not seem like a lot, it makes a large effect in buck terms many thanks to the results of intensifying:

|

Starting Balance (2010 ) |

Compound Annual Return |

Balance in 2024 |

|---|---|---|

|

$ 10,000 |

15.9% (Vanguard ETF) |

$ 78,916 |

|

$ 10,000 |

13.7% (S&P 500) |

$ 60,345 |

Calculations by writer.

If modern technologies like cloud computer, semiconductors, and expert system remain to drive the technology field ahead, the biggest holdings in the Vanguard ETF are most likely to stay continuous in the coming years. In that situation, I anticipate the ETF will certainly proceed exceeding the S&P 500.

However, also if there is a change in market management, the Growth index will certainly rebalance as essential. Therefore, if the Vanguard ETF does endure a duration of underperformance about the S&P 500, I assume it’s most likely to be really short-term.

Should you spend $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF now?

Before you acquire supply in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 ideal supplies for financiers to acquire currently … and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $792,725! *

Stock Advisor gives financiers with an easy-to-follow plan for success, consisting of support on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

See the 10 supplies “

*Stock Advisor returns since August 22, 2024

Randi Zuckerberg, a previous supervisor of market growth and spokesperson for Facebook and sis to Meta Platforms CHIEF EXECUTIVE OFFICER Mark Zuckerberg, belongs to The Motley Fool’s board of supervisors. John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Anthony Di Pizio has no setting in any one of the supplies discussed. The Motley Fool has settings in and suggests Amazon, Apple, Meta Platforms, Microsoft, andNvidia The Motley Fool suggests the adhering to alternatives: lengthy January 2026 $395 contact Microsoft and brief January 2026 $405 contactMicrosoft The Motley Fool has a disclosure plan.

Prediction: This Unstoppable Vanguard ETF Will Keep Beating the S&P 500 Over the Long Term was initially released by The Motley Fool