Pepsi Carbon Monoxide ( NASDAQ: PEP) is best recognized for its soft drink items and snacking alternatives under the Frito-Lay brand name. It is an effective companion as sellers seek to bring in clients right into their shops. And the business simply obtained a little much better after revealing strategies to acquire Siete Foods for $1.2 billion, although Wall Street hardly discovered the offer. Here’s why the purchase is so vital.

What does Pepsi Carbon Monoxide do?

Pepsi Carbon monoxide’s name would certainly recommend it’s a drink manufacturer, which it is. But it’s a lot even more than that. It is truly a food corporation, with brand names that cover from drinks (Pepsi) to salted treats (Frito-Lay) to jam-packed food (Quaker Oats). And those are simply a few of its famous brand names; it additionally possesses Gatorade, Doritos, Tostitos, Muscle Milk, Smartfood, and Near East, amongst several others. It is a crucial companion to sellers and corner store worldwide.

The business’s range goes over, with a market cap of approximately $230 billion. Revenues in 2023 tallied as much as approximately $91.5 billion. You can discover its brand names in over 200 nations and areas worldwide. Its circulation and advertising and marketing expertise is remarkable and it is quickly among the biggest and most effective customer staples firms on Wall Street.

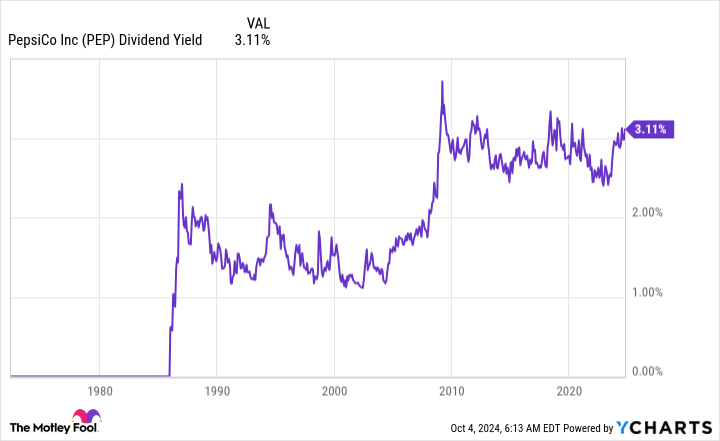

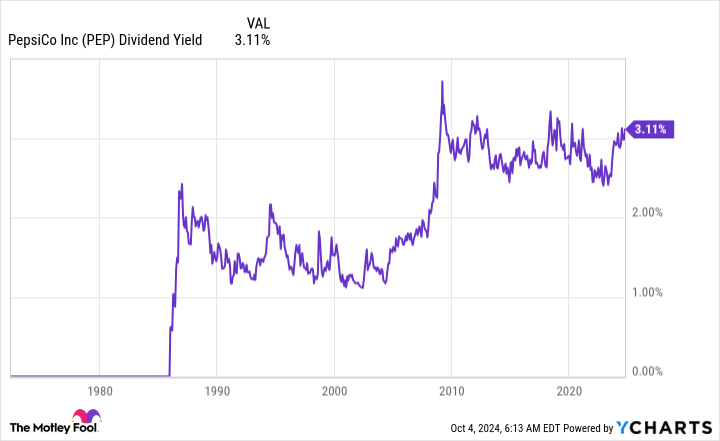

Investors must discover the business extremely appealing generally. But today it additionally looks moderately appealing, assessment smart. Pepsi Carbon monoxide’s price-to-sales, price-to-earnings, price-to-book worth, and price-to-cash circulation proportions are all listed below their five-year standards. The supply’s 3.2% reward return is towards the luxury of its historic return array. The return is additionally especially greater than that of the 2.6% ordinary return of customer staples field, utilizing the Consumer Staples Select Sector SPDR ETF ( NYSEMKT: XLP) as a market proxy. Simply placed, Pepsi Carbon monoxide looks rather valued, otherwise a little low-cost, today.

From a fundamental degree, after that, reward financiers must most likely be taking a look at Pepsi Carbon monoxide, keeping in mind that it has actually boosted its reward yearly for a remarkable 52 successive years. That, for referral, makes it a Dividend King.

What regarding Pepsi Carbon monoxide’s Siete purchase?

With Pepsi Carbon monoxide’s several effective brand names and substantial sales base, it is reasonable that Wall Street really did not obtain delighted regarding its $1.2 billion offer to getSiete Brands The supply has actually primarily gone no place because the offer was introduced. And simply to place a number on this, Siete is approximated to have profits of around $500 million, which is much less than 1% of Pepsi Carbon monoxide’s 2023 profits.

So this is a little purchase that will not truly relocate the needle for Pepsi Co. But it seems wonderfully valued, at around 2.4 times sales, so Pepsi Carbon monoxide isn’t paying too much. And the economically solid business ought to have little issue developing the money to spend forSiete Thus there’s little worry that the offer will certainly result in any type of economic interruption at Pepsi Co. In several means it is sort of a non-event.

But tactically, it is essential. If you take a look at the complete checklist of brand names that Pepsi Carbon monoxide possesses, consisting of several of its biggest and crucial nameplates, it merely really did not produce them all. It purchased them. Gatorade is a terrific instance, as the brand name was the crown gem of Quaker Oats when Pepsi Carbon monoxide purchased that business. It is just one of one of the most leading sporting activities consume alcohol brand names and catapulted Pepsi Carbon monoxide to the head of that item specific niche each time when Pepsi Carbon monoxide’s very own offerings there were doing not have. This isn’t to recommend the Siete is the followingGatorade It isn’t. However, the strategy taken with Gatorade is primarily the very same one that’s being taken with Siete.

There’s overlap in between what Siete creates and what Pepsico makes, most especially in the chip classification. But Siete, a self explained Mexican-American food business, additionally has offerings in the sauce, flavoring, bean, tortilla, taco covering, and sugary foods locations. It assists increase Pepsico’s get to in locations it currently contends and, maybe, also presses the business a little bit additionally right into the hispanic food classification.

Pepsi Carbon monoxide is acquiring a solid, promising brand name that it can make use of to expand its general service. Just connecting Siete right into Pepsi Carbon monoxide’s effective advertising and marketing and circulation systems will likely increase its sales. More significantly, it offers Pepsi Carbon monoxide much more get to in the salted junk food section. Although not a significant sell and of itself, this bolt-on purchase strategy is exactly how Pepsi Carbon monoxide constructed its leading placement and exactly how it preserves it with time.

No huge offer and yet a huge offer

Pepsi Carbon monoxide’s Siete purchase isn’t most likely to quickly relocate the needle for the business, which is why financiers really did not pay all that much interest. But if you believe in years and not days, the offer stands for the winning service strategy that Pepsi Carbon monoxide has actually made use of for years to increase its service– and, equally as vital, to compensate returns financiers well along the road. If you are a reward capitalist, Siete is simply another factor to such as Pepsi Carbon monoxide while its supply seems on the sale shelf.

Don’ t miss this 2nd possibility at a possibly rewarding chance

Ever seem like you failed in acquiring one of the most effective supplies? Then you’ll wish to hear this.

On unusual events, our professional group of experts concerns a “Double Down” supply suggestion for firms that they believe will stand out. If you’re fretted you have actually currently missed your possibility to spend, currently is the very best time to acquire prior to it’s far too late. And the numbers promote themselves:

-

Amazon: if you spent $1,000 when we increased down in 2010, you would certainly have $20,855! *

-

Apple: if you spent $1,000 when we increased down in 2008, you would certainly have $43,423! *

-

Netflix: if you spent $1,000 when we increased down in 2004, you would certainly have $392,297! *

Right currently, we’re providing “Double Down” signals for 3 unbelievable firms, and there might not be an additional possibility such as this anytime quickly.

See 3 “Double Down” supplies “

*Stock Advisor returns since October 7, 2024

Reuben Gregg Brewer has no placement in any one of the supplies stated. The Motley Fool has no placement in any one of the supplies stated. The Motley Fool has a disclosure plan.

Pepsi Carbon monoxide’s $1.2 Billion Siete Purchase: The Underrated Move Shaping Its Future was initially released by The Motley Fool