Semiconductor and AI leader Nvidia ( NVDA) records revenues following Wednesday, August 28 after the marketplace close and financiers are waiting breathless. Nvidia’s amazing efficiency over the previous 2 years is nearly indecipherable, yet the business’s development appears it needs to proceed at this exact same quick speed for many years to find.

Here, we will certainly cover the course Nvidia has actually required to reach its existing placement, what to anticipate from following week’s revenues record and whether it’s feasible for Nvidia to get to a $10 Trillion market capitalization.

The outcomes Nvidia has actually offered its investors with over the last 25 years is absolutely tough to downplay. Over that duration, the supply has actually intensified at a yearly price of 35.4%, producing an excessive 217,000% return. Even much more lately, over simply the last 5 years, NVDA supply has actually intensified at a yearly price of 98.5%, 30xing financier cash over that time.

Image Source: Zacks Investment Research

How Did Nvidia Stock Get Here?

At the midsts of the 2022 bearish market, Nvidia had a market cap of $250 billion; today, it stands at a shocking $3 trillion. The speedy surge is a straight outcome of Nvidia’s tactical concentrate on AI framework via its information facility items. Since the pivot, yearly sales have actually virtually quadrupled to $80 billion, and are anticipated to increase once more by 2026. Even much more excellent is that Nvidia flaunts 53% web margins on that particular earnings.

Fueled by rising need for AI-driven options, Nvidia placed itself at the heart of the AI transformation. Nvidia’s concentrate on tactical collaborations with significant cloud carriers, its proceeded advancement in AI software program (like the CUDA system), and its capacity to anticipate the enormous capacity of generative AI were crucial to the supply’s unmatched rally.

Partnering with fellow technology titans such as Amazon ( AMZN), Microsoft ( MSFT) and Alphabet ( GOOGL) has actually been the key chauffeur of its development. Because Amazon, Microsoft and Alphabet run enormous cloud computer procedures, and much AI advancement will certainly take place in the cloud they have actually raked 10s of billion right into Capex investing. While this is widely valuable to Nvidia, it is likewise great for all 3 significant cloud carriers. It’s a cooperative connection as Amazon, Alphabet and Microsoft include even more power customers to their systems and Nvidia offers them the equipment.

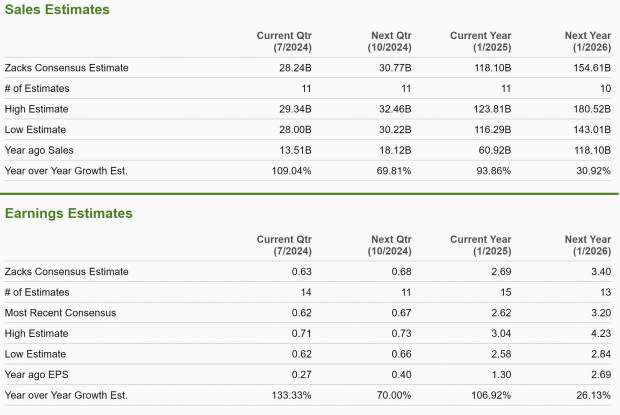

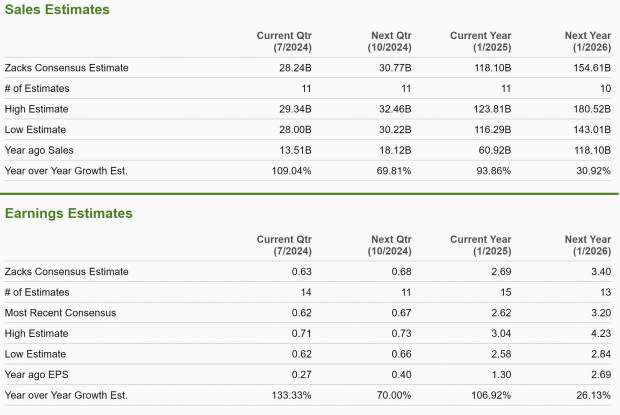

Nvidia Earnings Estimates

If we check out the existing quarter revenues projections, we can take into point of view the extraordinary speed that Nvidia remains to expand both the leading and profits. Sales for the quarter are anticipated to expand 110% year over year (YoY) to $28.2 billion, while revenues are predicted to climb up 133% YoY to $0.63 per share. Looking additionally bent on the assumptions are just as excellent.

Although Nvidia had actually rested atop the Zacks Rank for virtually 2 years, as experts were continually updating revenues price quotes, today it has a Zacks Rank # 3 (Hold) ranking, which most absolutely isn’t an adverse point. There is absolutely nothing bearish regarding a ranking # 3, just merely that revenues price quotes have not been updated lately.

Image Source: Zacks Investment Research

Can Nvidia Reach $10 trillion?

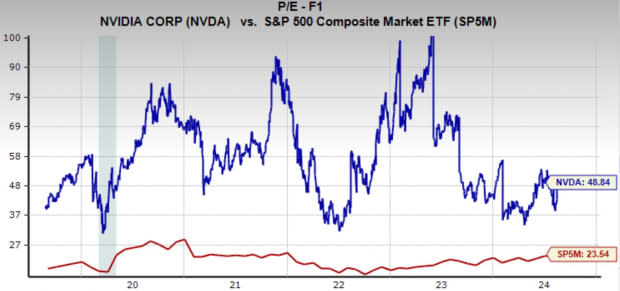

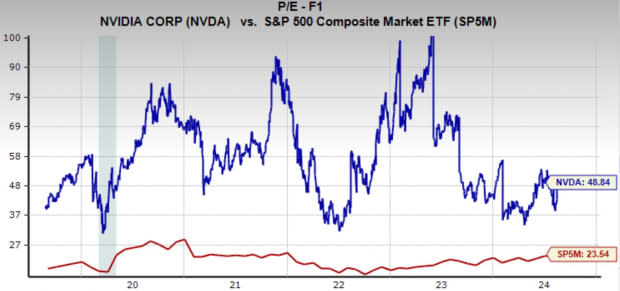

It isn’t simply feasible, it’s most likely Nvidia will certainly get to a market cap of $10 trillion within the following 5 years based upon existing projections. Today, Nvidia has a one year onward revenues multiple of 48.9 x, which is well listed below its five-year average of 55x. Incredibly, Nvidia has actually expanded so quickly that despite the fact that the supply cost is up 20x in the last 5 years, it is still near to its most affordable loved one assessment as a result of the extraordinary earnings development.

To reach the final thought that Nvidia might deserve $10 trillion is naturally rather speculative, nonetheless a basic projection demonstrates how it is not an unreasonable assumption. Earnings are anticipated to expand 37.6% each year over the following 3 to 5 years, and if the supply expands at that speed while keeping its existing revenues numerous, it would certainly exist in under 5 years.

Image Source: Zacks Investment Research

Should Investors Buy Shares in Nvidia?

For financiers looking for direct exposure to AI and high-growth technology, Nvidia continues to be amongst one of the most engaging alternatives. Despite the extraordinary run-up in its supply cost, the business’s management in AI framework, tactical collaborations, and unrivaled development prices recommend that Nvidia can still have considerable upside possible.

At its core, Nvidia is placed to continue to be a principal in the AI transformation, with its GPUs powering the future of AI-driven sectors. The business’s concentrate on constant advancement and its collaborations with significant cloud carriers like Amazon, Microsoft, and Alphabet offer a solid structure for future development.

While Nvidia’s assessment is fairly high, it is backed by amazing revenues development that is anticipated to proceed at a fast speed. The business’s capacity to get to a $10 trillion market cap highlights its long-lasting development trajectory, making it an eye-catching financial investment for those with a greater danger resistance and a long-lasting point of view.

In final thought, Nvidia’s supply might be a purchase for financiers that count on the future of AI and agree to weather temporary market volatility for long-lasting gains. With its management in the AI area and solid revenues development estimates, Nvidia can remain to compensate financiers as it approaches brand-new turning points.

Want the most up to date referrals from Zacks Investment Research? Today, you can download and install 7 Best Stocks for the Next 30Days Click to obtain this totally free record

Amazon com,Inc (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA):Free Stock Analysis Report

Alphabet Inc (GOOGL): Free Stock Analysis Report

To review this post onZacks com click on this link.

Zacks Investment Research