The long-awaited minute has actually gotten here. The Federal Reserve is fulfilling today, and financial experts are anticipating policymakers will certainly introduce the initial rates of interest reduced in 4 years. The Fed started raising prices back in 2022 to tranquil surging rising cost of living and considering that has actually raised the benchmark price 11 times, leaving it at 5.5% today. That’s the highest degree in greater than two decades.

These steps have actually done their work, with rising cost of living going down over this duration. Right currently, it goes to 2.5% and nearing the Fed’s objective of 2%. Why that degree? Because it “is most consistent with the Federal Reserve’s mandate for maximum employment and price stability,” according to the Federal Open Markets Committee.

So financial experts and investors have actually been hypothesizing that on Wednesday the Fed will certainly decrease the benchmark price by at the very least 25 basis factors, and some also forecast a 50 basis factor cut. As a financier in the stock exchange, you might be questioning what the marketplace will certainly do adhering to the Fed’s action. Let’s want to background for some hints.

Why is a price reduced such a huge bargain for supplies?

First, allow’s think about why a price cut is such a huge bargain for the stock exchange generally and for capitalists particularly. Higher prices can harm company incomes and financier cravings for supplies as a result of a number of aspects. As the fed funds price rises, so do various other loaning expenses for people and business.

For instance, high-growth business counting on fundings to construct their services will certainly see these costs climb. As an outcome, prospective capitalists might fret about their capacity to money development and might keep away from these kind of supplies. As for people, greater loaning expenses consume right into their budget plans, which indicates they possibly will not have as much optional revenue to invest.

Investors, seeing this unravel, frequently shed self-confidence in supplies most susceptible in this kind of atmosphere. They may think twice to acquire shares of those young development business– frequently innovation gamers– and they might keep away from business, such as those in home entertainment or traveling, that depend on optional costs.

Investors may also control their financial investments in the stock exchange all at once and select financial investments that often tend to thrive in a higher-rate atmosphere, such as bonds.

Of program, as rates of interest drop, the circumstance changes, with loaning coming to be simpler and less costly for business and people, while customers locate themselves with even more cash to invest in non-essentials. All of this paints a brighter photo for company incomes, which, subsequently, makes capitalists extra certain regarding placing their bucks right into the stock exchange.

The S&P 500’s efficiency after previous price cuts

Now, as we wait for the Fed’s following action, allow’s think about just how the stock exchange responded in the past to price cuts. In the previous 2 cycles of cuts, from the preliminary price decline, the S&P 500 index ( SNPINDEX: ^ GSPC) climbed in the dual figures in the twelve month adhering to that action. Those price cuts got on March 3, 2020 andAug 1, 2019, and the S&P 500 climbed 27% and 10%, specifically, for many years to adhere to.

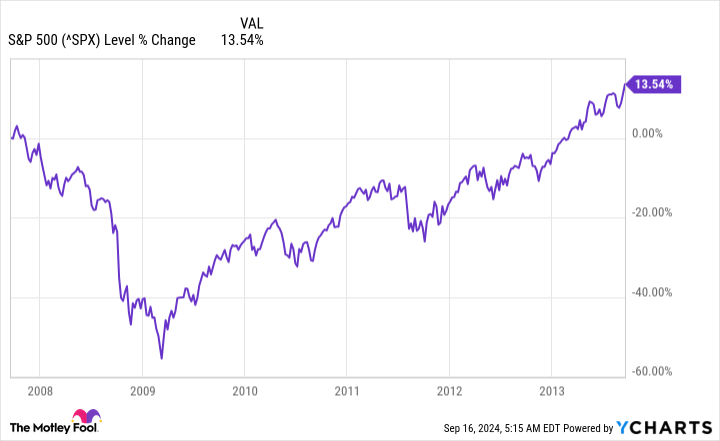

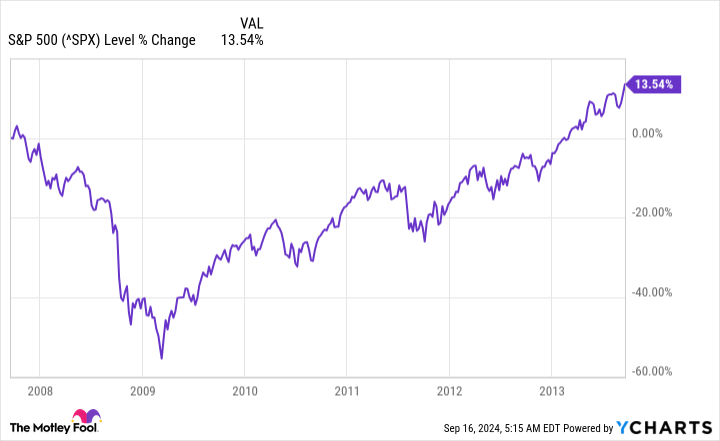

Prior to that, price cuts occurred throughout the Great Recession and an accident in the real estate market over the 2007 and 2008 duration. The initial price reduced after that occurred in September of 2007, and this moment it took a lot longer for the S&P 500 to climb up back to previous degrees.

^ SPX information by YChart s.

It’s crucial to keep in mind, however, that the Great Recession was an especially tough time worldwide, so it does not stand for an asset of contrast for the S&P 500 today.

What does every one of this mean for the stock exchange progressing? It’s difficult to forecast what the index will certainly do next off, however current background reveals us a beneficial pattern. That stated, if the Fed decreases prices as anticipated or makes a much more hostile cut today, this will not alleviate the loaning circumstance for business and people overnight. It will certainly take a collection of cuts to generate concrete outcomes.

But fortunately is that a prospective price reduce today will certainly obtain points relocating the ideal instructions– which might aid the S&P 500 adhere to the current historic pattern and increase in the coming year.

Should you spend $1,000 in S&P 500 Index now?

Before you acquire supply in S&P 500 Index, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 ideal supplies for capitalists to acquire currently … and S&P 500 Index had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $729,857! *

Stock Advisor supplies capitalists with an easy-to-follow plan for success, consisting of assistance on constructing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

See the 10 supplies “

*Stock Advisor returns since September 16, 2024

Adria Cimino has no setting in any one of the supplies pointed out. The Motley Fool has no setting in any one of the supplies pointed out. The Motley Fool has a disclosure plan.

The Fed May Cut Interest Rates This WeekHistory Says Stocks Will Do This Next was initially released by The Motley Fool