Utilities have actually stomped on the accelerator over the previous year. An excellent measure for the field’s rise is the surge in The Utilities Select Sector SPDR ETF, which is up 21% over the previous year. Several variables have actually assisted power energy supplies, consisting of the possibility of reduced rates of interest and the velocity of power need from drivers like AI information facilities.

Despite that power rise, a number of energy supplies still appear like eye-catching financial investments nowadays, specifically for those looking for a high-yielding reward. Black Hills Corporation ( NYSE: BKH), Duke Energy ( NYSE: DUK), and Xcel Energ y ( NASDAQ: XEL) stick out to a couple ofFool com factors for their above-average returns. Here’s why they think these energies are a few of the very best in the field to acquire now.

Black Hills is tough to defeat on the reward front

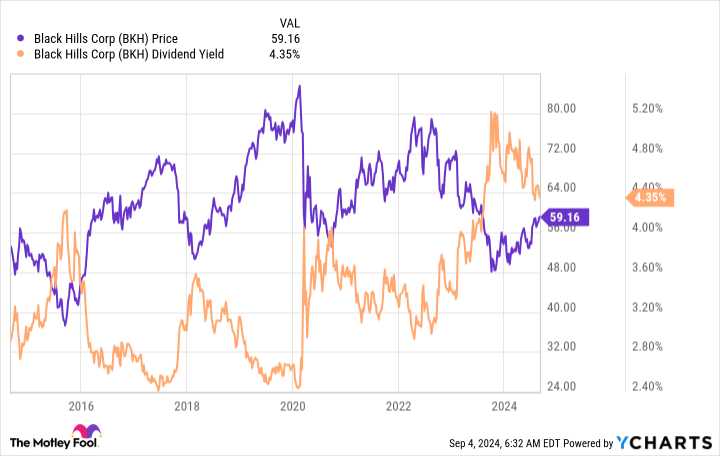

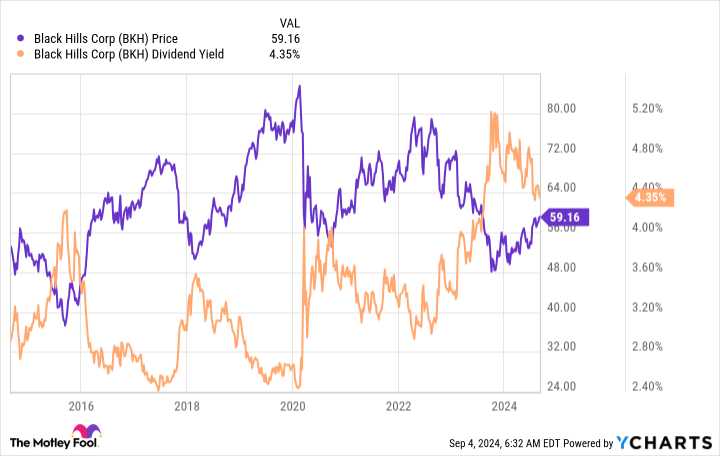

Reuben Gregg Brewer (Black Hills Corporation): When it involves energies, the majority of financiers most likely will not understand the nameBlack Hills That makes good sense, provided its small $4 billion market cap. However, this small electrical and gas energy has actually accomplished something that couple of various other energies have: It has actually raised its reward yearly for over 5 years. That makes Black Hills a very exclusiveDividend King You do not develop a returns document like that by mishap.

Black Hills offers 1.3 million consumers throughout components of Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, andWyoming Customer development in its areas is broadening at almost 3 times the price of united state populace development. That’s great. However, the firm has greater take advantage of than a number of its peers, which was an adverse while rates of interest got on the surge. That triggered the firm’s supply to drop, and it pressed the reward return towards the luxury of the current return variety. The approximately 4.4% return is still traditionally eye-catching, also after a supply rally, driven by assumptions that rates of interest will certainly drop.

But what is the future most likely to hold from right here? Management is forecasting profits development of in between 4% and 6% a year with 2028, driven by a five-year capital expense strategy worth around $4.3 billion. The reward is most likely to expand in addition to profits, gradually. So you obtain a reasonably high reward return– the ordinary energy returns 3%– in addition to an affordable reward development price and a Dividend King energy with an expanding company. That ought to be rather an appealing mix to the majority of traditional reward financiers.

This energy’s development strategies ought to imply larger returns

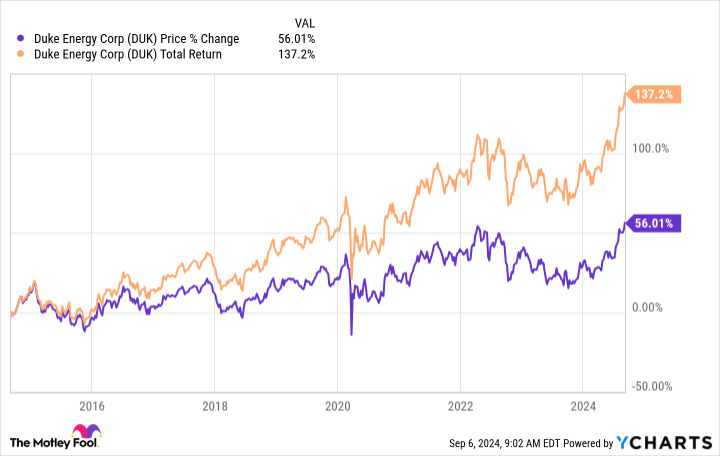

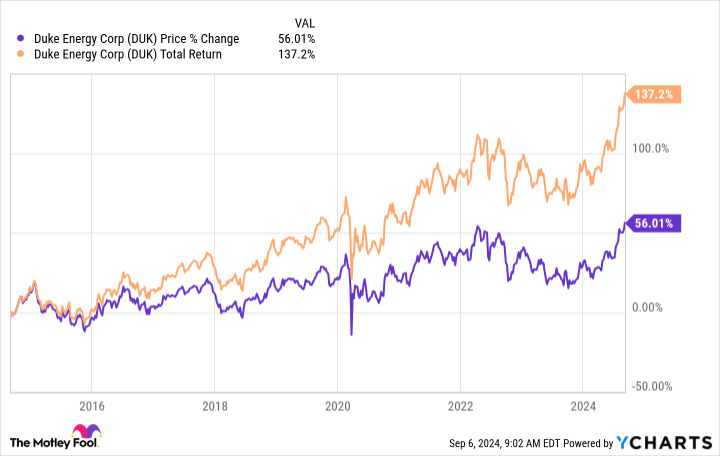

Neha Chamaria (Duke Energy): Duke Energy’s reward return of 3.6% isn’t amongst the greatest in the energy field, however the supply has actually been just one of the leading entertainers in the last few years, much more so when returns are taken into consideration. In simply the previous ten years, for instance, financiers that had Duke Energy supply and reinvested returns the whole time have greater than increased their cash. Duke Energy has an easy approach: Keep updating and broadening its facilities to win regulatory authorities’ authorizations for price base walkings at routine periods and make use of every one of that capital to reinvest additional and benefit investors. So much, Duke Energy hasn’t dissatisfied its investors, and it’s not likely it will.

Duke Energy prepares to spend $73 billion in between 2024 and 2028 to update its 300,000 miles of high-voltage line, develop brand-new power generation ability, and update its gas circulation network. The firm thinks that capital expense ought to enhance its modified profits per share by 5% to 7% yearly with 2028 and permit it to pay larger returns every year.

To be reasonable, Duke Energy’s rate of reward development hasn’t been all that terrific, however as lengthy as any type of reward development is backed by greater profits and capital, it needs to drive the supply rate in the long-term. We’ve currently seen that occur with Duke Energy shares.

Duke Energy’s returns additionally look secure and dependable, for 2 factors. First, the firm is just one of the biggest energies in the united state and runs in a few of the fastest-growing states, such as Florida and theCarolinas That additionally implies there’s solid possibility to broaden its consumer base. Second, Duke Energy is targeting a returns payment proportion of 60% to 70%, which implies the firm will certainly constantly have some cash to pay financial debt and fund development, also throughout difficult times. With administration currently protecting future development with its $73 billion capital expense strategy, it’s never ever far too late to acquire and hold this energy supply.

Powerful overall return possibility

Matt DiLallo (Xcel Energy): Xcel Energy’s supply has actually risen greater than 25% over the previous 6 months. However, the electrical and gas energy is still an appealing financial investment nowadays. Even keeping that power rise, it trades at concerning 17.5 times its onward profits That’s well listed below the forward profits of approximately 20 that the majority of its energy peers bring nowadays. It’s additionally more affordable than the S&P 500‘s 23.5 times onward profits.

The firm’s reasonably much more eye-catching appraisal is why it supplies a greater 3.5% reward return, greater than double the S&P 500’s sub-1.5% return. Xcel Energy has actually raised its payment for 21 straight years. It has actually expanded its reward at a greater than 6% substance yearly price over the last years

Xcel Energy ought to have a lot of power to proceed expanding its reward in the future. The firm, which runs 4 electrical and gas energies throughout 8 Western and Midwestern states, anticipates to spend at the very least $39 billion over the following 5 years in keeping and broadening its procedures. Meanwhile, it sees the prospective to spend a step-by-step $5 billion over that duration to sustain increasing power need. This projection drives its sight that it can expand its profits per share by 5% to 7% yearly.

The energy thinks it might expand its reward at a comparable price, provided its practical payment proportion of 50% to 60% of its steady profits. Add its present accept its profits development price, and Xcel Energy might create overall yearly investor returns in the 9% to 11% variety. There’s upside to that if the firm’s appraisal increases closer to that of its energy field peers. That’s a strong return from such a low-risk, high-yield reward supply.

Should you spend $1,000 in Duke Energy now?

Before you acquire supply in Duke Energy, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 ideal supplies for financiers to acquire currently … and Duke Energy had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $630,099! *

Stock Advisor gives financiers with an easy-to-follow plan for success, consisting of advice on constructing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

See the 10 supplies “

*Stock Advisor returns since September 9, 2024

Matt DiLallo has no placement in any one of the supplies discussed. Neha Chamaria has no placement in any one of the supplies discussed. Reuben Gregg Brewer has placements inBlack Hills The Motley Fool suggestsDuke Energy The Motley Fool has a disclosure plan.

Utility Sector’s 20% Rise: The Best High-Yield Stocks You Can Still Buy was initially released by The Motley Fool

&w=324&resize=324,235&ssl=1)