For most retired people, Social Security is greater than a check. It stands for a required income source that many retired-worker recipients could not live without.

Over the last 23 years, nationwide pollster Gallup has actually been evaluating elders to identify just how dependent they get on their Social Security advantage. At no factor in this above two-decade stretch of yearly ballot has the portion of retired people requiring their Social Security earnings to make ends satisfy dropped listed below 80%. In 2024, 88% of retired people noted their Social Security advantage stands for either a “major” or “minor” income source.

Given the vital function America’s leading retired life program plays in laying an economic structure for America’s aging labor force, it must come as not a surprise that Social Security’s cost-of-living modification (SODA POP) expose, which is slated forOct 10 at 8:30 a.m. ET, is the most-awaited statement of the year.

As we have actually relocated better to this expose, the 2025 soda pop projection has actually meaningfully tightened, using both guarantee and dissatisfaction to recipients.

What function does Social Security’s soda pop hold?

Social Security’s often-talked-about soda pop is the device the Social Security Administration (SSA) makes use of to readjust advantages on a year-to-year basis to represent adjustments in the rate of items and solutions.

For instance, if a wide basket of items and solutions that are on a regular basis acquired by elders cumulatively boosts in rate by 2%, 3%, or 5%, Social Security advantages ought to preferably increase by a proportionate total up to guarantee that no buying power is shed. The yearly cost-of-living modification intends to maintain the program’s recipients on the same level with the rising cost of living (i.e., climbing rates) they’re emulating.

From the initial sent by mail retired-worker advantage sign in January 1940 with 1974, modifications to advantages were entirely approximate and passed along by unique sessions ofCongress Following no COLAs throughout the whole of the 1940s, 11 instead huge modifications were carried out from 1950 with 1974.

Starting in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) was entrusted with monitoring rising cost of living for Social Security and efficiently became its inflationary secure in charge of figuring out the yearly soda pop. The CPI-W has greater than a half-dozen significant investing classifications and a shopping list of subcategories, every one of which have their very own corresponding portion weightings. It’s these weightings that enable the CPI-W to be revealed as a solitary, succinct number every month.

Most significantly, just trailing-12-month CPI-W analyses from July with September aspect right into the soda pop computation. If the typical third-quarter (July to September) CPI-W analysis in the existing year is more than the typical CPI-W analysis throughout the similar duration in 2015, rising cost of living has actually happened and advantages will certainly increase.

How a lot of a boost to anticipate is figured out by the year-over-year portion rise in typical third-quarter CPI-W analyses, rounded to the nearby tenth of a percent.

Social Security’s 2025 cost-of-living modification has actually significantly tightened

Over the last twenty years, the typical soda pop has actually been an instead sub-par 2.6%. This duration consists of 3 years when depreciation (dropping rates) took place and no soda pop was passed along (2010, 2011, and 2016), in addition to the tiniest favorable soda pop on document (0.3% in 2017).

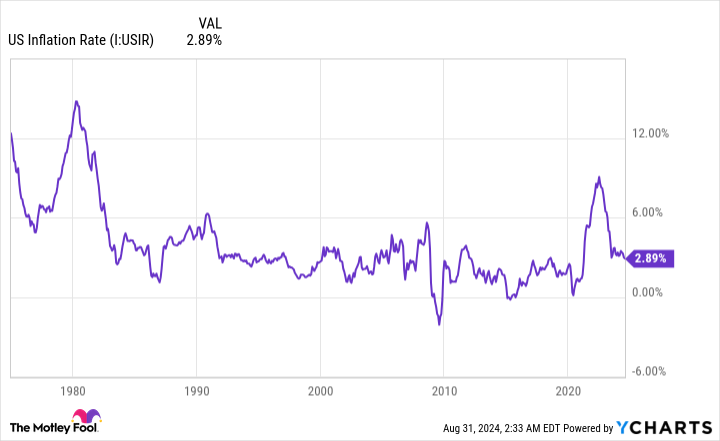

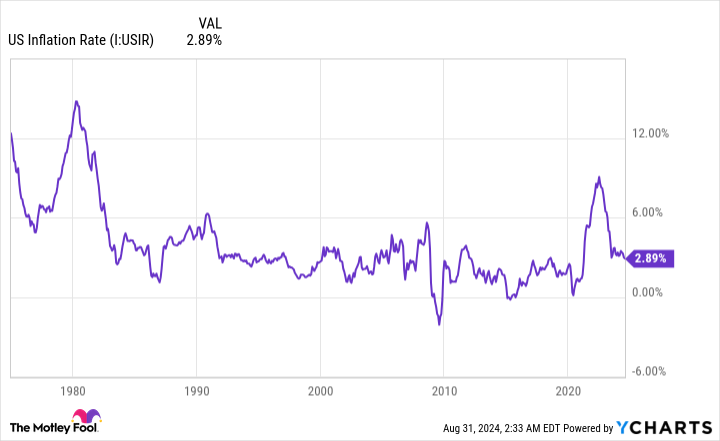

However, the last 3 years have actually rather damaged this anemic soda pop fad. The fastest uptick in the dominating rising cost of living price in 4 years resulted in a 5.9% soda pop in 2022, 8.7% soda pop in 2023, and 3.2% soda pop in 2024. In specific, the 8.7% cost-of-living modification in 2023 was the highest possible on a portion basis in 41 years.

With the July rising cost of living record from the Bureau of Labor Statistics in guides, and the August rising cost of living record due onSept 11, we have actually experienced projections for the 2025 soda pop slim dramatically.

The Senior Citizens League (TSCL), a detached elderly campaigning for team, started the year anticipating a modest 2025 soda pop of 1.4%. Following the July rising cost of living record, this quote has actually increased to 2.57%, which necessarily would certainly assemble to 2.6%.

Meanwhile, independent Social Security and Medicare plan expert Mary Johnson, that lately relinquished TSCL, has actually had her 2025 soda pop projection decrease from 3.2% complying with the April rising cost of living record to 2.6% after the most recent record.

Despite beginning with contrary ends of the range, TSCL and Johnson are currently efficiently in arrangement that the 2025 cost-of-living modification will certainly be 2.6%.

For the standard Social Security recipient– i.e., virtually 68 million receivers– a 2.6% soda pop would certainly equate right into an added $46.35 per check, based upon the typical payment of $1,782.74 in July 2024. However, this rise in advantages can differ from one person to another, in addition to based upon recipient kind.

For retired employees, that represent greater than 51 numerous the program’s near to 68 million recipients, a 2.6% soda pop equates right into a typical regular monthly rise of $49.90.

By contrast, the typical look for the approximately 7.2 million employees with specials needs and near to 5.8 million survivor recipients would certainly increase by $40.01 and $39.25, specifically, following year.

The 2025 soda pop might make background and dissatisfy at the exact same time

Assuming TSCL’s and Johnson’s straightened projections are right, a 2.6% cost-of-living modification would certainly note the tiniest portion rise in 4 years. While this may seem frustrating, it would certainly still match the typical soda pop over the last twenty years.

More remarkably, it would certainly note the very first time because 1997 that Social Security’s soda pop has actually gotten to at the very least 2.6% in 4 successive years. On a collective basis, advantages will certainly have increased by nearly 22% from completion of 2021, based upon a 2.6% cost-of-living modification following year.

While it’s wonderful theoretically to see advantages climbing at a much faster rate than at any kind of factor in current memory, there are likewise 2 frustrating awareness to be made regarding Social Security’s 2025 SODA POP.

To begin with, a 2.6% soda pop is most likely to lead to a loss of buying power for recipients, which however has actually been an usual incident because this century started.

TSCL has actually launched 2 researches where they have actually contrasted collective COLAs over pick timespan to the accumulated rise in rate for a basket of items and solutions on a regular basis acquired by elders. Between January 2000 and February 2023, it approximates the purchasing power of a Social Security buck dropped by 36%. In a different research launched in July 2024, TSCL located that the buying power of Social Security earnings has actually dropped 20% because 2010.

With 2 of one of the most essential prices for elders– sanctuary and healthcare solutions– showing off trailing-12-month prices of rising cost of living that are significantly over 2.6%, a loss of purchasing power looks almost ensured.

The various other dissatisfaction can be found in the type of Medicare Part B costs quickly climbing momentarily successive year. Part B is the sector of Medicare that covers outpatient solutions.

In May, the Medicare Trustees Report forecasted regular monthly component B costs would certainly increase to $185 in 2025, which corresponds to a 5.9% rise. This matches the portion bump experienced in 2024.

Most Social Security recipients that are registered in Medicare have their Part B costs instantly subtracted from their regular monthly advantage. In various other words, a 2nd successive year without a positive side from Medicare Part B will certainly reduce the influence of Social Security’s upcoming soda pop.

Next year is appearing like among those uncommon circumstances where background is made, however dissatisfaction impends huge.

The $ 22,924 Social Security reward most retired people entirely neglect

If you resemble many Americans, you’re a couple of years (or even more) behind on your retired life cost savings. But a handful of obscure “Social Security secrets” can aid guarantee an increase in your retired life earnings. For instance: one very easy method can pay you as long as $ 22,924 extra … yearly! Once you discover just how to optimize your Social Security advantages, we believe you can retire with confidence with the assurance we’re all after. Simply click on this link to uncover just how to get more information regarding these techniques.

View the “Social Security secrets” “

The Motley Fool has a disclosure plan.

Social Security’s 2025 Cost- of-Living Adjustment (SODA POP) Has Narrowed– Here’s How Much the Average Check Is Forecast to Rise Next Year was initially released by The Motley Fool