Artificial knowledge (AI) leader Nvidia ( NASDAQ: NVDA) is readied to organize its 2024 AI Summit beginningOct 7. The occasion will certainly combine leaders from throughout the sector to see and speak with several of the primary minds in AI. It’s an opportunity to capture a peek at the future of this possibly advanced modern technology.

With such a huge occasion upcoming, you may be asking on your own: Should I buy Nvidia currently? History might offer us a hint. Let’s take a closer take a look at the firm.

Nvidia controls its opponents

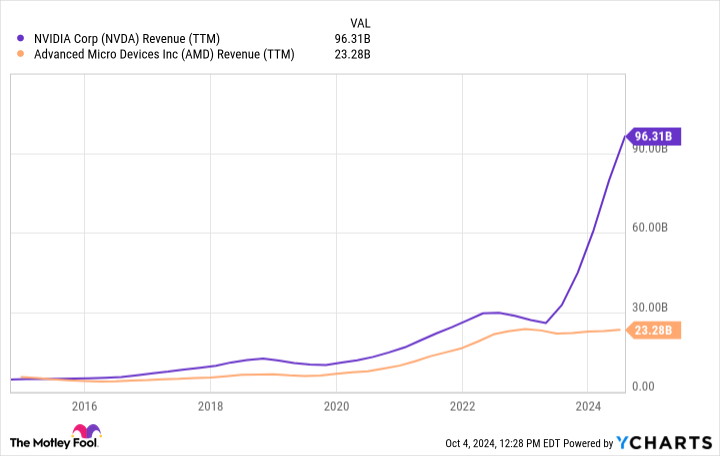

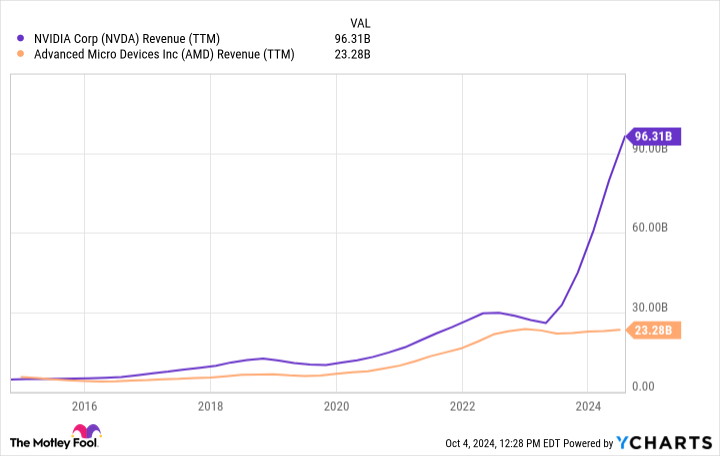

There was a time when Nvidia and its long time competitor, Advanced Micro Devices, were neck and neck in their fight to manage the video gaming market. By and big, there was parity in between both of the firm’s earnings declarations. That’s altered. After AI struck an inflection factor in late 2022, Nvidia is controling AMD, making much more in earnings than AMD performs in overall earnings. Take a take a look at this graph, which reveals simply exactly how huge the current change has actually been.

That’s what you obtain when you manage 90% of a market as important as AI silicon. The fantastic information for Nvidia is that it does not resemble the lap of luxury will certainly quit anytime quickly. The messaging from the remainder of large technology, the firms that stand for the majority of its company, is that their investing is most likely to speed up in the future.

This is a race of kinds, and none of the large gamers can pay for to be left. As Alphabet‘s chief executive officer, Sundar Pichai, placed it in the firm’s newest profits telephone call: “The risk of underinvesting is dramatically greater than the risk of overinvesting for us here.” Alphabet anticipates to invest about $50 billion this year in capital investment (capex), up from $32 billion the year in the past– and it’s not the only one.

At existing, the mass of this investing is still moving with Nvidia as AMD, Intel, and others battle to match the power and effectiveness of Nvidia’s chips. There is still massive need for its present generation, and the firm’s future generation will likely deliver within the following couple of months. The substantial earnings Nvidia has actually appreciated suggests it has big total up to invest in keeping its side. Despite currently leading the pack, Nvidia outspent AMD in r & d about 2 to one last quarter.

What background needs to claim

This will certainly be the 3rd year straight that Nvidia will certainly organize an AI occasion in this blood vessel. The firm started these occasions in 2022 with an online occasion concentrated on speech in AI. 2023 was meant to be the initial year of a full-fledged, multi-day AI top, yet the occasion was relocated online for a solitary day. This year’s occasion will certainly happen face to face over 3 days.

Despite their even more small conference styles, both of the previous models resulted in a wonderful bump-up in Nvidia’s supply rate. In the week that complied with 2022’s occasion, shares were up as high as 10%. In 2023, they were up as high as 6.5%. So will this year’s meeting likewise cause an enter supply rate? Maybe.

I understand that may be a frustrating solution, yet the reality is that we can not understand for certain. First of all, 2 years is a really little example dimension where to attract solid verdicts. Also, also if we had much more years to referral, relationship is not causation Just due to the fact that 2 points can be connected– like an AI top and an enter supply rate– does not imply one occurs due to the fact that of the various other.

But the occasion is an opportunity to bear in mind the power that AI holds. Instead of thinking of feasible temporary supply motions, concentrate on the firm’s lasting leads. Don’t forget the woodland for the trees. This is a business on top of its video game, allowing the fostering of a possibly advanced modern technology.

Should you spend $1,000 in Nvidia now?

Before you purchase supply in Nvidia, consider this:

The Motley Fool Stock Advisor expert group simply determined what they think are the 10 ideal supplies for financiers to purchase currently … and Nvidia had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $765,523! *

Stock Advisor supplies financiers with an easy-to-follow plan for success, consisting of assistance on constructing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

See the 10 supplies “

*Stock Advisor returns since October 7, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. Johnny Rice has no setting in any one of the supplies stated. The Motley Fool has settings in and suggests Advanced Micro Devices, Alphabet, andNvidia The Motley Fool suggests Intel and suggests the adhering to choices: brief November 2024 $24 get in touch withIntel The Motley Fool has a disclosure plan.

Should You Buy Nvidia Stock As Its AI Summit Gets Underway?History Says This Will Happen was initially released by The Motley Fool