Recent breakthroughs in expert system (AI) are triggering a standard change in modern technology, and the repercussions will likely be far-ranging. Nvidia ( NASDAQ: NVDA) has actually come to be the de facto common holder for the AI transformation, as its modern graphics refining systems (GPUs) have actually come to be the gold criterion for training AI versions and performing AI reasoning.

The speeding up fostering of generative AI has actually been the driver that has actually stimulated allegorical development for the chipmaker, producing triple-digit sales and revenue development in each of the previous 4 quarters.

Nvidia is arranged to report the outcomes of its monetary 2025 2nd quarter (finished July 30) after market close on Wednesday,Aug 28, and investors will certainly be enjoying with eager rate of interest. I anticipate the firm will certainly supply document outcomes, sending out Nvidia supply to tape-record elevations. Here’s why.

You can not mean Nvidia without AI

Nvidia went far for itself as a leader in the computer game sector, establishing chips that made use of identical handling, or the capability to run a wide variety of complicated calculations concurrently. This produced realistic photos in computer game, changing the sector. Nvidia adjusted this exact same modern technology to deal with the raw, number-crunching demands of AI and rapidly caught the market in this arising modern technology.

The large bulk of AI handling occurs in information facilities, and Nvidia has actually currently verified its well worth at zooming info via the ether. The firm managed an approximated 98% of the information facility GPU market in 2015, according to information put together by semiconductor experts at TechnologyIn views.

The expanding need for AI has information facility and cloud drivers investing greatly to update their capacities to deal with the roughness of AI handling. Making AI offered to the masses is anticipated to let loose a wave of efficiency that’s anticipated to include trillions of bucks to the worldwide economic situation.

While Nvidia had a head beginning in this arising sector, the firm isn’t hing on its laurels. Earlier this year, the firm revealed its Blackwell style, which included a host of brand-new modern technology that guarantees to take AI to the following degree.

Perhaps much more excellent is the GB200 Grace Blackwell Superchip, which attaches 2 B200 GPUs with an Nvidia Grace CPU to develop “the world’s most powerful chip” for AI.

While there have actually been records of a possible launch hold-up, much more current records recommend Nvidia is still on course to start delivering its next-generation AI chip early following year.

This all aids to highlight that Nvidia has no strategies of yielding its critical benefit or market-leading placement anytime quickly.

Why its second-quarter monetary record will certainly be a vital driver

Nvidia has actually verified its nerve over the previous year, however capitalists are seeking to the future. Concerns regarding rising cost of living and the development of the economic situation have actually taken spotlight in current weeks, with financial experts discussing whether the Federal Reserve Bank has actually waited also long to reduced rate of interest or whether it can still craft a soft touchdown– bringing rising cost of living in control, without tipping the economic situation right into an economic crisis. Those worries have actually started to decrease, so capitalists are transforming their views to Nvidia, which is commonly considered as a bellwether for the state of AI fostering.

A recall at Nvidia’s expectation in current quarters can supply much-needed understanding right into what capitalists must anticipate following week. In each of the previous 4 quarters, Nvidia has actually supplied triple-digit development, which has actually exceeded its very own advice, and in each circumstances by a reasonable margin. Nvidia’s profits development has actually cruised past its expectation by a margin of in between 8% and 19%, which recommends the firm’s existing projection is just as conventional.

For its monetary 2025 2nd quarter (finished July 30), Nvidia is directing for profits of $28 billion, standing for a boost of 107% year over year. Wall Street is much more passionate, with experts’ agreement approximates increasing to $28.6 billion. Even that might wind up being conventional, as Nvidia has actually exceeded capitalist assumptions to buy and earnings in each of the previous 4 quarters– once again by a reasonable margin.

If Nvidia defeats its very own profits advice by at the very least 8% or even more– which it has actually carried out in each of the coming before 4 quarters– that would certainly place its profits at $30 billion or even more. If that holds true, it will likely include an appropriate boost in its advice, causing a traditional “beat and raise.” Since this is generally a favorable signal, the supply cost will likely enter action.

To be clear, capitalists will certainly be enjoying Nvidia’s progressive advice for proof the nonreligious tailwind of AI is still blowing solid. Based on the offered proof and making use of background as an overview, I anticipate that Nvidia will certainly supply record-breaking outcomes and exceed assumptions, sending its supply to brand-new elevations.

Is the supply worth the cost?

Thanks to Nvidia’s fantastic outcomes, there’s been an appropriate boost in its appraisal. Analysts and capitalists alike have actually been rushing to choose just how finest to worth Nvidia supply, however we remain in unchartered region right here. Nvidia produced profits of $61 billion in monetary 2024 (finishedJan 28), a boost of 126%. Growth of that size is absolutely deserving of a costs, however there’s no agreement pertaining to the dimension of claimed costs.

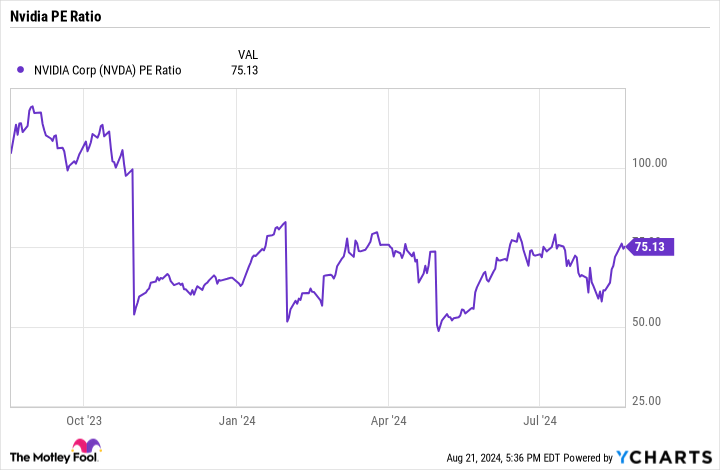

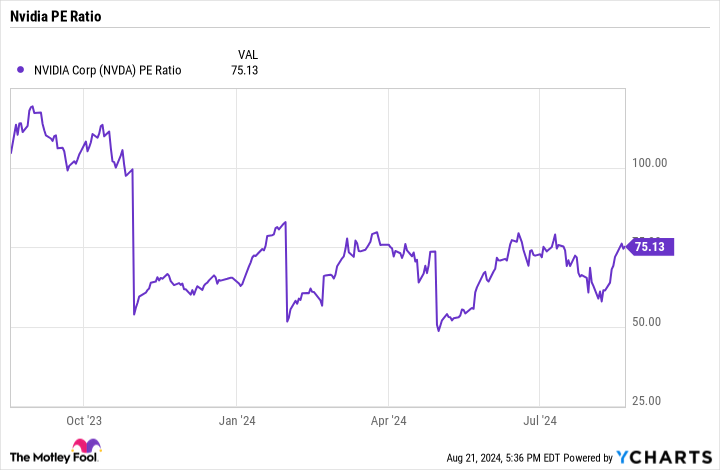

Nvidia is presently costing 75 times revenues, however that number will see a significant reset after the firm provides its monetary record, as brand-new, greater earnings are factored right into the proportion. The graph plainly reveals the plain decrease following each of its 3 previous monetary records in November, February, and May, specifically.

While some capitalists may stop at paying in the area of 50 times revenues (stood for by the dips in the supply graph), I would certainly suggest that’s a reasonable cost to spend for a firm supplying triple-digit development and leading the 4th commercial transformation.

Should you spend $1,000 in Nvidia now?

Before you acquire supply in Nvidia, consider this:

The Motley Fool Stock Advisor expert group simply recognized what they think are the 10 finest supplies for capitalists to acquire currently … and Nvidia had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Consider when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our suggestion, you would certainly have $792,725! *

Stock Advisor gives capitalists with an easy-to-follow plan for success, consisting of advice on developing a profile, normal updates from experts, and 2 brand-new supply choices monthly. The Stock Advisor solution has greater than quadrupled the return of S&P 500 given that 2002 *.

See the 10 supplies “

*Stock Advisor returns since August 22, 2024

Danny Vena has placements inNvidia The Motley Fool has placements in and suggestsNvidia The Motley Fool has a disclosure plan.

Prediction: Nvidia Will Deliver Record Results onAug 28, Which Will Supercharge the Stock was initially released by The Motley Fool