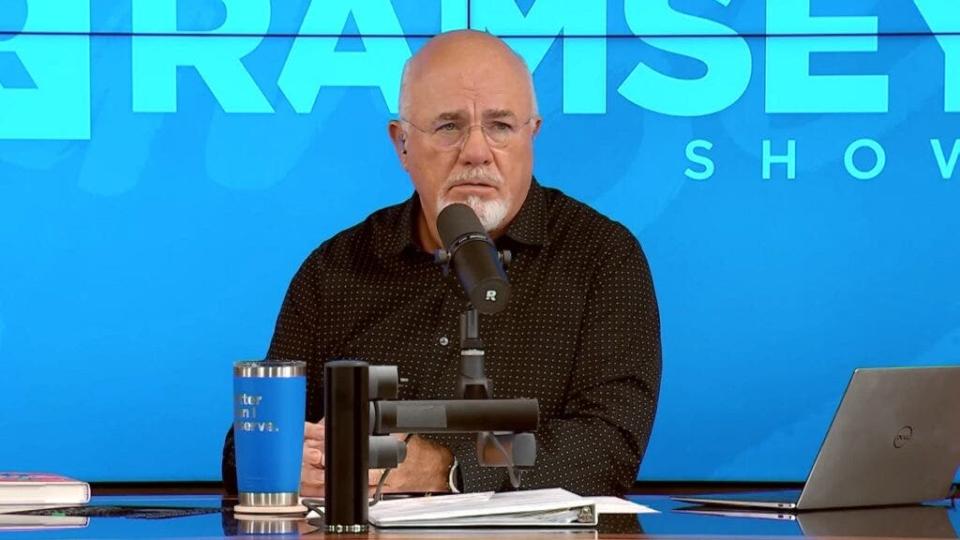

Financial specialist Dave Ramsey has a clear message for anybody attempting to identify why they’re not making progression with their cash: You can be losing $5,000 a year on points you do not require. In a current tweet, Ramsey mentioned that costs simply $13.70 daily on unneeded acquisitions amounts to that much in a year.

Don’t Miss:

It might not feel like a lot in the beginning look– nevertheless, what’s $13.70 a day? Maybe it’s a coffee, a takeout lunch, or something you grabbed online without hesitating. Ramsey’s factor is that those little, daily costs can quietly drain your savings account with time, stopping you from getting to larger monetary objectives.

The Impact of Small Spending

How to squander $5,000 a year:

Spend $13.70 a day on points you do not require.— Dave Ramsey (@DaveRamsey) September 3, 2024

Ramsey’s tweet takes into viewpoint just how very easy it is to misplace your costs when carried out in percentages. Many individuals do not understand just how swiftly those “little” acquisitions can build up. $13.70 a day might not really feel like a lot, yet when increased by 365 days, you have actually invested $5,000 on points you likely really did not require.

Trending: Teens might never ever require knowledge teeth got rid of many thanks to this MedTech Company– Be a very early financier for simply $300 for 100 shares!

For somebody having a hard time to conserve for a reserve, settle financial obligation, or construct lasting wide range, that $5,000 can make a considerable distinction. Many individuals believe they’re not investing a lot daily, once they take a closer appearance, they understand the number of little acquisitions are gnawing at their funds.

Simple Changes, Big Results

Ramsey supplies uncomplicated guidance to cut down on unneeded costs: Be deliberate. Ensure your cash is approaching something rewarding, like repaying financial obligation, conserving for a deposit on a home, or establishing a reserve. Create a spending plan, keep an eye on your expense, and check it.

See Also: The variety of ‘401( k)’ Millionaires is up 43% from in 2014– Here are 3 methods to sign up with the club.

What Could You Do With $5,000?

Think concerning what an additional $5,000 a year can provide for you. Maybe it’s the distinction in between living income to income and having a cost savings pillow. It can aid settle high-interest financial obligation, add to retired life, or enable you to take a getaway without entering into bank card financial obligation.

Ramsey usually states that “Your number one wealth-building tool is your income,” highlighting that real monetary success originates from sensible conserving and investing, not indebting oneself to financial institutions like Sallie Mae or Best Buy.

Trending: A billion-dollar financial investment technique with minimums as reduced as $10– you can enter into the following large realty boom today.

Ramsey analyzes just how usual it has actually ended up being to depend on financial obligation to fund desires and financial investments, mentioning that “when you give your income to someone else, you don’t have it anymore.”

He tests the concept that financial obligation is typical, specifically calling out the mistaken reasoning behind trainee car loans and bank card benefits. With wit, he claims, “Oh, Sallie Mae’s been with us for 15 freaking years in our spare bedroom,” highlighting the length of time trainee financial obligation can consider individuals down.

Read Next:

UNLOCKED: 5 NEW PROFESSIONS EACH WEEK. Click currently to obtain leading profession concepts day-to-day, plus limitless accessibility to sophisticated devices and techniques to get a side in the marketplaces.

Get the most up to date supply evaluation from Benzinga?

This short article Dave Ramsey Says You’re Wasting $5,000 A Year If You ‘Spend $13.70 A Day On Things You Don’t Need’ initially showed up onBenzinga com

© 2024Benzinga com. Benzinga does not give financial investment guidance. All legal rights booked.